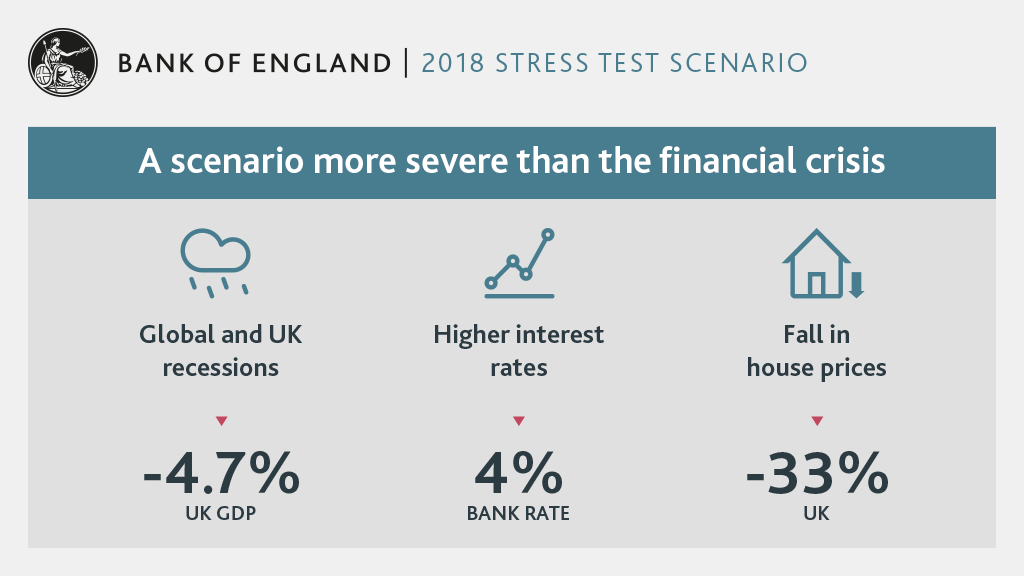

The 2018 annual cyclical scenario tests the resilience of the UK banking system to deep simultaneous recessions in the UK and global economies, large falls in asset prices and a separate stress of misconduct costs.

The stresses applied to the economic and financial market prices and measures of activity in the 2018 ACS will be the same as in the 2017 test.

The hurdle rates for the 2018 test will evolve from those used in earlier years in four important ways:

- The Bank will hold banks of greater systemic importance to higher standards.

- Hurdle rates will incorporate buffers to capture domestic systemic importance as well as global systemic importance.

- The calculation of minimum capital requirements incorporated in the hurdle rates will more accurately reflect how they would evolve in a real stress.

- Adjustments will be made to reflect the increased loss absorbency that will result from higher provisions in stress under the new IFRS 9 accounting standard.

Key elements of the 2018 stress test

Variable paths for the 2018 stress test

Traded risk scenario for the 2018 stress test

2018 guidance for participating banks and building societies