UK banks are strong enough to serve households and businesses in bad times as well as good

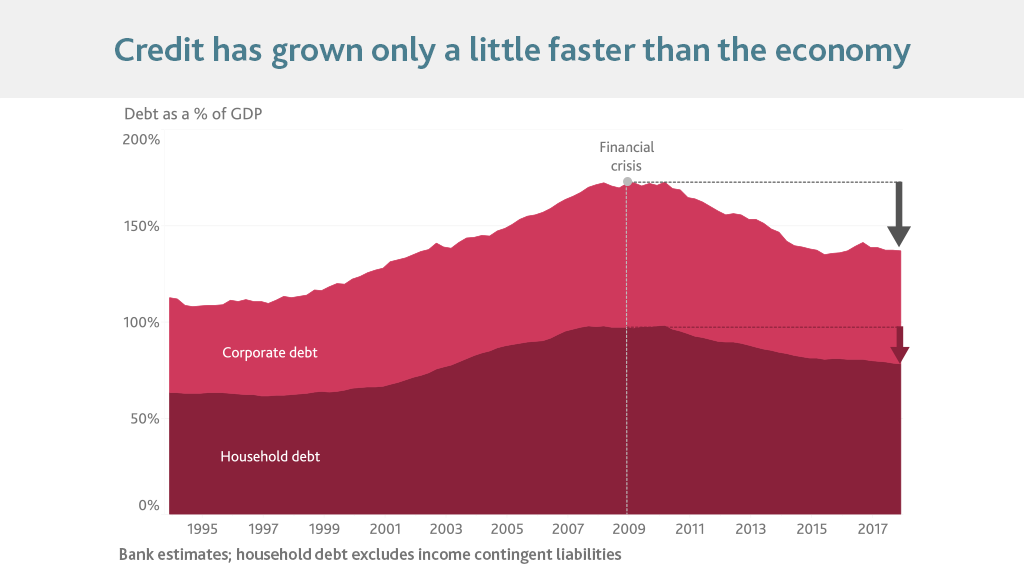

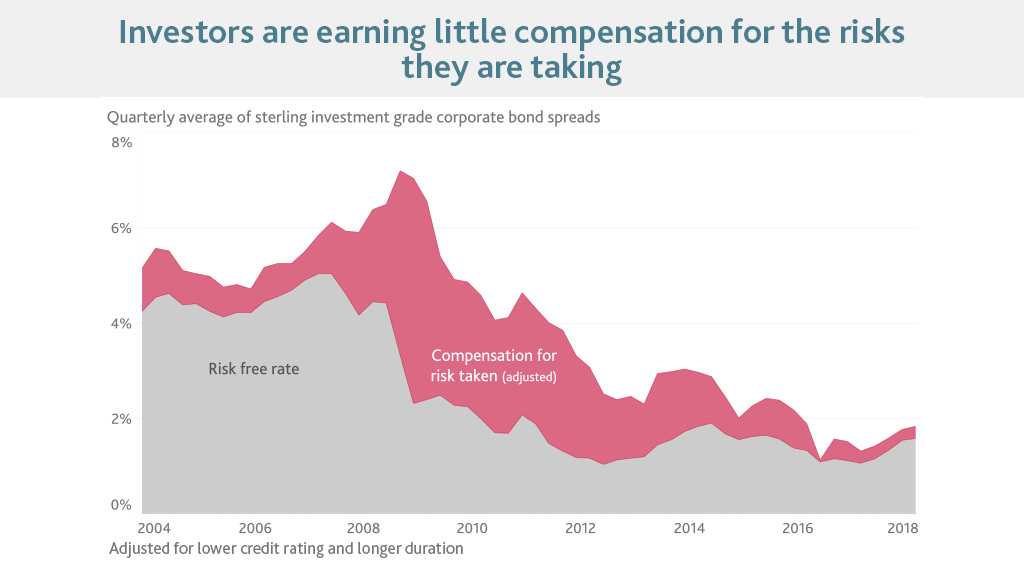

Domestic risks – apart from those related to Brexit – are standard overall, though domestic risk appetite remains strong

Global risks are material, and have increased

…and prepared to avoid future disruption

There’s been progress to avoid disruption to financial services during Brexit, but more needs to be done

