What is a central bank?

A central bank is a financial institution whose job is to support the economy for a country or group of countries. It can also be called a ‘reserve bank’ or a ‘monetary authority’.

Bank of England's explainer on how it is independent from the Government.

-

Hi, my name is Tiago, and I work at the Bank of England. The Bank of England is the central bank of the United Kingdom. We’re different to a bank that you would come across in the high street. That means we don’t hold accounts or make loans to the public. We issue banknotes that you spend in shops. There are over 3 billion of these notes in circulation, worth over £60 billion. We set the official interest rate for the United Kingdom. This is called Bank Rate. It directly influences the cost of savings, loans and mortgage rates. The Bank of England also keeps a close watch on the financial system, so you can have confidence that your money is safe, in good times and in bad.

In which ways is the Bank of England independent of the Government?

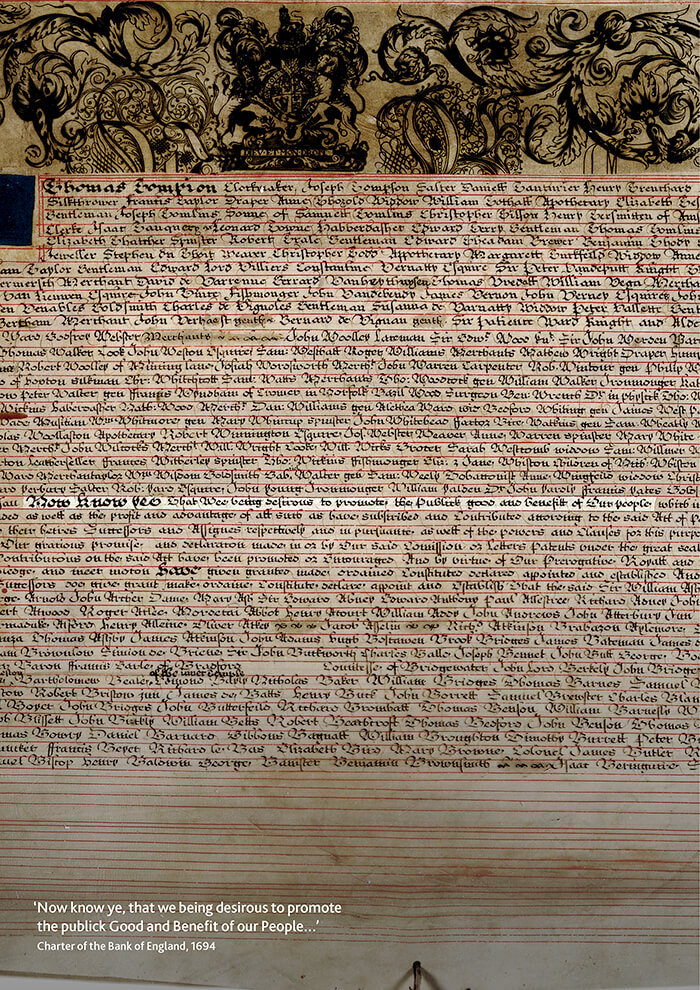

For over 250 years, until it was nationalised in 1946, we were a private bank owned by various shareholders.

Today, we are owned by the UK Government, who appoint all of our senior policymakers. But we have independence from the Government in terms of how we carry out our responsibilities.

What does this mean?

Well first of all, Parliament has given us very precise goals and responsibilities. For each one, we have specific tools we can use to meet our objectives.

Take our target for inflation, for example. The Government sets the target – which is 2%. Independence for monetary policy – which we’ve had since May 1997 – means that we set interest rates (and ‘quantitative easing’) at what we think to be the most appropriate level to achieve the inflation target. A committee meets to agree on these decisions eight times a year.

We have committees that make decisions about our other responsibilities, such as making sure the financial system is working properly to serve UK households and businesses.

How is the Bank of England accountable as a public body?

We’re overseen by a group of Directors, who are responsible for setting and monitoring the way we function as an organisation.

Although we are independent, we have to explain how and why we arrive at the decisions we make. And as a public body, we are answerable to both the UK parliament and public.

One way that we are held accountable is through public meetings with the House of Commons Treasury Committee. These meetings typically happen when we publish our latest reports on the state of economy and the financial system.

These reports also explain any changes in our policies (such as interest rates) to support the economy. They are accompanied by a press conference on the day they are published, where you can watch the Governor and other senior officials answer questions on our assessment of the economy, our latest policy decisions and which factors fed into the decisions.