What are the ‘physical’ risks from climate change?

Climate change means we may face more frequent or severe weather events like flooding, droughts and storms. Examples of recent weather events that have been linked to human-driven climate change include the heatwave and droughts in China in the summer of 2013 and, the following winter, extreme rainfall and flooding here in the UK.

These events bring 'physical risks' that impact our society directly and have the potential to affect the economy. If these events happen more frequently, people will become more reliant on insurance to cover the costs of damage to their houses and cars.

As weather-related insurance claims rise, insurance companies have more to pay out, increasing everyone’s premiums. If companies and households are not insured, they may need to foot the bill themselves. In both cases, the consumer ends up paying more.

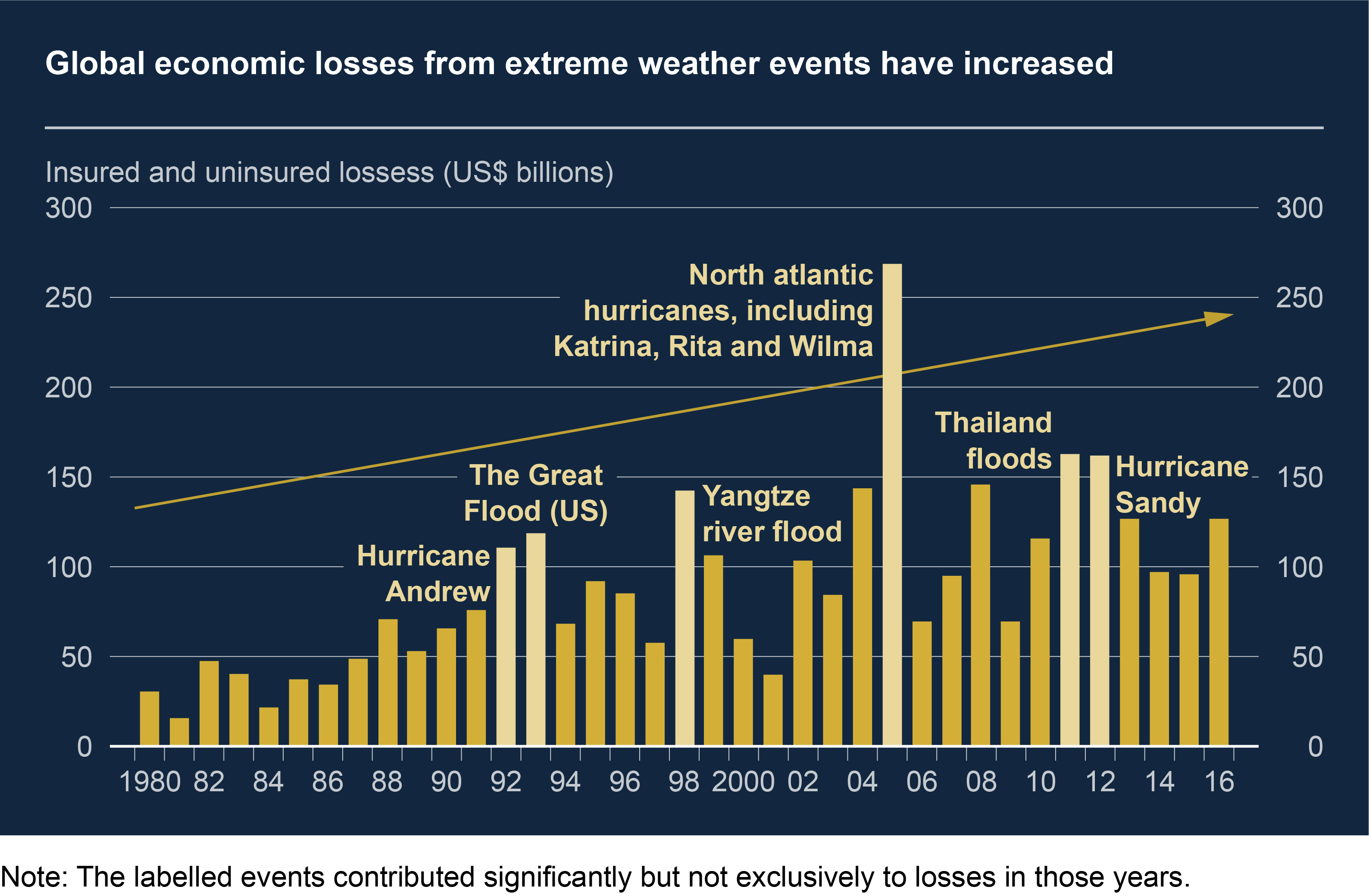

Weather-related losses – both insured and uninsured – are much higher in recent decades.

See Chart 2 of 'The Bank’s response to climate change' for details of the data underpinning this chart.

One reason behind this increase is the fact that more homes, offices and factories have been built in high risk areas. But there are signs that climate change is having an impact, too. For example, insurance losses from Superstorm Sandy in New York are estimated to have been around 30% higher because of the 20cm rise in sea level at the tip of Manhattan.

Losses from severe weather events can have big effects on the wider economy. For instance, if weather-related damage leads to a fall in house prices (and so reduces the wealth of homeowners) then there could be a knock-on effect on overall spending in the economy.

What are the ‘transition’ risks?

Transition risks can occur when moving towards a less polluting, greener economy. Such transitions could mean that some sectors of the economy face big shifts in asset values or higher costs of doing business. It’s not that policies stemming from deals like the Paris Climate Agreement are bad for our economy – in fact, the risk of delaying action altogether would be far worse. Rather, it’s about the speed of transition to a greener economy – and how this affects certain sectors and financial stability.

One example is energy companies. If government policies were to change in line with the Paris Agreement, then two thirds of the world’s known fossil fuel reserves could not be burned. This could lead to changes in the value of investments held by banks and insurance companies in sectors like coal, oil and gas.

The move towards a greener economy could also impact companies that produce cars, ships and planes, or use a lot of energy to make raw materials like steel and cement.

While the physical risks from climate change have been discussed for many years, transition risks are a relatively new category. Some firms are now choosing to reduce investments into sectors like coal to help manage these risks. As companies disclose more information relating to climate change, financial firms will be able to make more informed decisions.

Bank of England's explainer on climate change.

What are the liability risks?

The Bank’s report on insurance flagged a third risk – liability. These risks come from people or businesses seeking compensation for losses they may have suffered from the physical or transition risks from climate change outlined above. The issue of liability risk raises the important question:

'If future generations do suffer from severe climate change, who will they hold responsible?'.

An example helps to illustrate the issue. Suppose investors back a business which goes on to make a loss due to climate-related events. There may then be a question as to whether the business had provided enough information about its exposure to these climate-related financial risks. If investors felt this information had not been provided, they might make a claim against the business.

Liability cases could also include people who have suffered from physical events, such as flooding, making claims against polluting companies who they argue are, at least in part, responsible.