AUTH 1

Introduction to the Authorisation manual

AUTH 1.1

Application and purpose

- 01/12/2004

Application

AUTH 1.1.1

See Notes

Purpose

AUTH 1.1.2

See Notes

- 03/09/2001

AUTH 1.1.3

See Notes

AUTH 1.2

Introduction

- 01/12/2004

AUTH 1.2.1

See Notes

AUTH 1.2.2

See Notes

- 03/09/2001

AUTH 1.2.3

See Notes

AUTH 1.2.4

See Notes

AUTH 1.2.5

See Notes

AUTH 1.2.6

See Notes

AUTH 1.3

The Authorisation manual

- 01/12/2004

AUTH 1.3.1

See Notes

- 03/09/2001

AUTH 1.3.2

See Notes

- 18/10/2001

AUTH 1.3.3

See Notes

AUTH 1.3.4

See Notes

- 03/09/2001

AUTH 1.3.5

See Notes

- 03/09/2001

AUTH 1.3.6

See Notes

AUTH 1.3.7

See Notes

AUTH 1.3.8

See Notes

- 03/09/2001

AUTH 1.3.9

See Notes

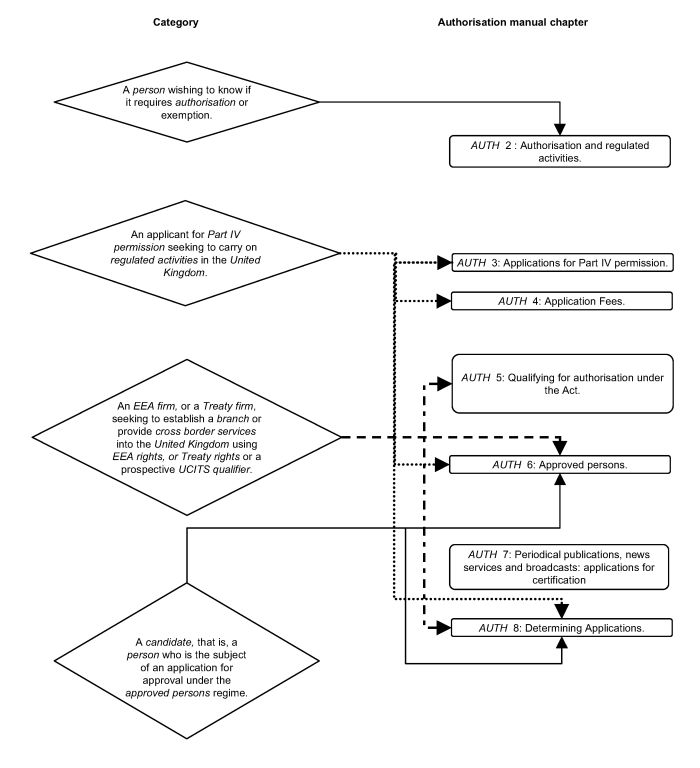

Summary of AUTH

This table belongs to AUTH 1.3.7 G

| Chapter: | Applicable to: | On: |

|

AUTH 2: Authorisation and regulated activities | a person wishing to find out whether it needs to be authorised (or is an exempt person). | the Act, the Regulated Activities Order and the Exemption Order. |

|

AUTH 3: Applications for Part IV permission | an applicant for Part IV permission. | how the FSA will exercise the powers granted to it in Part IV of the Act to determine and, if appropriate, grant an application for Part IV permission. |

|

AUTH 4: Authorisation Fees | an applicant for Part IV permission. | the fees the FSA will levy on applicants for Part IV permission. |

|

AUTH 5: Qualifying for authorisation under the Act | 1. an EEA firm wishing to exercise its EEA right and establish a branch in, or provide cross border services into, the United Kingdom; | how an EEA firm, a Treaty firm or a UCITS qualifier can qualify for authorisation under the Act. |

| 2. a Treaty firm wishing to exercise its Treaty rights; | ||

| 3. a prospective UCITS qualifier. | ||

|

AUTH 6: Approved persons | 1. an applicant

for Part IV permission seeking

approval for a person to perform a controlled

function under arrangements to

be entered into by the firm or

its contractors (including appointed

representatives); 2. a candidate. | 1. the controlled functions that

the FSA has

specified; and. 2. how the FSA will exercise the powers given to it in Part V of the Act to require firms to obtain prior approval for persons who will perform controlled functions. |

| Note: EEA firms, Treaty firms and UCITS qualifiers should refer to SUP 10 (Application). | ||

|

AUTH 7: Periodical publications, news services and broadcasts: application for certification | anyone involved in publishing periodicals, or in providing news services or broadcasts, who gives (or proposes to give) advice about securities or contractually based investments. | 1. whether the person will be carrying on the regulated activity of advising on investments; and |

| 2. how the FSA will exercise its power to give certificates. | ||

|

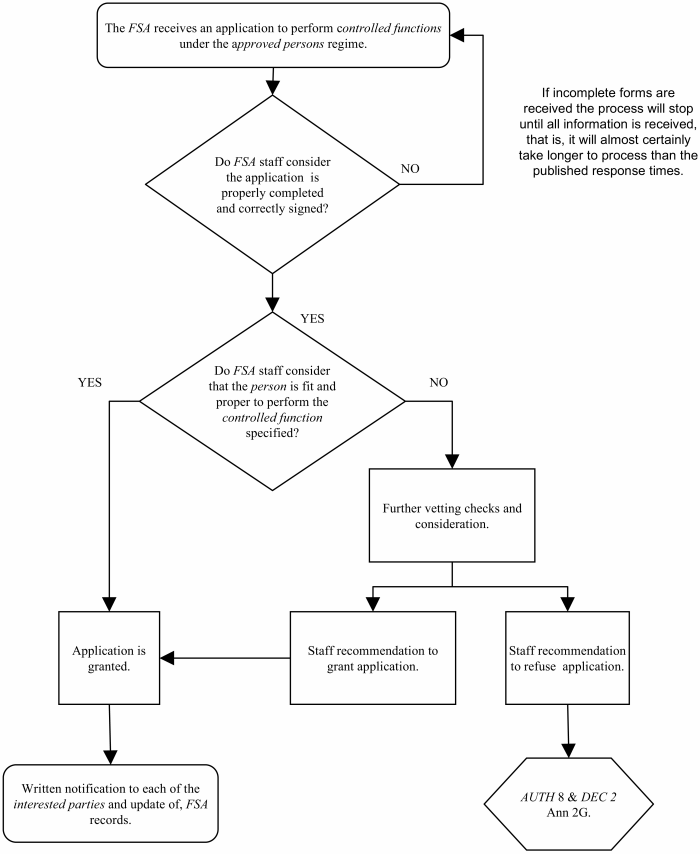

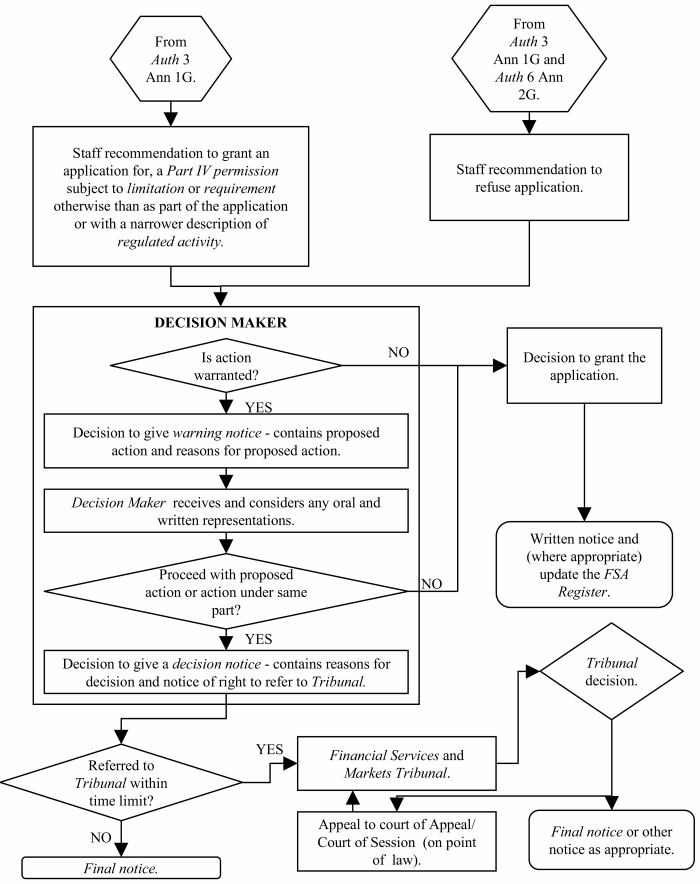

AUTH 8: Determining applications | 1. applicants for Part IV permission generally; | 1. the procedures which the FSA will follow when granting an application; and |

| 2. an EEA firm or a Treaty firm that has submitted an application for approval of a person under the approved persons regime; | 2. a summary

of the FSA's decision

making procedures for: (a) refusing, or proposing to refuse, an application for Part IV permission or an application for approval under the approved persons regime; or | |

| 3. a candidate. | (b) granting, or proposing to grant, an application for Part IV permission subject to limitations or requirements not applied for or with a narrower description of regulated activity than that to which the application relates. |

