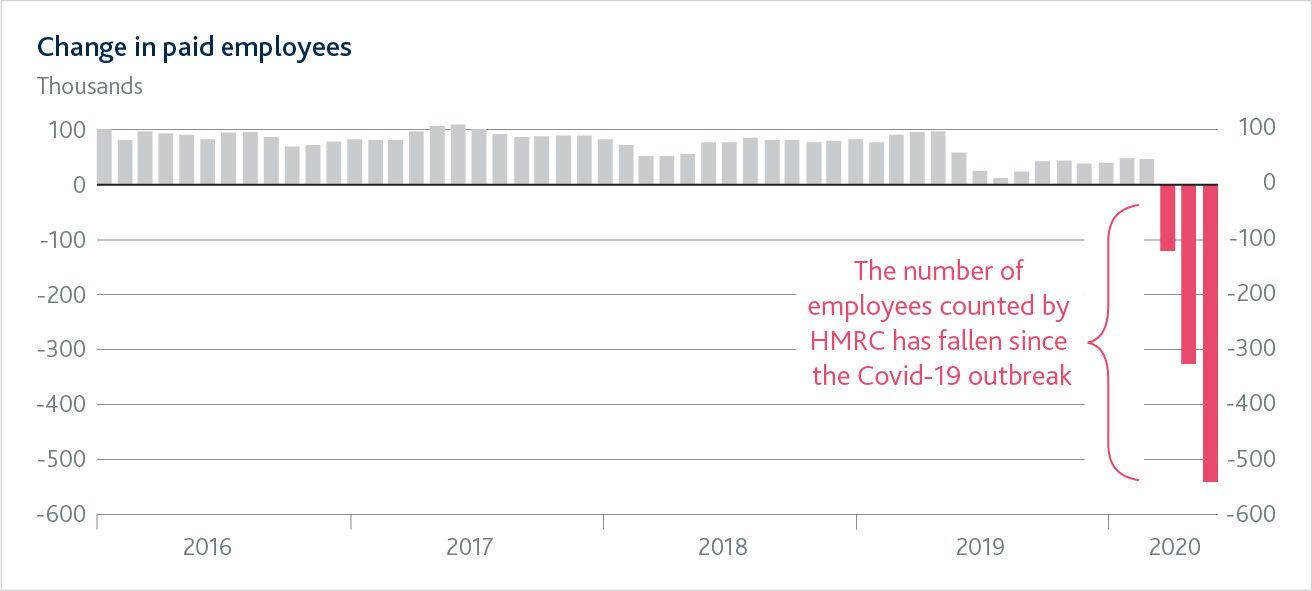

Covid-19 is reducing jobs and incomes in the UK. It has also put a big strain on UK businesses’ cash flow, and is threatening the livelihoods of many people.

Our role is to ensure UK monetary and financial stability. We set monetary policy to influence spending in the economy and to ensure (the pace of price rises) returns to our 2% target sustainably. Low and stable inflation supports jobs and growth and helps people plan for the future. We ensure the UK financial system is resilient to, and prepared for, a wide range of risks – so that the system can serve UK households and businesses in bad times as well as good.

We have put in place a package of measures that will support households and businesses, help the economy recover and keep the financial system safe and stable.