Firms will have to show they can restore services quickly after cyber attacks

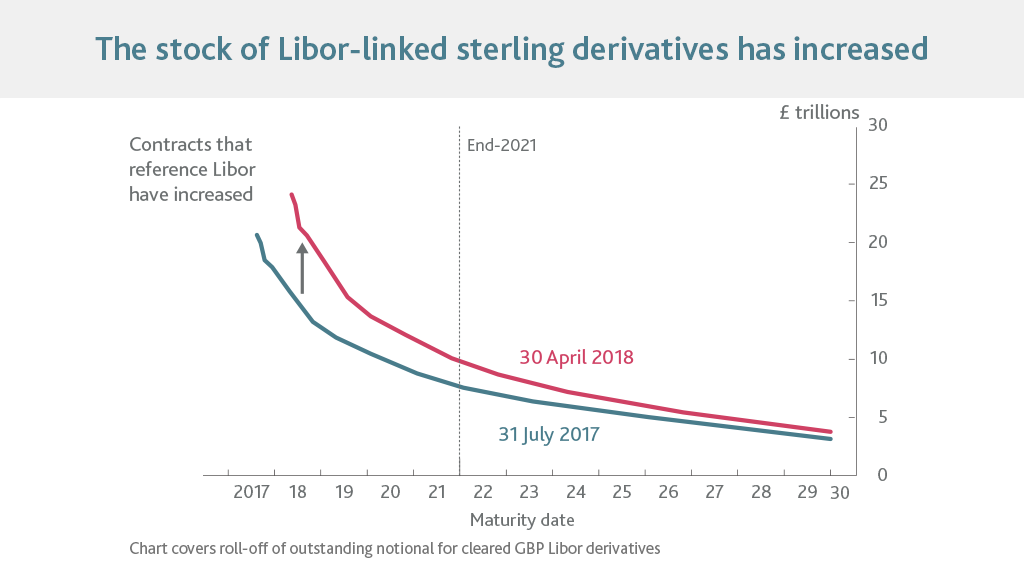

Firms need to transition contracts away from using Libor

Executive summary

The Financial Policy Committee (FPC) aims to ensure the UK financial system is resilient to, and prepared for, the wide range of risks it could face — so that the system can serve UK households and businesses in bad times as well as good.

The FPC continues to judge that, apart from those related to Brexit, domestic risks remain standard overall. In recent months there has been some reduction in domestic risk appetite, although it remains strong.

- Levels of household and corporate debt in the UK relative to incomes remain materially below their 2008 levels. Overall, credit growth remains broadly in line with the growth in nominal GDP and debt‑servicing burdens are low.

- In recent months, corporate bond spreads have increased and mortgage loan spreads have widened a little.

- Non‑bank lending to riskier companies has been expanding rapidly. But lending by banks has been muted, limiting the increase in overall corporate leverage and the effect on banks’ resilience.

- Consumer credit continues to expand rapidly. The Committee acted last year to ensure lenders are able to absorb severe losses on consumer credit.

- Although banks’ risk appetite in mortgage lending has increased over the past few years, weak demand has kept mortgage credit growth modest. The FPC’s previous mortgage market measures have insured against a marked deterioration in lending standards.

Risks from global vulnerabilities remain material and have increased.

- Increases in Italian government bond yields suggest rising risks in the euro area and underline the vulnerabilities

created by high public debt levels and interlinkages between banks and sovereigns in a currency union. - Tightening conditions in US dollar funding markets are increasing risks in some emerging markets.

- Trade tensions have intensified. Debt levels in China remain highly elevated. And corporate leverage in the US has

continued to increase.