AUTH 1.4

The FSA's approach to applications for Part IV permission: an overview

- 01/12/2004

AUTH 1.4.1

See Notes

- 03/09/2001

AUTH 1.4.2

See Notes

- 03/09/2001

AUTH 1.4.3

See Notes

- 03/09/2001

The FSA's approach to risk assessment

AUTH 1.4.4

See Notes

- 03/09/2001

AUTH 1.5

Understanding the requirements and standards of the regulatory system

- 01/12/2004

AUTH 1.5.1

See Notes

- 03/09/2001

AUTH 1.5.2

See Notes

- 03/09/2001

AUTH 1.5.3

See Notes

AUTH 1.5.4

See Notes

- 03/09/2001

AUTH 1.6

Applying for Part IV permission: overview of the process

- 01/12/2004

AUTH 1.6.1

See Notes

- 03/09/2001

AUTH 1.6.2

See Notes

- 03/09/2001

AUTH 1.6.3

See Notes

- 03/09/2001

AUTH 1.6.4

See Notes

- 03/09/2001

AUTH 1.6.5

See Notes

- 03/09/2001

AUTH 1.6.6

See Notes

AUTH 1.6.7

See Notes

- 01/07/2003

AUTH 1.6.8

See Notes

- 01/07/2003

AUTH 1.6.9

See Notes

AUTH 1.6.10

See Notes

- 03/09/2001

AUTH 1.6.11

See Notes

- 03/09/2001

AUTH 1.6.12

See Notes

- 01/07/2003

AUTH 1.7

Appointed representatives

- 01/12/2004

AUTH 1.7.1

See Notes

- 03/09/2001

AUTH 1.7.2

See Notes

- 18/10/2001

AUTH 1.8

What other general guidance is available from the FSA?

- 01/12/2004

AUTH 1.8.1

See Notes

- 03/09/2001

AUTH 1.8.2

See Notes

AUTH 1.8.3

See Notes

- 03/09/2001

AUTH 1.8.4

See Notes

- 01/10/2002

AUTH 1.8.5

See Notes

AUTH 1.9

Next steps?

- 01/12/2004

AUTH 1.9.1

See Notes

- 03/09/2001

AUTH 1.9.2

See Notes

Who to contact at the FSA

This table belongs to AUTH 1.9.1 G

| FSA dept. | For advice on: | Contact details: |

| Authorisation and Approvals Department | The authorisation aspects of the Act and relevant secondary legislation made under the Act (for example, the Regulated Activities Order) | Authorisation

Enquiries The Financial Services Authority 25 The North Colonnade Canary Wharf London E14 5HS Telephone: 020 7066 0082 |

| Authorisation and Approvals Department | Applications for Part IV permission | Authorisation

Teams The Financial Services Authority 25 The North Colonnade Canary Wharf London E14 5HS Telephone: 020 7066 3954 email: corporate.authorisation@fsa.gov.uk |

| Regulatory Decisions | Passporting notifications (into or out of the United Kingdom) | Passport Notification

Unit The Financial Services Authority 25 The North Colonnade Canary Wharf London E14 5HS Telephone: 020 7066 1000 email: passport.notifications@fsa.gov.uk |

| Authorisation and Approvals Department | Applications for approval of persons under the approved persons regime | Enquiries and

Applications Department (Individual Approvals team) The Financial Services Authority 25 The North Colonnade Canary Wharf London E14 5HS Telephone: 020 7066 0019 Fax: 020 7066 0017 email: iva@fsa.gov.uk |

- 01/07/2003

AUTH 1 Annex 1

Introduction to the Authorisation Manual

- 01/12/2004

Where to next?

AUTH 1 Ann 1

See Notes

AUTH 2

Authorisation and regulated activities

AUTH 2.1

Application and purpose

- 01/12/2004

Application

AUTH 2.1.1

See Notes

- 03/09/2001

Purpose

AUTH 2.1.2

See Notes

- 03/09/2001

AUTH 2.2

Introduction

- 01/12/2004

AUTH 2.2.1

See Notes

- 03/09/2001

AUTH 2.2.2

See Notes

- 03/09/2001

AUTH 2.2.3

See Notes

- 03/09/2001

AUTH 2.2.4

See Notes

- 03/09/2001

AUTH 2.2.5

See Notes

- 03/09/2001

AUTH 2.3

The business element

- 01/12/2004

AUTH 2.3.1

See Notes

- 03/09/2001

AUTH 2.3.2

See Notes

- 01/10/2002

AUTH 2.3.3

See Notes

- 03/09/2001

AUTH 2.4

Link between activities and the United Kingdom

- 01/12/2004

AUTH 2.4.1

See Notes

- 03/09/2001

AUTH 2.4.2

See Notes

- 03/09/2001

AUTH 2.4.3

See Notes

- 21/08/2002

AUTH 2.4.4

See Notes

- 03/09/2001

AUTH 2.4.5

See Notes

- 03/09/2001

AUTH 2.4.6

See Notes

- 03/09/2001

AUTH 2.4.7

See Notes

- 21/08/2002

AUTH 2.5

Investments and activities: general

- 01/12/2004

AUTH 2.5.1

See Notes

- 03/09/2001

AUTH 2.5.2

See Notes

- 03/09/2001

Modification of certain exclusions as a result of Investment Services and Insurance Mediation Directives

AUTH 2.5.3

See Notes

- 03/09/2001

Investment services

AUTH 2.5.4

See Notes

- 03/09/2001

AUTH 2.5.5

See Notes

- 01/10/2002

Insurance mediation or reinsurance meditation

AUTH 2.5.6

See Notes

- 03/09/2001

AUTH 2.6

Specified investments: a broad outline

- 01/12/2004

AUTH 2.6.1

See Notes

- 03/09/2001

Deposits

AUTH 2.6.2

See Notes

- 03/09/2001

AUTH 2.6.3

See Notes

- 01/10/2002

AUTH 2.6.4

See Notes

- 03/09/2001

Electronic Money

AUTH 2.6.4A

See Notes

- 27/04/2002

Rights under a contract of insurance

AUTH 2.6.5

See Notes

- 03/09/2001

AUTH 2.6.6

See Notes

- 03/09/2001

AUTH 2.6.7

See Notes

- 03/09/2001

AUTH 2.6.8

See Notes

- 03/09/2001

Shares etc

AUTH 2.6.9

See Notes

- 03/09/2001

AUTH 2.6.10

See Notes

- 03/09/2001

Debt instruments

AUTH 2.6.11

See Notes

- 03/09/2001

AUTH 2.6.12

See Notes

- 03/09/2001

Warrants

AUTH 2.6.13

See Notes

- 03/09/2001

AUTH 2.6.14

See Notes

- 03/09/2001

Certificates representing securities

AUTH 2.6.15

See Notes

- 03/09/2001

AUTH 2.6.16

See Notes

- 03/09/2001

Units

AUTH 2.6.17

See Notes

- 03/09/2001

AUTH 2.6.18

See Notes

- 03/09/2001

Rights under a stakeholder pension scheme

AUTH 2.6.19

See Notes

Options

AUTH 2.6.20

See Notes

- 03/09/2001

Futures

AUTH 2.6.21

See Notes

- 03/09/2001

AUTH 2.6.22

See Notes

- 03/09/2001

Contracts for differences

AUTH 2.6.23

See Notes

- 03/09/2001

AUTH 2.6.24

See Notes

- 03/09/2001

Lloyd's investments

AUTH 2.6.25

See Notes

- 03/09/2001

Rights under a funeral plan

AUTH 2.6.26

See Notes

- 03/09/2001

Rights under a regulated mortgage contract

AUTH 2.6.27

See Notes

- 31/10/2004

Rights to or interests in investments

AUTH 2.6.28

See Notes

- 31/10/2004

AUTH 2.6.29

See Notes

- 03/09/2001

AUTH 2.7

Activities: a broad outline

- 01/12/2004

AUTH 2.7.1

See Notes

- 03/09/2001

Accepting deposits

AUTH 2.7.2

See Notes

- 03/09/2001

Issuing e-money

AUTH 2.7.2A

See Notes

- 01/10/2002

Effecting or carrying out contracts of insurance as principal

AUTH 2.7.3

See Notes

- 03/09/2001

AUTH 2.7.4

See Notes

- 03/09/2001

Dealing in investments (as principal or agent)

AUTH 2.7.5

See Notes

- 03/09/2001

AUTH 2.7.6

See Notes

- 03/09/2001

Arranging deals in investments and arranging regulated mortgage activities

AUTH 2.7.7

See Notes

- 18/10/2001

AUTH 2.7.7A

See Notes

- 01/10/2002

Managing investments

AUTH 2.7.8

See Notes

- 03/09/2001

Safeguarding and administering investments

AUTH 2.7.9

See Notes

- 03/09/2001

AUTH 2.7.10

See Notes

- 03/09/2001

Sending dematerialised instructions

AUTH 2.7.11

See Notes

- 03/09/2001

Establishing etc collective investment schemes

AUTH 2.7.12

See Notes

- 01/04/2004

AUTH 2.7.13

See Notes

In addition, express provision is included in the Regulated Activities Order to make acting as trustee of an authorised unit trust scheme into a regulated activity. The full picture for authorised schemes (that is, schemes that can be promoted to the public) is as follows:

- (1) Acting as trustee of an authorised unit trust scheme is expressly included as a regulated activity.

- (2) Acting as a depositary of an open-ended investment company that is authorised under regulations made under section 262 of the Act (Open-ended investment companies), is a regulated activity.

