By Gene Kindberg-Hanlon and Andrej Sokol of the Bank’s International Directorate.

- Global activity is a key driver of UK GDP and a bellwether of prospects. Nowcasting global GDP growth, or predicting outturns ahead of their release, is therefore a key input into the Monetary Policy Committee’s assessment of the UK economic outlook.

- The Bank uses a suite of models to assess the momentum in the world economy in real time. A wide range of financial market, survey-based and high-frequency output indicators are used to inform the suite.

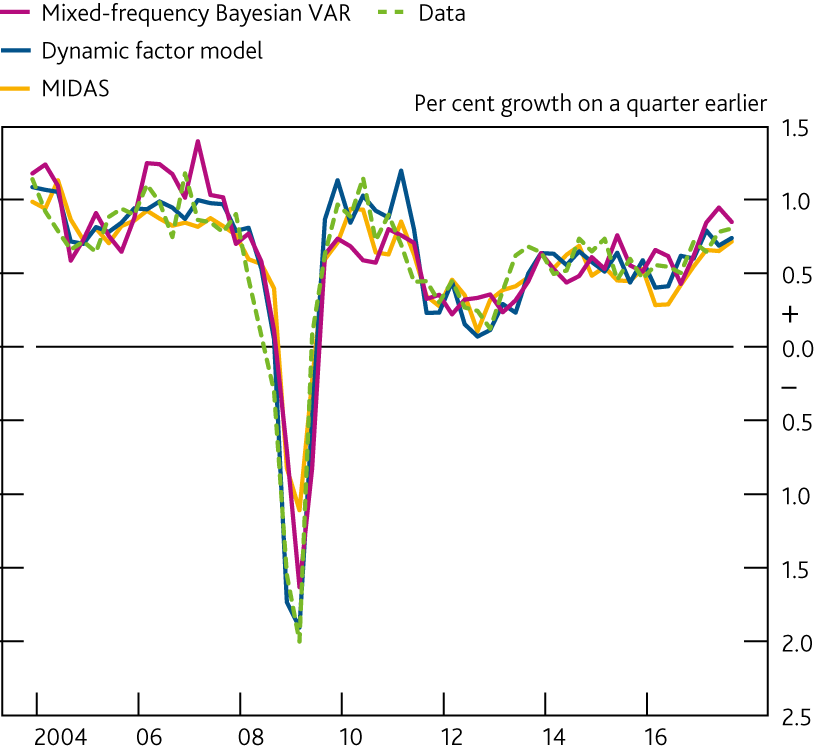

- The statistical suite of global nowcasting models tends to provide an accurate assessment of global activity growth, and significantly outperformed a simple model that did not benefit from the use of high-frequency data during the financial crisis.

Overview

Developments in world activity can spill over to UK gross domestic product (GDP) growth both through trade and non-trade linkages. World GDP growth is therefore a key input into the Monetary Policy Committee’s forecast. Official GDP releases, particularly in sufficient number to construct a global aggregate, only appear with a significant lag. However, there are many sources of economic activity and financial market data that can provide more timely insights into the path of world activity.

The Bank focuses on two key measures of global activity: UK export-weighted world GDP, and purchasing power parity-weighted world GDP. The first provides a picture of demand conditions with a larger weighting towards the UK’s main trading partners. The second provides a more general picture of global activity growth, weighting together economies by their respective output. Statistically tracking the growth of world GDP can potentially benefit from the use of a huge range of high-frequency indicators. However, that poses a challenge where indicators provide conflicting signals. To process those data efficiently, the international nowcasting suite contains three core models, some of which are similar to those used to nowcast UK GDP (Anesti et al (2017)).

The nowcasting suite has performed well historically, producing a sound model-based anchor for the first quarter of the Bank’s quarterly global forecast that feeds into the Inflation Report (see summary chart). The use of high-frequency data has added the most value to predicting world GDP growth during the financial crisis. And models using high-frequency data are particularly valuable during turning points for global growth — therefore they will be a useful tool in monitoring the sustainability of the recent upturn in global growth. That said, a simpler benchmark model has been difficult to outperform in the post-crisis period given the low volatility of world GDP growth.

Gauging the globe: the Bank's approach to nowcasting world GDP