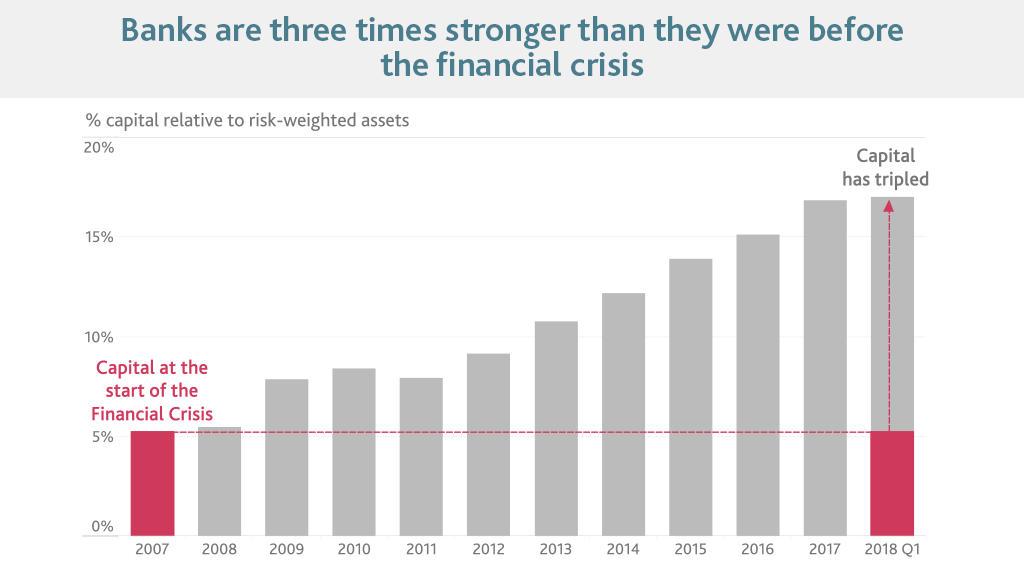

The 2017 stress test showed that the UK banking system is resilient to severe domestic, global and market shocks. The FPC is maintaining the UK countercyclical capital buffer (CCyB) rate at 1%.

- Major UK banks’ capital strength has tripled since 2007, with an aggregate Tier 1 capital ratio of 17% in 2018 Q1.

- The FPC remains alert to any increase in risks faced by the UK banking system. Financing conditions in debt markets, which remain accommodative, could promote further risk‑taking in the UK and elsewhere. The UK is more vulnerable to a reduction in foreign investor appetite for UK assets, as the share of capital inflows vulnerable to refinancing risk has risen. And material global risks could spill over to the UK.

- The FPC will conduct as normal a comprehensive assessment of the resilience of the UK banking system in the 2018 stress test and review the adequacy of the 1% CCyB rate.

The FPC continues to judge that the UK banking system could support the real economy through a disorderly Brexit.

- The 2017 stress test encompassed a wide range of UK macroeconomic outcomes that could be associated with Brexit. As it has set out previously, the FPC judges that Brexit risks do not warrant additional capital buffers for banks.

- Irrespective of the particular form of the UK’s future relationship with the EU, and consistent with its statutory responsibility, the FPC will remain committed to the implementation of robust prudential standards in the UK. This will require maintaining a level of resilience that is at least as great as that currently planned, which itself exceeds that required by international baseline standards.

The FPC is continuing to monitor preparations to mitigate disruption to financial services that could arise from Brexit. Progress has been made but material risks remain.

- An implementation period has been agreed, subject to finalisation and ratification of the Withdrawal Agreement between the EU and the UK, elements of which are still in negotiation.

- The EU (Withdrawal) Bill has been passed by Parliament.

- The UK Government has committed to legislate, if necessary, to put in place a temporary permissions regime to enable EU‑based financial companies to continue to provide financial services to UK end‑users. Once enacted, this will mitigate a number of risks of disruption to UK customers.

- The biggest remaining risks of disruption are where action is needed by both UK and EU authorities, such as ensuring the continuity of existing derivative contracts. As yet the EU has not indicated a solution analogous to a temporary permissions regime. The FPC welcomes the establishment in April of a technical working group, chaired by the European Central Bank and Bank of England, on risk management in the area of financial services in the period around 30 March 2019.

The FPC is setting standards for how quickly critical financial companies must be able to restore vital services following a cyber attack. It plans to test them against these in cyber stress tests.

- Firms have primary responsibility for their ability to resist and recover from cyber attack.

- The impact tolerances being established by the FPC will be based on the time after which disruption to services could cause material economic impact.

- Working with others, especially the National Cyber Security Centre, the Bank will test that firms would be able to meet the FPC’s standards for recovering services.

Continued reliance of financial markets on Libor poses a risk to financial stability that can be reduced only through a transition to alternative rates. The FPC will monitor progress and report regularly.

- The scarcity of unsecured deposit transactions poses a risk to the medium‑term sustainability of Libor. The FCA has secured agreement of Libor panel banks to submit to Libor until end‑2021.

- Good progress has been made to establish potential alternatives to Libor. In the UK, SONIA (the sterling overnight index average) is the preferred alternative. And two important market‑led consultation exercises are due to be carried out soon.

- However, as long as the outstanding stock of contracts maturing after 2021 that reference Libor continues to increase, so will associated medium‑term financial stability risks.