- (3) Acting as a sole director of such a company is a regulated activity.

- (4) Managing an authorised unit trust scheme will amount to operating the scheme and so will be a regulated activity. A person acting as manager is also likely to be carrying on other regulated activities (such as dealing (see AUTH 2.7.5 G) or managing investments (see AUTH 2.7.8 G)).

- (5) An open-ended investment company will, once it is authorised under regulations made under section 262 of the Act, become an authorised person in its own right under Schedule 5 to the Act (Persons concerned in Collective Investment Schemes). Under ordinary principles, a company operates itself and an authorisedopen-ended investment company will be operating the collective investment scheme constituted by the company. It is not required to go through a separate process of authorisation as a person because it has already undergone the process of product authorisation.

- (6) Operators, trustees or depositaries of UCITS schemes constituted in other EEA States are also authorised persons under Schedule 5 of the Act if those schemes qualify as recognised collective investment schemes for the purposes of section 264 of the Act.

- 03/09/2001

Establishing etc stakeholder pension schemes

AUTH 2.7.14

See Notes

- 03/09/2001

Advising on investments

AUTH 2.7.15

See Notes

- 03/09/2001

AUTH 2.7.16

See Notes

- 03/09/2001

Lloyd's activities

AUTH 2.7.17

See Notes

- 03/09/2001

Entering funeral plan contracts

AUTH 2.7.18

See Notes

- 01/10/2002

AUTH 2.7.19

See Notes

- 03/09/2001

Entering into and administering a regulated mortgage contract

AUTH 2.7.20

See Notes

- 01/10/2002

Agreeing

AUTH 2.7.21

See Notes

- 01/10/2002

AUTH 2.8

Exclusions applicable to particular regulated activities

- 01/12/2004

AUTH 2.8.1

See Notes

- 03/09/2001

Accepting deposits

AUTH 2.8.2

See Notes

- 21/08/2002

Issuing e-money

AUTH 2.8.2A

See Notes

- 27/04/2002

Effecting and carrying out contracts of insurance

AUTH 2.8.3

See Notes

- 21/08/2002

Dealing in investments as principal

AUTH 2.8.4

See Notes

The regulated activity of dealing in investments as principal applies to specified transactions relating to any security or to any contractually based investment (apart from rights under funeral plan contracts or rights to or interests in such contracts). The activity is cut back by exclusions as follows.

- (1) Of particular significance is the exclusion in article 15 of the Regulated Activities Order (Absence of holding out etc). This applies where dealing in investments as principal involves entering into transactions relating to any security or assigning rights under a life policy (or rights or interests in such a contract). In effect, it superimposes an additional condition that must be met before a person's activities become regulated activities. The additional condition is that a person must hold himself out as making a market in the relevant specified investments or as being in the business of dealing in them, or he must regularly solicit members of the public with the purpose of inducing them to deal. This exclusion does not apply to dealing activities that relate to any contractually based investment except the assigning of rights under a life policy.

- (2) Entering into a transaction relating to a contractually based investment is not regulated if the transaction is entered into by an unauthorised person and it takes place in either of the following circumstances (a transaction entered into by an authorised person would be caught). The first set of circumstances is where the person with whom the unauthorised person deals is either an authorised person or an exempt person who is acting in the course of a business comprising a regulated activity in relation to which he is exempt. The second set of circumstances is where the unauthorised person enters into a transaction through a non-UK office (which could be his own) and he deals with or through a person who is based outside the United Kingdom. This non-UK person must be someone who, as his ordinary business, carries on any of the activities relating to securities or contractually based investments that are generally treated as regulated activities.

- (3) A person (for example, a bank) who provides another person with finance for any purpose can accept an instrument acknowledging the debt (and as security for it) without risk of dealing as principal as a result.

- (4) A company does not deal as principal by issuing its own shares or share warrants and a person does not deal as principal by issuing his own debentures or debenture warrants.

- (5) Risk-management activities involving options, futures and contracts for differences will not require authorisation if specified conditions are met. The conditions include the company's business consisting mainly of unregulated activities and the sole or main purpose of the risk management activities being to limit the impact on that business of certain kinds of identifiable risk.

- (6) A person will not be treated as carrying on the activity of dealing in investments as principal if, in specified circumstances (outlined in AUTH 2.9), he enters as principal into a transaction:

- (a) while acting as bare trustee (or, in Scotland, as nominee);

- (b) in connection with the sale of goods or supply of services;

- (c) that takes place between members of a group or joint enterprise;

- (d) in connection with the sale of a body corporate;

- (e) in connection with an employee share scheme;

- (f) as an overseas person;

- (g) as an incoming ECA provider (see AUTH 2.9.18 G).

- 01/10/2002

Dealing in investments as agent

AUTH 2.8.5

See Notes

- 21/08/2002

Arranging deals in investments and arranging regulated mortgage contracts

AUTH 2.8.6

See Notes

- 01/10/2002

Managing investments

AUTH 2.8.7

See Notes

- 21/08/2002

Safeguarding and administering investments

AUTH 2.8.8

See Notes

- 21/08/2002

Sending dematerialised instructions

AUTH 2.8.9

See Notes

- 01/10/2002

Establishing etc collective investment schemes

AUTH 2.8.10

See Notes

- 21/08/2002

Establishing etc stakeholder pension schemes

AUTH 2.8.11

See Notes

- 01/10/2002

Advising on investments

AUTH 2.8.12

See Notes

- 21/08/2002

Lloyd's activities

AUTH 2.8.13

See Notes

- 03/09/2001

Entering funeral plan contracts

AUTH 2.8.14

See Notes

- 21/08/2002

Agreeing

AUTH 2.8.15

See Notes

- 21/08/2002

AUTH 2.8.16

See Notes

- 03/09/2001

AUTH 2.9

Regulated activities: exclusions applicable into certain circumstances

- 01/12/2004

AUTH 2.9.1

See Notes

- 01/10/2002

AUTH 2.9.2

See Notes

- 03/09/2001

Trustees, nominees or personal representatives

AUTH 2.9.3

See Notes

- 03/09/2001

AUTH 2.9.4

See Notes

- 03/09/2001

Professions or business not involving regulated activities

AUTH 2.9.5

See Notes

- 03/09/2001

AUTH 2.9.6

See Notes

- 21/02/2002

Sale of goods and supply of services

AUTH 2.9.7

See Notes

- 03/09/2001

AUTH 2.9.8

See Notes

- 31/10/2004

Group and joint enterprises

AUTH 2.9.9

See Notes

- 03/09/2001

AUTH 2.9.10

See Notes

- 03/09/2001

Sale of body corporate

AUTH 2.9.11

See Notes

- 03/09/2001

AUTH 2.9.12

See Notes

- 03/09/2001

Employee share schemes

AUTH 2.9.13

See Notes

- 03/09/2001

AUTH 2.9.14

See Notes

- 03/09/2001

Overseas persons

AUTH 2.9.15

See Notes

- 03/09/2001

AUTH 2.9.16

See Notes

- 03/09/2001

AUTH 2.9.17

See Notes

- 03/09/2001

Incoming ECA providers

AUTH 2.9.18

See Notes

- 03/09/2001

Insurance mediation activities

AUTH 2.9.19

See Notes

- 03/09/2001

AUTH 2.10

Persons carrying on regulated activities who do not need authorisation

- 01/12/2004

AUTH 2.10.1

See Notes

- 03/09/2001

AUTH 2.10.2

See Notes

- 03/09/2001

AUTH 2.10.3

See Notes

- 03/09/2001

AUTH 2.10.4

See Notes

- 03/09/2001

Appointed representatives

AUTH 2.10.5

See Notes

- 03/09/2001

Recognised Investment Exchanges and Recognised Clearing Houses

AUTH 2.10.6

See Notes

- 03/09/2001

Particular exempt persons

AUTH 2.10.7

See Notes

- 03/09/2001

AUTH 2.10.8

See Notes

- 03/09/2001

Members of Lloyd's

AUTH 2.10.9

See Notes

- 03/09/2001

AUTH 2.10.10

See Notes

- 03/09/2001

AUTH 2.10.11

See Notes

- 03/09/2001

Members of the professions

AUTH 2.10.12

See Notes

- 03/09/2001

AUTH 2.10.13

See Notes

- 03/09/2001

AUTH 2.10.14

See Notes

- 03/09/2001

AUTH 2.10.15

See Notes

- 03/09/2001

AUTH 2.10.16

See Notes

- 03/09/2001

AUTH 2.11

What to do now?

