What role does the financial system play in the economy?

The financial system helps people to use money in different ways.

It is made up of different parts. These include banks, other institutions (such as insurers) and the financial markets that connect them together.

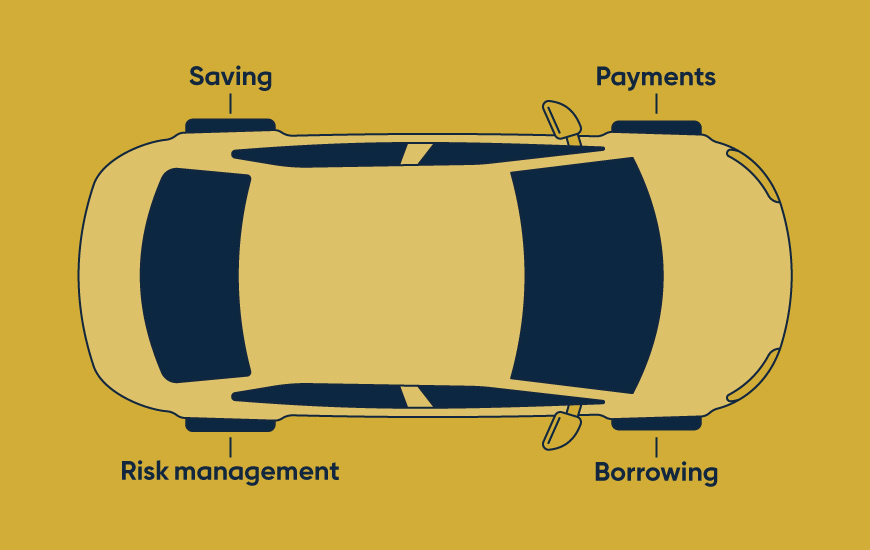

You can think of the financial system as the wheels of the economy. It provides essential services that keep the economy moving.

It gives people ways to:

- make payments so we can buy and sell goods and services

- manage and insure against risks

- manage savings

- borrow money

What happens when the financial system is unstable?

It can be difficult to spot when things are unstable. It might only become obvious when conditions on the road get tougher and then things start to go wrong. Hidden weaknesses can leave the financial system vulnerable if financial institutions are not prepared for unexpected events.

If one area of the financial system is weak, problems can start to spread or multiply. This can disrupt the services which households and businesses rely on for their day-to-day needs.

For example, you might find it harder get a mortgage or save enough for your retirement. The Global Financial Crisis (2007-2009) showed that financial instability can severely affect lots of people’s jobs and lives.

How can the financial system be made more stable?

Here at the Bank of England it’s our job to make sure the UK’s financial system is resilient to any risks and shocks. We call this our financial stability objective. In our organisation there are two bodies that do this work: the Financial Policy Committee (FPC) and the Prudential Regulation Authority (PRA).

The FPC are the mechanics of the financial system who check under the bonnet of the car. They work to keep everything moving smoothly. One way they do this is to identify risks and flaws. They work out how bad these might get then they act to remove or reduce them, if they need to.

The PRA are the safety engineers who regulate and oversee financial institutions.

There are three things that help to keep the UK’s financial system stable, even if it comes under stress: regulations, tests and shock absorbers.

First, financial regulations are a bit like the safety regulations that a car manufacturer has to meet. Except these regulations are for financial firms (such as banks, building societies and insurance companies). But they check more than just the products and services the firms provide. They also check the way a firm is run and how it operates. For example, it must not take excessive risks with other people’s money. The Bank of England is one of the UK’s three financial regulators. The other two are HM Treasury and the Financial Conduct Authority.

The second thing is that these firms have to undergo tests to see how they would cope with difficult conditions. It’s a bit like the way an MOT checks things like a car’s tyre pressure and brake pads. We call them ‘stress tests’. We stress test the UK’s major banks every year to make sure they can withstand shocks.

The third thing acts a bit like a car’s shock absorber when it reduces the impact of bumps in the road. For example, we make sure large UK banks to keep extra money set aside in case they need it. We call this a ‘counter cyclical capital buffer (CCyB)’.