In a nutshell

Our role is to ensure UK monetary and financial stability. We set to influence spending in the economy and to ensure (the pace of price rises) returns to our 2% target sustainably. Low inflation supports jobs and growth. We ensure the UK financial system is resilient to, and prepared for, the wide range of risks it could face – so that the system can serve UK households and businesses in bad times as well as good.

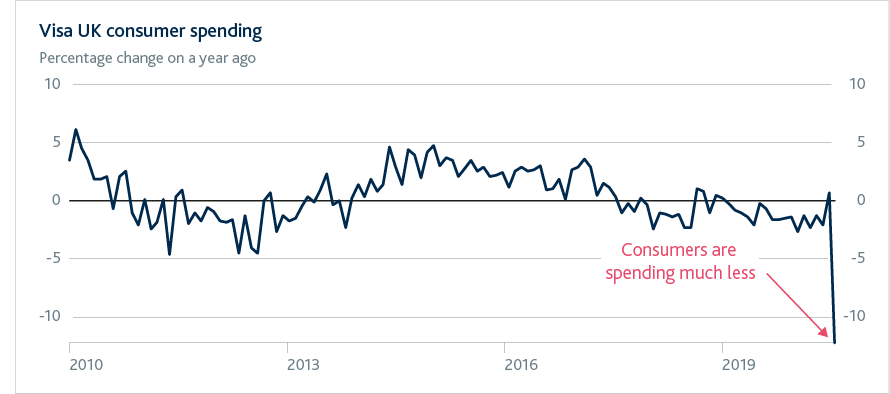

Covid-19 and the measures to contain its spread are dramatically reducing jobs and incomes in the UK. They have also put a big strain on UK businesses’ cash flow.

We have put in place a package of measures that will support households and businesses, help the economy recover and keep the financial system safe and stable.

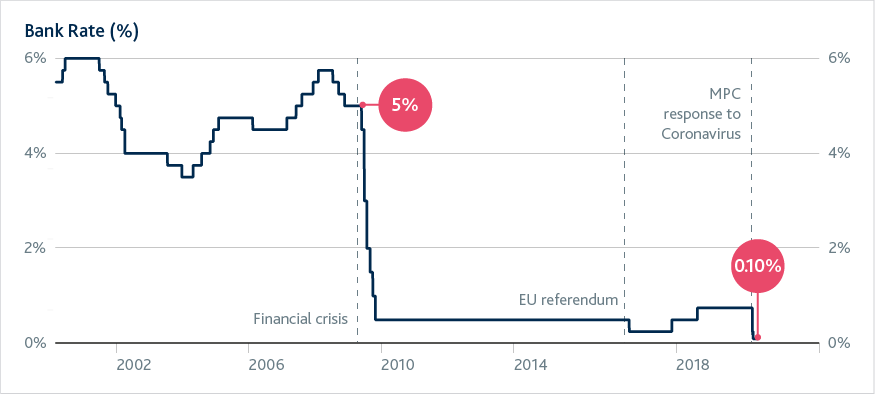

Since January, we have cut interest rates and injected a further £200 billion into the UK economy through quantitative easing. That reduces the costs that some households and businesses face and will help the economy to recover.

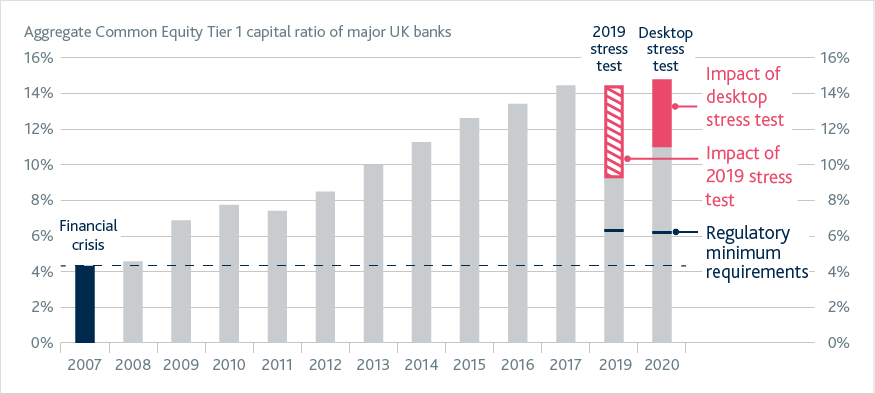

We are helping banks to expand lending. We reduced the amount of their own financial resources (called capital) that banks and building societies need to make loans to UK businesses and households. Supported by our actions, and by Government and Bank of England lending schemes, the UK financial system can help businesses deal with financial difficulties by refinancing existing loans and by extending new loans.

We have tested the major UK banks. This has shown that they are strong enough to continue lending during this period of severe economic disruption. By expanding lending, banks will support the economy and limit losses to themselves.

We will continue to monitor the economic and financial situation closely, and whether households and businesses can get the credit they need. We stand ready to take further actions to help the economy recover, ensure that inflation returns to our 2% target, and support financial stability.