- 01/12/2004

AUTH 2.11.1

See Notes

- 03/09/2001

AUTH 2 Annex 1

Authorisation and regulated activities

- 01/12/2004

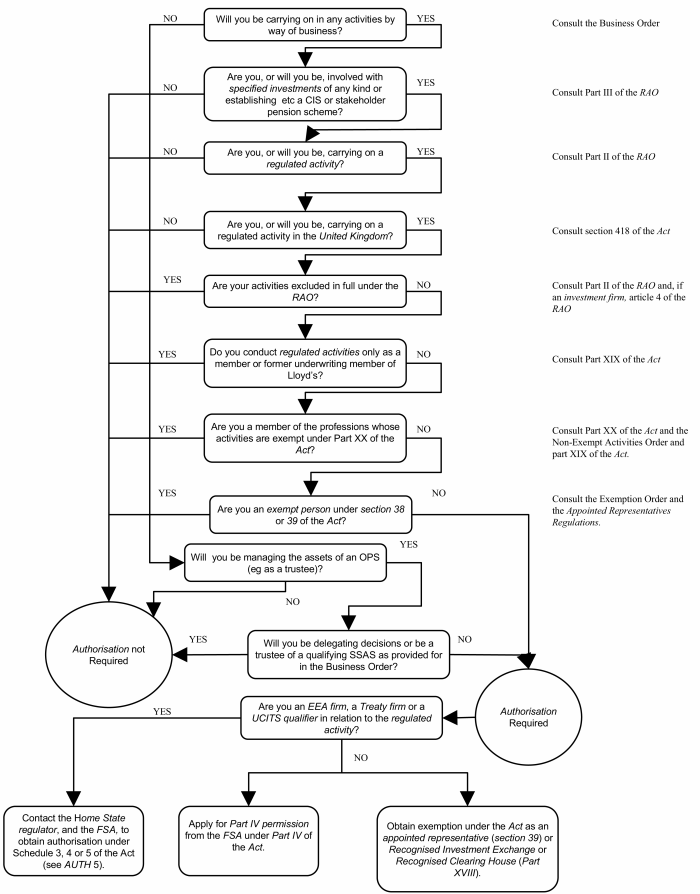

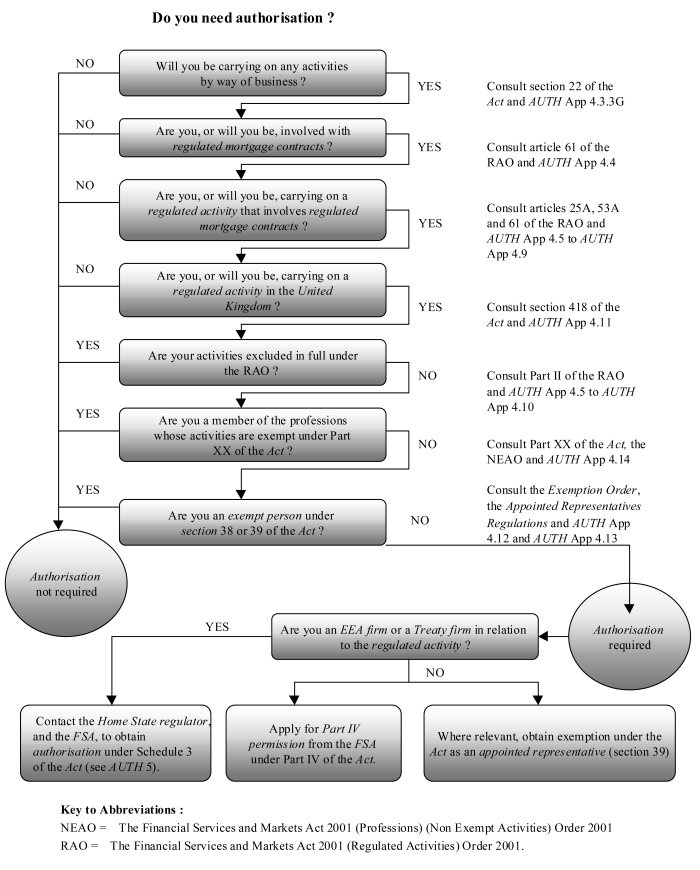

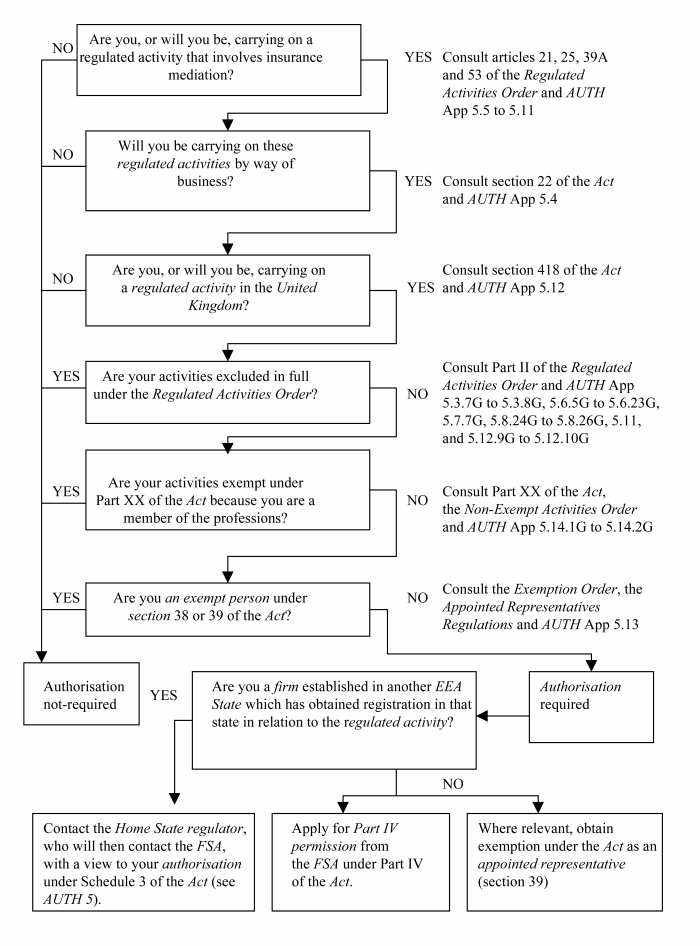

Do you need authorisation?

AUTH 2 Annex 1

See Notes

- 03/09/2001

AUTH 2 Annex 2

Regulated activities and the permission regime

- 01/12/2004

AUTH 2 Annex 2.1

See Notes

| 1.1 G | Table 1 is designed to relate the permission regime to regulated activities. Section 42(6) of the Act gives the FSA the power to describe the regulated activity or regulated activities for which it gives permission in such manner as the FSA considers appropriate. Table 1 details how the FSA has chosen to describe the regulated activities and specified investments for the purposes of the permission regime. |

| 1.2 G | In an application for Part IV permission, an applicant will need to state the regulated activities it requires permission to carry on. This will involve an applicant identifying the regulated activities and the specified investments associated with those activities for which it requires Part IV permission. |

| 1.3 G | Part II of the Regulated Activities Order (Specified activities) specifies the activities for the purposes of section 22 of the Act. This section states that an activity is a regulated activity if it is an activity of a specified kind which is carried on by way of business and: |

| (1) | relates to an investment of a specified kind; or |

| (2) | in the case of an activity specified for the purposes of section 22(1)(b) of the Act, is carried on in relation to property of any kind. |

| Part III of the Regulated Activities Order (Specified investments) specifies the investments referred to at AUTH 2 Annex 2. | |

| 1.4 G | Column 1 of Table 1 lists the regulated activities and column 2 lists the associated specified investments. Descriptions of some categories of specified investments are expanded in Tables 2 and 3. There are notes to all three tables which provide further explanation where appropriate. |

| 1.5 G | A reference to an article in the tables in AUTH 2 Annex 2 G is to the relevant article in the Regulated Activities Order. |

| Table 1: Regulated Activities [See note 1 to Table 1] | ||

| Regulated activity | Specified investment in relation to which the regulated activity (in the corresponding section of column one) may be carried on | |

| Accepting deposits | ||

| (a) accepting deposits (article 5) | deposit (article 74) | |

| Issuing electronic money | ||

| (aa) issuing electronic money (article 9B) | electronic money (article 74A) | |

| Insurance business | ||

| (b) effecting contracts of insurance (article 10(1)) | contract of insurance (article 75) [Expanded in Table 2] | |

| (c) carrying out contracts of insurance (article 10(2)) | ||

| Designated investment business [see note 1A and 1B to Table 1] | ||

| (d) dealing in investments as principal (article 14) [see note 2 to Table 1] | security [Expanded in Table 3]; or | |

| (e) dealing in investments as agent (article 21) [see note 2 to Table 1] | contractually based investment [Expanded in Table 3] | |

| (f) arranging (bringing about) deals in investments (article 25(1)) [see note 1B to Table 1] [also see Sections of Table 1 headed 'Lloyd's market' and 'regulated mortgage activities'] | ||

| (g) making arrangements with a view to transactions in investments (article 25(2)) [see note 1B to Table 1] [also see Sections of Table 1 headed 'Lloyd's market' and 'regulated mortgage activities'] | ||

| (h) managing investments (article 37) [see note 3 to Table 1] | ||

| (i) safeguarding and administering investments (article 40) [see note 3 Table 1] | ||

| For the purposes of the permission regime, this regulated activity is subdivided into: | ||

| (i) | safeguarding and administration of assets (without arranging); | |

| (ii) | arranging safeguarding and administration of assets | |

| (j) advising on investments (article 53) [see note 1B to Table 1] [also see Section of Table 1 headed 'Lloyd's market' and 'regulated mortgage activity'] | ||

| For the purposes of the permission regime, this regulated activity is subdivided into: | ||

| (i) | advising on investments (except pension transfers and pension opt-outs); | |

| (ii) | advising on pension transfers and pension opt-outs [see note 4 to Table 1] | |

| (k) sending dematerialised instructions (article 45(1)) | ||

| (l) causing dematerialised instructions to be sent (article 45(2)) | ||

| (m) establishing, operating or winding up a collective investment scheme (article 51(1(a)) | [see note 5 to Table 1] | |

| For the purposes of the permission regime, this regulated activity is subdivided into: | ||

| (i) | establishing, operating or winding up a regulated collective investment scheme; | |

| (ii) | establishing, operating or winding up an unregulated collective investment scheme | |

| (n) acting as trustee of an authorised unit trust scheme (article 51(1)(b)) | ||

| (o) acting as the depositary or sole director of an open-ended investment company (article 51(1)(c)) | ||

| (p) establishing, operating or winding up a stakeholder pension scheme (article 52) | ||

| Insurance mediation activity [see note 5A to Table 1] | ||

| (pa) dealing in investments as agent (article 21) | life policy [see note 5B to Table 1] | |