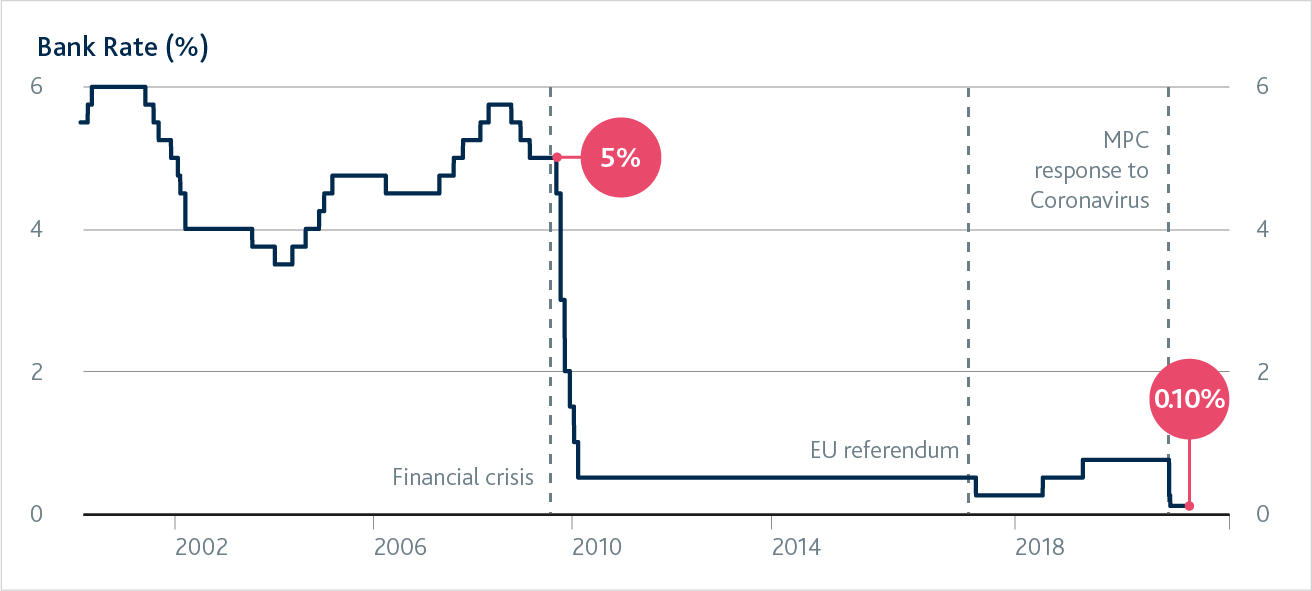

Since January, we have cut and are supporting the UK economy through £300 billion of quantitative easing. This reduces borrowing costs for households and businesses and will help the economy to recover.

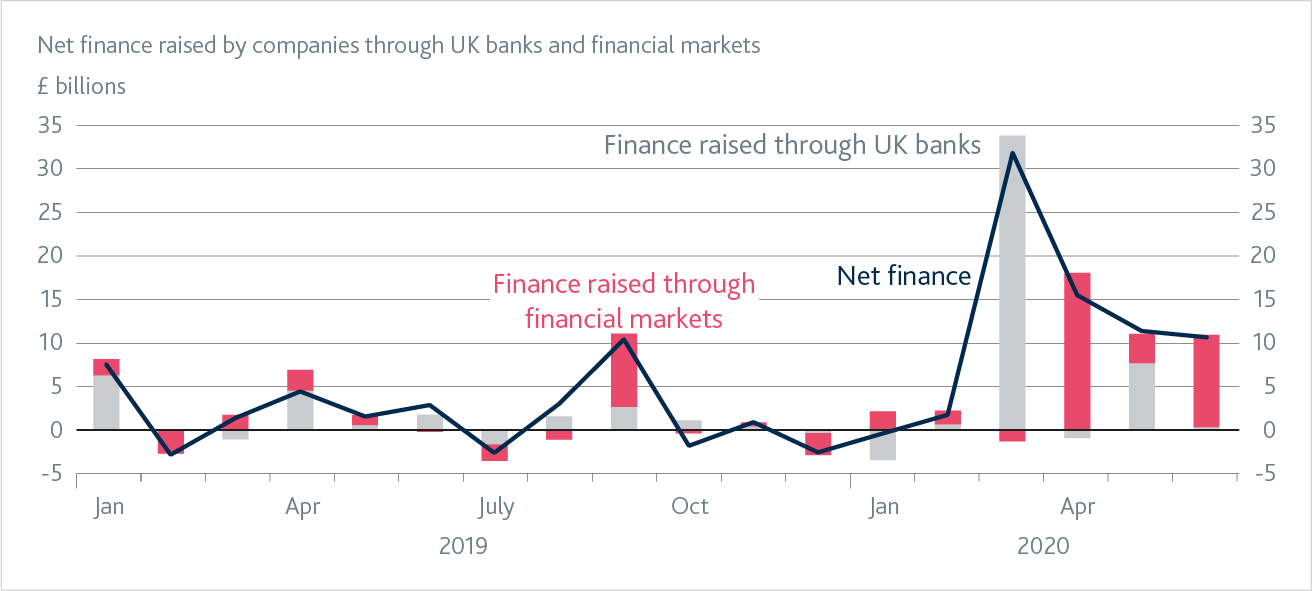

Households and businesses need help from the financial system to weather the economic disruption associated with Covid-19. Actions we took to strengthen the UK financial system since the global financial crisis mean UK banks are strong enough to be able to keep lending to households and businesses even in very severe situations. By expanding lending, banks will support the economy and limit losses to themselves.

We will continue to monitor the economy closely including how the UK financial system is serving UK households and businesses during this shock. We stand ready to take further actions to help the economy recover, ensure that inflation returns to our 2% target, and support financial stability to promote the good of the people of the United Kingdom.