COLLG 1

Overview

COLLG 1.1

Introduction

- 01/12/2004

About this guide

COLLG 1.1.1

See Notes

Structure of collective investment regulation in the United Kingdom

COLLG 1.1.2

See Notes

What are regulated collective investment schemes?

COLLG 1.1.3

See Notes

What are ICVCs?

COLLG 1.1.4

See Notes

What are AUTs?

COLLG 1.1.5

See Notes

COLLG 1.1.6

See Notes

Powers and duties of the scheme, the authorised fund manager, and the depositary

COLLG 1.1.7

See Notes

Authorisation to carry on regulated activities

COLLG 1.1.8

See Notes

- 11/02/2009

COLLG 2

European Legislation

COLLG 2.1

Introduction

- 01/12/2004

Background and scope

COLLG 2.1.1

See Notes

General scope of the UCITS Directive

COLLG 2.1.2

See Notes

Obligations on the management company and depositary

COLLG 2.1.3

See Notes

COLLG 2.1.4

See Notes

Investment and borrowing powers and limits

COLLG 2.1.5

See Notes

Information to investors

COLLG 2.1.6

See Notes

The management company passport

COLLG 2.1.7

See Notes

Marketing requirements (for UK firms)

COLLG 2.1.8

See Notes

COLLG 3

The FSA's responsibilities under the Act

COLLG 3.1

Introduction

- 01/12/2004

COLLG 3.1.1

See Notes

Marketing of schemes in the UK (section 238)

COLLG 3.1.2

See Notes

Application for authorisation (sections 242 and 243)

COLLG 3.1.3

See Notes

Determining and refusing applications (sections 244 and 245)

COLLG 3.1.3A

See Notes

- 11/02/2009

Revocation of authorisation (section 254)

COLLG 3.1.4

See Notes

Notification of changes to unit trusts (section 251)

COLLG 3.1.5

See Notes

Powers of intervention (sections 257 and 281)

COLLG 3.1.6

See Notes

Scheme particulars (section 248)

COLLG 3.1.7

See Notes

Recognition of overseas schemes

COLLG 3.1.8

See Notes

Recognition of schemes constituted in other EEA states (section 264)

COLLG 3.1.8A

See Notes

- 11/02/2009

Recognition of schemes authorised in designated territories (section 270)

COLLG 3.1.8B

See Notes

- 11/02/2009

Recognition of individual overseas schemes (section 272)

COLLG 3.1.8C

See Notes

- 11/02/2009

Subsequent notification in respect of schemes recognised under sections 270 and 272 of the Act

COLLG 3.1.9

See Notes

- 01/12/2004

Refusal of approval: schemes recognised under sections 270 and 272 of the Act

COLLG 3.1.10

See Notes

- 01/12/2004

Revocation of recognition of overseas schemes (section 279)

COLLG 3.1.11

See Notes

Scheme facilities in the United Kingdom (section 283)

COLLG 3.1.12

See Notes

- 01/12/2004

COLLG 4

The FSA's Responsibilities under the OEIC Regulations

COLLG 4.1

Introduction

- 01/12/2004

COLLG 4.1.1

See Notes

- 01/12/2004

Applications for authorisation (Regulations 12 - 17)

COLLG 4.1.2

See Notes

Notification of changes to ICVCs (Regulation 21)

COLLG 4.1.3

See Notes

Revocation of authorisation (Regulation 23)

COLLG 4.1.4

See Notes

Power of intervention (Regulation 25)

COLLG 4.1.5

See Notes

Corporate Code

COLLG 4.1.6

See Notes

- 01/12/2004

The FSA's registration function

COLLG 4.1.7

See Notes

COLLG 5

The COLL sourcebook

COLLG 5.1

Introduction

- 01/12/2004

COLLG 5.1.1

See Notes

Definition of terms in COLL

COLLG 5.1.2

See Notes

Outline of the content of COLL

COLLG 5.1.3

See Notes

Qualified investor schemes

COLLG 5.1.3A

See Notes

- 11/02/2009

Recognised schemes

COLLG 5.1.3B

See Notes

- 11/02/2009

Related Sourcebooks

COLLG 5.1.4

See Notes

COLLG 5.1.5

See Notes

COLLG 5.1.6

See Notes

[deleted]

- (1) [deleted]

- (2) [deleted]

- (3) [deleted]

- (4) [deleted]

COLLG 5.1.7

See Notes

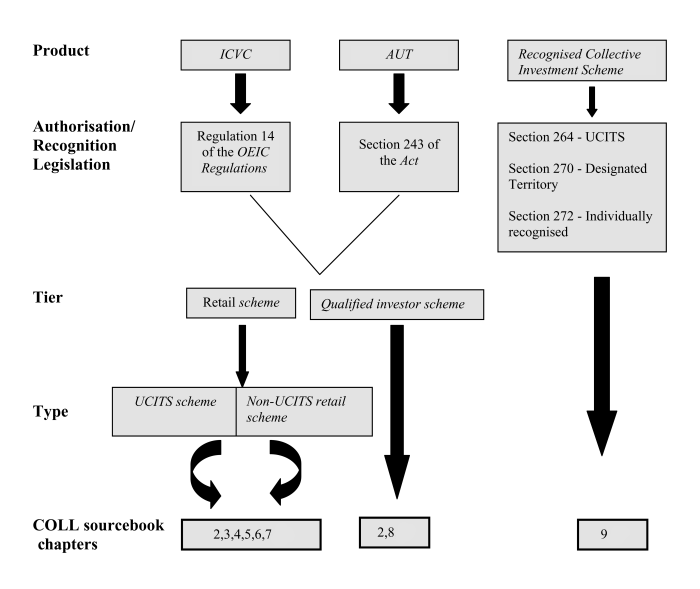

Regulated schemes: explanatory diagram

COLLG 5.1.9

See Notes