(pb) arranging (bringing about) deals in investments (article 25(1)) | pure protection contract [see note 5C to Table 1] | |

(pc) making arrangements with a view to deals in investments (article 25(2)) | general insurance contract [see note 5D to Table 1] | |

(pd) assisting in the administration and performance of a contract of insurance (article 39A) | rights to or interests in investments (Article 89) in so far as they relate to a life policy | |

(pe) advising on investments (article 53) | ||

For the purposes of the permission regime, this regulated activity is subdivided into: | ||

(i) | advising on investments (except pension transfers or pension opt-outs); | |

(ii) | advising on pension transfers or pension opt-outs [See note 5E to Table 1] | |

| The Lloyd's market [see note 6 to Table 1] | ||

| (q) advising on syndicate participation at Lloyd's (article 56) | membership of a Lloyd's syndicate (article 86(2)) | |

| (r) managing the underwriting capacity of a Lloyd's syndicate as a managing agent at Lloyd's (article 57) | underwriting capacity of a Lloyd's syndicate (article 86(1)) | |

| (s) arranging (bringing about) deals in investments (article 25(1)) | underwriting capacity of a Lloyd's syndicate (article 86(1)), membership of a Lloyd's syndicate (Article 86(2)) or rights to or interests in investments (Article 89) in so far as they relate to underwriting capacity of a Lloyd's syndicate or membership of a Lloyd's syndicate | |

| (t) making arrangements with a view to transactions in investments (article 25(2)) | ||

| Funeral plan providers | ||

| (u) entering as provider into a funeral plan contract (article 59) [see note 1A] | funeral plan contract (article 87) | |

| Regulated mortgage activity | ||

| (v) arranging (bringing about) regulated mortgage contracts (article 25(A)(1)) | regulated mortgage contract (Article 88) | |

(w) making arrangements with a view to regulated mortgage contracts (article 25(A)(2)) | ||

(x) advising on regulated mortgage contracts (article 53A) | ||

(y) entering into a regulated mortgage contract (article 61(1)) | ||

(z) administering a regulated mortgage contract (article 61(2)) | ||

| Notes to Table 1 |

| Note 1: |

| In addition to the regulated activities listed in Table 1, article 64 of the Regulated Activities Order specifies that agreeing to carry on a regulated activity is itself a regulated activity in certain cases. This applies in relation to all the regulated activities listed in Table 1 apart from: |

| • accepting deposits (article 5); |

| • issuing electronic money (article 9B) |

| • effecting and carrying out contracts of insurance (article 10); |

| •establishing, operating or winding up a collective investment scheme (article 51(a)); |

| • acting as trustee of an authorised unit trust scheme (article 51(1)(b)); |

| • acting as the depositary or sole director of an open-ended investment company (article 51(1)(c)); and |

| • establishing, operating or winding up a stakeholder pension scheme (article 52). |

| Permission to carry on the activity of agreeing to carry on a regulated activity will be given automatically by the FSA in relation to those other regulated activities for which an applicant is given permission (other than those activities in articles 5, 9B, 10, 51 and 52 detailed above). |

| Note 1A: |

Funeral plan contracts are contractually based investments. Accordingly, the following are regulated activities when carried on in relation to a funeral plan contract: (a) arranging (bringing about) deals in investments, (b) making arrangements with a view to transactions in investments, (c) managing investments, (d) safeguarding and administering investments, (e) advising on investments, (f) sending dematerialised instructions and (g) causing dematerialised instructions to be sent (as well as agreeing to carry on each of the activities listed in (a) to (g)). However, they are not designated investment business. |

| Note 1B: |

| Life policies are contractually based investments. Where the regulated activities listed as designated investment business in (e) to (g) and (j) are carried on in relation to a life policy, these activities also count as 'insurance mediation activities'. The full list of insurance mediation activities is set out in (pa) to (pe). The regulated activities of agreeing to carry on each of these activities will, if carried on in relation to a life policy, also come within both designated investment business and insurance mediation activities. |

| Note 2: |

| For the purposes of the regulated activities of dealing in investments as principal (article 14) and dealing in investments as agent (article 21), the definition of contractually based investments [expanded in Table 3] excludes a funeral plan contract (article 87) and rights to or interests in funeral plan contracts. |

| Note 3: |

| (i) The regulated activities of managing investments (article 37) and safeguarding and administering investments (article 40) may apply in relation to any assets, in particular circumstances, if the assets being managed or safeguarded and administered include, or may include, any security or contractually based investment. |

| Note 4: |

| (j) For the purposes of the permission regime, the activity in (j)(ii) of advising on pension transfers and pension opt-outs is carried on in respect of the following specified investments: |

| • unit (article 81); |

| • stakeholder pension scheme (article 82); and |

| • life policy (as defined in note 5); |

| • rights to or interests in investments in so far as they relate to a unit, a stakeholder pension scheme or a life policy. |

| Note 5: |

| Article 4(2) of the Regulated Activities Order specifies the activities (m) to (p) for the purposes of section 22(1)(b) of the Act. That is, these activities will be regulated activities if carried on in relation to any property and are not expressed as relating to a specified investment. |

| Note 5A: |

| Where they are carried on in relation to a life policy, the activities listed as insurance mediation activities in (pa) to (pe) (as well as the regulated activity of agreeing to carry on those activities) are also designated investment business. |

| Note 5B: |

| Life policy is the term used in the Handbook to mean 'qualifying contract of insurance' (as defined in Article 3(1) of the Regulated Activities Order), and except in COB 3, AUTH App 1 and AUTH App 5 the term also includes a long-term care insurance contract which is a pure protection contract. |

| Note 5C: |

| Pure protection contract is the term used in the Handbook to mean a long-term insurance contract which is not a life policy. |

| Note 5D: |

| General insurance contract is the term used in the Handbook to mean contract of insurance within column 1 of Table 2. |

| Note 5E: |

| For the purposes of the permission regime, the activity in (pe)(ii) of advising on pension transfers and pension opt-outs is carried on in respect of the following specified investments: |

• life policy (explained in note 5A); |

• rights to or interests in investments in so far as they relate to a life policy. |

| Note 6: |

| • Section 315 of the Act (The Society: authorisation and permission) states that the Society of Lloyd's has permission to carry on the regulated activities referred to in that section, one of which is specified in article 58 of the Regulated Activities Order. This permission is unique to the Society of Lloyd's. |

| Table 2: Contracts of insurance | |||

| Contract of insurance (article 75 of the RAO) | |||

| (a) general insurance contract (Part I of Schedule 1 to the Regulated Activities Order) | (b) long-term insurance contract (Part II of Schedule 1 to the Regulated Activities Order) | ||

| 1.1.3 Number | |||

| (1) | 1 | Accident (paragraph 1) | life and annuity (paragraph I) |

| (a) | 2 | Sickness (paragraph 2) | marriage and birth (paragraph II) |

| (i) | 3 | Land vehicles (paragraph 3) | linked long-term (paragraph III) |

| (ii) | 4 | Railway rolling stock (paragraph 4) | permanent health (paragraph IV) |

| (iii) | 5 | Aircraft (paragraph 5) | tontines (paragraph V) |

| (iv) | 6 | Ships (paragraph 6) | capital redemption (paragraph VI) |

| (v) | 7 | Goods in transit (paragraph 7) | pension fund management (paragraph VII) |

| (vi) | 8 | fire and natural forces (paragraph 8) | collective insurance (paragraph VIII) |

| (vii) | 9 | damage to property (paragraph 9) | social insurance (paragraph IX) |

| (viii) | 10 | motor vehicle liability (paragraph 10) | |

| (ix) | 11 | aircraft liability (paragraph 11) | |

| (x) | 12 | liability of ships (paragraph 12) | |

| (xi) | 13 | general liability (paragraph 13) | |

| (xii) | 14 | credit (paragraph 14) | |

| (xiii) | 15 | suretyship (paragraph 15) | |

| (xiv) | 16 | miscellaneous financial loss (paragraph 16) | |

| (xv) | 17 | legal expenses (paragraph 17) | |

| (xvi) | 18 | assistance (paragraph 18) | |

| Notes to Table 2 | |||

| Note 1: See IPRU(INS) Ann 10.2 Part II for the groups of classes of general insurance business from the Annex to the First non-Life Directive. | |||

| Note 2: See IPRU(INS) 11.8 and the definition of ancillary risks in IPRU(INS) and AUTH 3.12.6 G to AUTH 3.12.12 G for guidance on the treatment of supplementary and ancillary provisions in relation to contracts of insurance. | |||

| Table 3: Securities, contractually based investments and relevant investments [see notes 1 and 2 to Table 3] | ||

| Security (article 3(1)) | Contractually based investment (article 3(1)) | Relevant investment (article 3(1)) |

|

share (article 76) debenture (article 77) government and public security (article 78) warrant (article 79) certificate representing certain security (article 80) unit (article 81) stakeholder pension scheme (article 82) rights to or interests in investments (article 89) in so far as they relate to any of the above categories of security |

option (article

83) For the purposes of the permission regime, option is subdivided into: • option (excluding a commodity option and an option on a commodity future); • commodity option and option on a commodity future. future (article 84) For the purposes of the permission regime, future is subdivided into: • future (excluding a commodity future and arolling spot forex contract); • commodity future; • rolling spot forex contract. contract for differences (article 85) For the purposes of the permission regime, contract for differences is subdivided into: • contract for differences (excluding a spread bet and a rolling spot forex contract); • spread bet; • rolling spot forex contract. life policy (but excluding a long-term care insurance contract which is a pure protection contract) [see note 5B to Table 1] funeral plan contract (article 87) [see note 1A to Table 1] rights to or interests in investments (article 89) in so far as they relate to any of the above categories of contractually based investment. |

contractually

based investment (article 3(1)) pure protection contract [see note 5C to Table 1] general insurance contract [see note 5D to Table 1] |

| Notes to Table 3 | ||

|

Note 1:

