English banknotes are not legal tender in Scotland. Scottish notes are not legal tender in England or Scotland. Debit cards, cheques and contactless payments are not legal tender anywhere. Confused? Read on to get the full story.

What does 'legal tender' mean?

You might have heard someone in a shop say: ‘But it’s legal tender!’ Most people think this means the shop is obliged to accept the payment form. But that is not the case.

A shop owner can choose what to accept. If you want to pay for a pack of chewing gum with a £50 note, it is perfectly legal to turn you down. Likewise for all other banknotes, it is a matter of discretion. If your nearest corner shop decided to only accept payments in Pokémon cards, they would be within their rights to do so. But they would probably lose customers.

Legal tender has a narrow technical meaning that will rarely come up in everyday life. The law ensures that if you offer to fully pay off a debt to someone in a form that is considered legal tender – and there is no contract specifying another form of payment – that person cannot sue you for failing to repay.

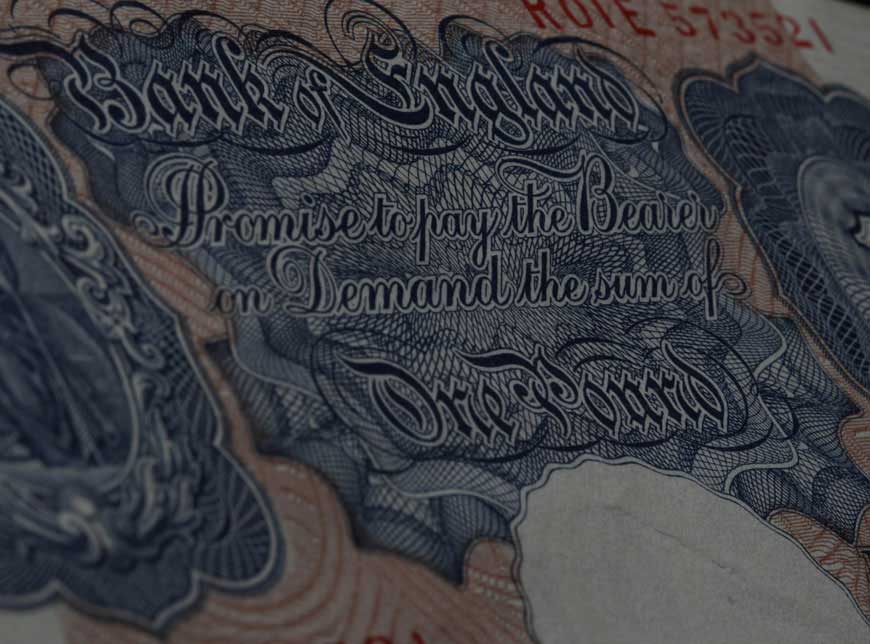

Scottish and Northern Ireland banknotes

So, what counts as legal tender?

It varies throughout the UK. In England and Wales, it is Royal Mint coins and Bank of England notes. In Scotland and Northern Ireland, it is only Royal Mint coins and not banknotes.

There are also some restrictions when using small coins. For example, 1p and 2p coins only count as legal tender for any amount up to 20p. And 5p and 10p coins only count for any amount up to £5. But £1 and £2 coins count as legal tender for any amount.

Many common and safe payment methods such as cheques, debit cards and contactless are not legal tender. But again, this will have little to no effect on your everyday life.

When do Bank of England notes stop being legal tender?

Our notes stop being legal tender when we withdraw them.

We usually give several months’ notice of the date of withdrawal.

Before this happens, we design a new banknote and issue it. Our notes always keep their face value. If a bank, building society or Post Office branch will not accept them, then you can exchange them with us.

Find out more about exchanging old banknotes

A withdrawn £1 banknote

See our banknotes section for information on exchanging withdrawn banknotes, Scottish and Northern Ireland banknotes and other topics.