1. Security, contractually based investment and relevant investment are not, in themselves, specified investments they are defined as including a number of specified investments as set out in Table 3. Relevant investments is the term that is used to cover contractually based investments together with rights under a general insurance contract and a pure protection contract. Note 2: (1) For the purposes of the regulated activities of dealing in investments as principal (article 14) and dealing in investments as agent (article 21), the definition of contractually based investments excludes a funeral plan contract (article 87) and rights to or interests in funeral plan contracts. | ||

AUTH 3

Applications

for Part IV permission

AUTH 3.1

Application and purpose

- 01/12/2004

Application

AUTH 3.1.1

See Notes

- 03/09/2001

Purpose

AUTH 3.1.2

See Notes

- 03/09/2001

AUTH 3.2

Introduction

- 01/12/2004

AUTH 3.2.1

See Notes

AUTH 3.2.2

See Notes

- 03/09/2001

AUTH 3.3

When is Part IV permission required and what does it contain?

- 01/12/2004

AUTH 3.3.1

See Notes

AUTH 3.3.2

See Notes

- 03/09/2001

AUTH 3.3.3

See Notes

- 03/09/2001

AUTH 3.3.4

See Notes

- 03/09/2001

AUTH 3.3.5

See Notes

- 03/09/2001

AUTH 3.4

Activities

- 01/12/2004

AUTH 3.4.1

See Notes

AUTH 3.4.2

See Notes

- 03/09/2001

AUTH 3.4.3

See Notes

- 03/09/2001

AUTH 3.5

Specified investments

- 01/12/2004

AUTH 3.5.1

See Notes

AUTH 3.6

Limitations

- 01/12/2004

AUTH 3.6.1

See Notes

- 03/09/2001

AUTH 3.6.2

See Notes

- 03/09/2001

AUTH 3.6.3

See Notes

- 18/10/2001

AUTH 3.6.4

See Notes

AUTH 3.6.5

See Notes

AUTH 3.6.6

See Notes

- 03/09/2001

AUTH 3.7

Requirements

- 01/12/2004

AUTH 3.7.1

See Notes

- 03/09/2001

AUTH 3.7.2

See Notes

- 03/09/2001

AUTH 3.7.3

See Notes

- 13/02/2004

AUTH 3.7.4

See Notes

- 21/02/2002

AUTH 3.7.5

See Notes

- 03/09/2001

AUTH 3.7.6

See Notes

- 03/09/2001

AUTH 3.7.7

See Notes

AUTH 3.7.8

See Notes

- 03/09/2001

AUTH 3.8

The threshold conditions and financial resources

- 01/12/2004

The threshold conditions

AUTH 3.8.1

See Notes

- 03/09/2001

AUTH 3.8.2

See Notes

- 19/01/2003

AUTH 3.8.3

See Notes

- 03/09/2001

Financial resources

AUTH 3.8.4

See Notes

- 31/12/2004

AUTH 3.8.5

See Notes

- 27/04/2002

AUTH 3.8.6

See Notes

- 31/12/2004

AUTH 3.8.7

See Notes

AUTH 3.8.8

See Notes

- 31/12/2004

AUTH 3.9

Procedures in relation to applications for Part IV permission

- 01/12/2004

Pre-application meetings

AUTH 3.9.1

See Notes

- 01/07/2003

AUTH 3.9.2

See Notes

- 03/09/2001

The application for permission

AUTH 3.9.3

See Notes

- 01/07/2003

AUTH 3.9.4

See Notes

- 01/07/2003

AUTH 3.9.5

See Notes

- 03/09/2001

Information to be supplied to the FSA

AUTH 3.9.6

See Notes

- 03/09/2001

AUTH 3.9.7

See Notes

- 03/09/2001

AUTH 3.9.8

See Notes

- 03/09/2001

AUTH 3.9.9

See Notes

- 03/09/2001

AUTH 3.9.10

See Notes

- 03/09/2001

AUTH 3.9.11

See Notes

- 03/09/2001

AUTH 3.9.12

See Notes

- 01/07/2003

AUTH 3.9.13

See Notes

- 03/09/2001

AUTH 3.9.14

See Notes

- 01/07/2003

AUTH 3.9.15

See Notes

- 03/09/2001

Reports from third parties

AUTH 3.9.16

See Notes

- 03/09/2001

AUTH 3.9.17

See Notes

- 03/09/2001

AUTH 3.9.18

See Notes

- 03/09/2001

AUTH 3.9.19

See Notes

- 31/12/2004

AUTH 3.9.20

See Notes

- 03/09/2001

Applications to other bodies

AUTH 3.9.21

See Notes

- 03/09/2001

Connected persons

AUTH 3.9.22

See Notes

- 03/09/2001

AUTH 3.9.23

See Notes

- 03/09/2001

AUTH 3.9.24

See Notes

- 03/09/2001

Commencing regulated activities

AUTH 3.9.25

See Notes

- 01/07/2003

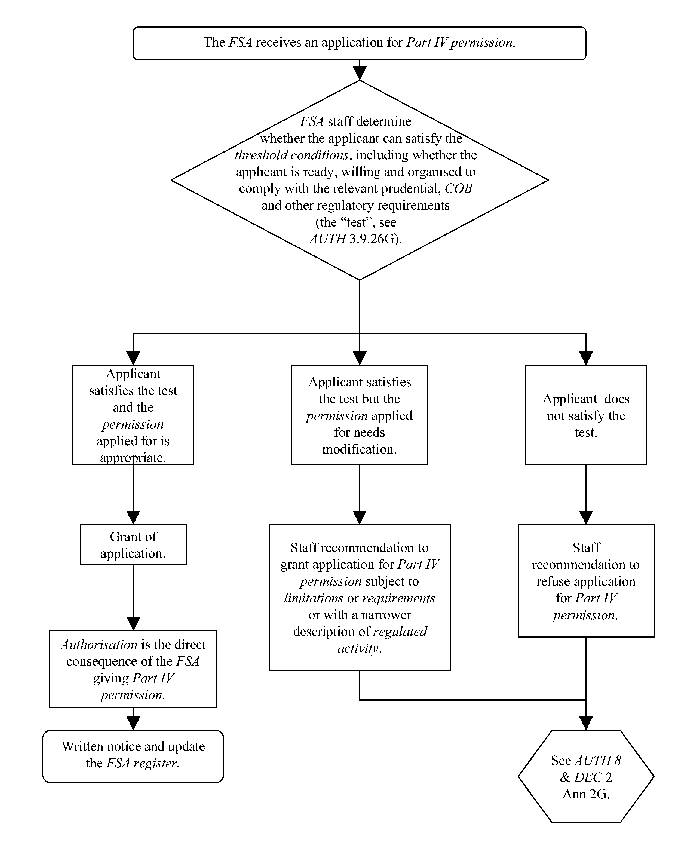

When will the FSA grant an application for Part IV permission?

AUTH 3.9.26

See Notes

- 03/09/2001

AUTH 3.9.27

See Notes

- 03/09/2001

AUTH 3.9.28

See Notes

- 01/07/2003

Other powers relating to the scope of Part IV permission

AUTH 3.9.29

See Notes

- 03/09/2001

How long will an application take?

AUTH 3.9.30

See Notes

- 03/09/2001

How will FSA make the decision?

AUTH 3.9.31

See Notes

Withdrawal of applications

AUTH 3.9.32

See Notes

- 03/09/2001

Authorised status

AUTH 3.9.33

See Notes

- 03/09/2001

AUTH 3.10

The FSA register

- 01/12/2004

AUTH 3.10.1

See Notes

- 03/09/2001

AUTH 3.11

Specific obligations: partnerships or unincorporated associations

- 01/12/2004

AUTH 3.11.1

See Notes

- 01/07/2003

AUTH 3.11.2

See Notes

- 03/09/2001

AUTH 3.11.3

See Notes

- 03/09/2001

AUTH 3.11.4

See Notes

- 01/07/2003

AUTH 3.12

Specific obligations: applicants seeking to carry on insurance business

- 01/12/2004

AUTH 3.12.1

See Notes

- 15/11/2001

AUTH 3.12.2

See Notes

- 31/12/2004

AUTH 3.12.3

See Notes

- 31/12/2004

AUTH 3.12.4

See Notes

- 03/09/2001

Friendly societies and reinsurance

AUTH 3.12.5

See Notes

- 03/09/2001

Contracts written on an ancillary and supplementary basis

AUTH 3.12.6

See Notes

- 03/09/2001

AUTH 3.12.7

See Notes

- 03/09/2001

AUTH 3.12.8

See Notes

- 03/09/2001

AUTH 3.12.9

See Notes

- 03/09/2001

AUTH 3.12.10

See Notes

- 03/09/2001

AUTH 3.12.11

See Notes

- 01/07/2003

AUTH 3.12.12

See Notes

- 03/09/2001

Reporting requirements

AUTH 3.12.13

See Notes

- 03/09/2001

Applicants seeking to carry on insurance business with a head office outside the United Kingdom (other than EEA firms or Treaty firms)

AUTH 3.12.14

See Notes

- 03/09/2001

AUTH 3.12.15

See Notes

- 31/12/2004

AUTH 3.12.16

See Notes

- 31/12/2004

AUTH 3.12.17

See Notes

- 31/12/2004

AUTH 3.13

Specific obligations: applicants seeking to carry on the regulated activities of accepting deposits or issuing electronic money

- 01/12/2004

AUTH 3.13.1

See Notes

- 27/04/2002

AUTH 3.14

Specific obligations: applicants seeking to hold or control client money

- 01/12/2004

AUTH 3.14.1

See Notes

- 03/09/2001

AUTH 3.14.2

See Notes

- 03/09/2001

AUTH 3.15

Specific obligations: applicants seeking to manage PEPS or ISAS

- 01/12/2004

AUTH 3.15.1

See Notes

- 03/09/2001

AUTH 3.15.2

See Notes

- 03/09/2001

AUTH 3.15.3

See Notes

AUTH 3.15.4

See Notes

AUTH 3.15.5

See Notes

- 03/09/2001

AUTH 3.16

Specific obligations: applicants seeking to establish, operate or wind up a stakeholder pension scheme

- 01/12/2004

AUTH 3.16.1

See Notes

AUTH 3.16.2

See Notes

- 03/09/2001

AUTH 3.17

Specific obligations: applicants seeking to establish a collective investment scheme or to act as manager of a regulated collective investment scheme

- 01/12/2004

AUTH 3.17.1

See Notes

- 01/04/2004

AUTH 3.17.2

See Notes

- 01/04/2004

AUTH 3.17.3

See Notes

- 01/04/2004

AUTH 3.17.4

See Notes

- 01/04/2004

AUTH 3.18

Specific obligations: additional considerations for applicants (other than EEA firms or Treaty firms) with a head office in a country of territory outside the United Kingdom seeking to establish a branch in the United Kingdom

- 01/12/2004

AUTH 3.18.1

See Notes

- 03/09/2001

AUTH 3.18.2

See Notes

- 03/09/2001

AUTH 3.18.3

See Notes

- 31/12/2004

AUTH 3.18.4

See Notes

- 03/09/2001

AUTH 3.19

Specific obligations: applications in connection with group-restructuring

- 01/12/2004

AUTH 3.19.1

See Notes

- 03/09/2001

AUTH 3.19.2

See Notes

- 01/07/2003

AUTH 3.19.3

See Notes

- 01/07/2003

AUTH 3.19.4

See Notes

- 03/09/2001

AUTH 3.20

Specific obligations: applicants seeking to establish a branch in, or provide services into, another EEA State

- 01/12/2004

AUTH 3.20.1

See Notes

- 03/09/2001

AUTH 3.20.2

See Notes

- 01/07/2003

AUTH 3.20.3

See Notes

- 01/04/2004

AUTH 3.20.4

See Notes

- 01/07/2003

AUTH 3.20.5

See Notes

- 03/09/2001

AUTH 3.21

Treaty firms applying for Part IV Permission

- 01/12/2004

AUTH 3.21.1

See Notes

- 21/02/2002

AUTH 3.21.2

See Notes

- 21/02/2002

AUTH 3.21.3

See Notes

- 21/02/2002

AUTH 3.21.4

See Notes

- 01/07/2003

AUTH 3.22

Specific issues: applicants that are limited partnerships under the Limited Partnerships Act 1907

- 01/12/2004

AUTH 3.22.1

See Notes

- 01/07/2003

AUTH 3.22.2

See Notes

- 01/07/2003

AUTH 3.22.3

See Notes

- 01/04/2004

AUTH 3.22.4

See Notes

- 01/07/2003

AUTH 3.22.5

See Notes

- 01/07/2003

AUTH 3.23

Specific issues: applicants that are limited liability partnerships

- 01/12/2004

AUTH 3.23.1

See Notes

- 01/07/2003

AUTH 3.23.2

See Notes

- 01/07/2003

AUTH 3.23.3

See Notes

- 01/07/2003

AUTH 3.23.4

See Notes

- 01/07/2003

AUTH 3.23.5

See Notes

- 01/07/2003

AUTH 3.24

Specific obligations: applicants wishing to operate an ATS

- 01/12/2004

AUTH 3.24.1

See Notes

- 01/04/2004

AUTH 3 Annex 1

Application for Part IV Permission

- 01/12/2004

AUTH 3 Annex 1.1

See Notes

AUTH 3 Annex 2

- 01/12/2004

AUTH 3 Annex 2.1

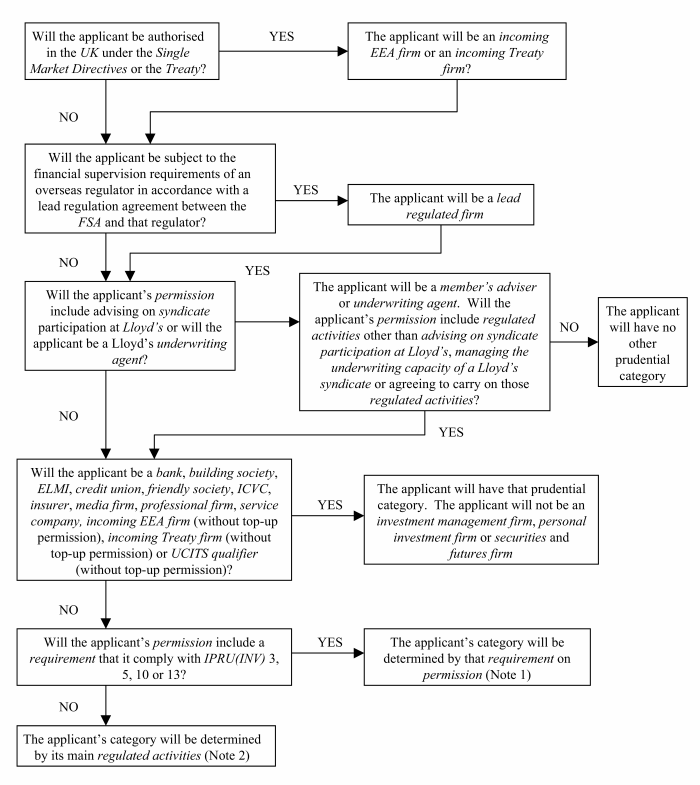

See Notes

| CHAPTER OF IPRU(INV) THAT REQUIREMENT ON PERMISSION REQUIRES THE FIRM TO COMPLY WITH | FIRM'S PRUDENTIAL CATEGORY |

| Chapter 3 | Securities and futures firm |

| Chapter 5 | Investment management firm |

| Chapter 10 | Securities and futures firm |

| Chapter 13 | Personal investment firm |

| The table below shows how a firm's main regulated activities determine its prudential category. A firm's 'main regulated activities' in this context are the regulated activities included in the firm's Part IV permission from which the firm derives or is expected to derive the most substantial part of its gross income, including commissions. The aggregate gross income from all of the activities listed against each prudential category should be considered to determine which source is the most substantial. The gross income is based on the business plan submitted as part of the firm's application for a Part IV permission. |

| ACTIVITIES FROM WHICH THE MOST SUBSTANTIAL PART OF THE FIRM'S GROSS INCOME, INCLUDING COMMISSIONS, FROM REGULATED ACTIVITIES IS DERIVED | FIRM'S PRUDENTIAL CATEGORY |

| (i) Managing investments other than for private customers or where the assets managed are primarily derivatives; (ii) OPS activity; (iii) acting as the manager or trustee of an AUT; (iv) acting as the ACD or depositary of an ICVC; (v) establishing, operating or winding up a collective investment scheme other than an AUT or ICVC; and (vi) safeguarding and administering investments. |

Investment management firm |

| (i) Advising on investments, or arranging (bringing about) deals in investments in relation to, packaged products; and (ii) managing investments for private customers. |

Personal investment firm |

| ACTIVITIES FROM WHICH THE MOST SUBSTANTIAL PART OF THE FIRM'S GROSS INCOME, INCLUDING COMMISSIONS, FROM REGULATED ACTIVITIES IS DERIVED | FIRM'S PRUDENTIAL CATEGORY |

| (i) An activity carried on as a member of an exchange; (ii) making a market in securities or derivatives; (iii) corporate finance business; (iv) dealing, or arranging (bringing about) deals in investments, in securities or derivatives; (v) the provision of clearing services as a clearing firm; (vi) managing investments where the assets managed are primarily derivatives; and (vii) activities relating to spread bets; |

|

| Securities and futures firm |

- 27/04/2002

AUTH 3 Annex 3

Determination of an applicant's prudential category

- 01/12/2004

AUTH 3 Annex 3.1

See Notes

- 03/09/2001

AUTH 4

Authorisation

Fees

AUTH 4.1

Introduction

- 01/12/2004

Application

AUTH 4.1.1

See Notes

- 01/01/2002

AUTH 4.1.2

See Notes

- 01/01/2002

Purpose

AUTH 4.1.3

See Notes

- 01/01/2002

Background

AUTH 4.1.4

See Notes

- 01/01/2002

AUTH 4.1.5

See Notes

- 01/04/2004

AUTH 4.1.5A

See Notes

- 01/01/2004

AUTH 4.1.6

See Notes

- 01/01/2002

AUTH 4.1.7

See Notes

- 01/11/2003

AUTH 4.1.7A

See Notes

- 01/01/2004

AUTH 4.1.8

See Notes

- 01/01/2002

AUTH 4.1.9

See Notes

- 01/01/2002

AUTH 4.1.10

See Notes

- 01/01/2002

AUTH 4.2

Obligation to Pay Authorisation Fees

- 01/12/2004

- Future version of AUTH 4.2 after 31/12/2005

General

AUTH 4.2.1

See Notes

- 01/11/2003

Amount

AUTH 4.2.2

See Notes

- 01/11/2003

AUTH 4.2.3

See Notes

- 01/01/2002

Due date and method of payment

AUTH 4.2.4

See Notes

- 01/01/2002

AUTH 4.2.5

See Notes

- 01/03/2003

Modification for certain Treaty firms

AUTH 4.2.6

See Notes

- 01/01/2002

AUTH 4.2.7

See Notes

- 01/01/2002

AUTH 4.3

Obligation to pay certification fees

- 01/12/2004

General

AUTH 4.3.1

See Notes

- 15/11/2001

Due date and method of payment

AUTH 4.3.2

See Notes

- 15/11/2001

AUTH 4.3.3

See Notes

- 15/11/2001

AUTH 4 Annex 1

Authorisation fees payable

- 01/12/2004

See Notes

| Application type (see Part 2) | Amount payable |

| (a) Credit unions - registration of common bond | £200 |

| (b) Version 1 credit unions - authorisation | £300 |

| (c) Version 2 credit unions - authorisation | £1,800 |

| (d) Straightforward | £1,500 |

| (e) Moderately complex | £5,000 |

| (f) Complex | £25,000 |

| Straightforward cases | |

| Activity grouping | Description |

| A.3 | Friendly societies only |

| A.4 | Friendly societies only |

| A.12 | Advisory arrangers, dealers or brokers (holding or controlling client money and/or assets) |

| A.13 | Advisory only firms and advisory arrangers, dealers or brokers (not holding or controlling client money and/or assets) |

| A.14 | Corporate finance advisers |

| A.18 | Mortgage lenders, advisers and arrangers (excluding mortgage lenders) |

| A.19 | General insurance mediation |

| Moderately complex cases | |

| Activity grouping | Description |

| A.1 | E-money issuers only |

| A.2 | Mortgage lenders and administrators |

| A.5 | Managing agents at Lloyd's |

| A.7 | Fund managers |

| A.9 | Operators, trustees and depositaries of collective investment schemes |

| A.10 | Firms dealing as principal |

| B. | Service companies |

| Complex cases | |

| Activity grouping | Description |

| A.1 | Deposit acceptors (excluding e-money issuers and credit unions) |

| A.3 | Insurers - general (excluding friendly societies) |

| A.4 | Insurers - life (excluding friendly societies) |

| The fee payable under SUP 6.3.22 R is 50% of that payable under AUTH 4.2.2 R.There are no circumstances specified for the purposes of SUP 6.3.22 R (2). |

| If the Treaty firm wishes to

undertake the permitted activities in question through its branch in the United Kingdom, the fee

is 50% of the fee that would be payable under AUTH

4.2.2 R. If the Treaty firm wishes to undertake the permitted activities in question by providing services in the United Kingdom, the fee is 25% of the fee which would be payable under AUTH 4.2.2 R. |

| The activity group definitions are set out in SUP 20 Annex 1. |

| The amount payable in relation to each application is £2,000. |

- 03/09/2001

AUTH 4 Annex 2

Authorisation fees payable in relation to the A.2 and A.18 activity groups up to and including 30 October 2004 and the A.19 activity group up to and including 13 January 2005

- 01/12/2004

See Notes

| Note: This annex specifies the application fees for applicants seeking to apply for Part IV permission, or to vary their existing Part IV permission, in order to undertake any of the activities specified in the A.2, A.18 and A.19 activity groups (see Part 1 of SUP 20 Annex 1 for details of the activities). |

| For the permitted activities included in the A.2 and A.18 activity groups, regulation commences on 31 October 2004. Regulation commences on 14 January 2005 for the permitted activities included in the A.19 activity group. |

| The fee rules set out in this annex will apply from the beginning of the application period until regulation of these permitted activities commences. At that time, these rules will cease to have effect and application fees for these types of permitted activities will be dealt with alongside the other authorisation fees as part of AUTH 4 Annex 1. |

| 1. For the A.2

and A.18 activity groups, these rates apply up to and including 30 October

2004. 2. For the A.19 activity group, these rates apply up to and including 13 January 2005. |

| Activity group | Amount payable | |||||

| Fee bands | Fee - early applications | Fee - other applications | Discount - electronic applications | Discount - non-electronic applications paying by direct debit | ||

| Band no. | Band | |||||

| A.2 Mortgage lenders and administrators | 1 2 3 4 | Gross advances

(£m) 0-10 >10-100 >100-1,000 >1,000 | Fee (?) 600 8,000 13,000 23,000 | Fee (?) 1,200 10,000 15,000 25,000 | Discount

(£) 100 250 250 500 | Discount

(£) 50 50 50 50 |

| A.18 Mortgage

lenders, advisers and arrangers; and A.19 General insurance mediation | 5 6 7 8 | Annual income

(£m) 0 - 1 >1-3 >3-25 >25 | Fee (?) 600 4,250 9,000 23,000 | Fee (?) 1,200 5,750 11,000 25,000 | Discount (£) 100 250 250 500 | Discount (£) 50 50 50 50 |

| (1) | An early application is an application lodged: | |||

| (a) | for A.2 or A.18 applications, before 1 April 2004; and | |||

| (b) | for A.19 applications, before 1 June 2004. | |||

| (2) | For the purposes of this table: | |||

| (a) | ||||

| An electronic application is one submitted via the electronic facility provided by the FSA for these purposes. | ||||

| (b) | Gross advances means the value of all new mortgage advances made (not the total mortgage balances outstanding) including loans for house purchase, remortgages, further advances and top-up loans, in the 12 months to 31 December 2003; PLUS | |||

| the value of all new mortgages administered (not the total mortgage balances outstanding) including loans for house purchase, remortgages, further advances and top-up loans, in the 12 months to 31 December 2003, multiplied by 0.5. | ||||

| Note: For this purpose, a mortgage is a contract for a loan secured by a first charge over residential property in the United Kingdom. | ||||

| (3) | For the purposes of this table, annual income means: | |||

| (a) | the net amount retained by the firm of all brokerages, fees, commissions and other related income (e.g. administration charges, overriders, profit shares) due to the firm in respect of or in relation to: | |||

| (i) | activities which would be mortgage mediation activity if they had been carried out after 30 October 2004; PLUS | |||

| (ii) | activities which would be insurance mediation activity (in relation to general insurance contracts or pure protection contracts) if they had been carried out after 13 January 2005; | |||

| earned in its latest financial year ending on or before 31 December 2003; | ||||

| PLUS | ||||

| (b) | (i) | in relation to the activities set out in (a)(i), for any mortgage mediation activity carried out by the firm for which it receives payment from the lender on a basis other than that in (a), the value of all new mortgage advances resulting from that activity multiplied by 0.004; | ||

| PLUS | ||||

| (ii) | If the firm is a mortgage lender, the value of all new mortgage advances which would be regulated mortgage contracts if they had been made after 30 October 2004 (other than those made as a result of mortgage mediation activity by another firm), multiplied by 0.004; | |||

| for its latest financial year ending on or before 31 December 2003; | ||||

| PLUS | ||||

| (c) | in relation to the activities set out in (a)(ii): | |||

| (i) | for any insurance mediation activity carried out by the firm for which it receives payment from the insurer on a basis other than that in (a), the amount of premiums receivable on the contracts of insurance resulting from that activity multiplied by 0.07; PLUS | |||

| (ii) | if the firm is an insurer, the amount of premiums receivable on its contracts of insurance multiplied by 0.07, excluding those contracts of insurance which: | |||

| (aa) | result from insurance mediation activity by another firm, where a payment has been made by the insurer to the firm under (a); or | |||

| (ab) | the insurer reports, and pays a fee on, in the A.4 activity group; or | |||

| (ac) | are not general insurance contracts or pure protection contracts; | |||

| for its latest financial year ending on or before 31 December 2003. | ||||

| The firm must include in its income calculation, on the same basis as above, earnings from those who will become its appointed representatives immediately after authorisation. | ||||

| In note (3), a reference to a "firm" also includes reference to any person who carried out activities which would be; | ||||

| (1) | mortgage mediation activity if they had been carried out after 30 October 2004; or | |||

| (2) | insurance mediation activity (in respect of general insurance contracts or pure protection contracts) if they had been carried out after 13 January 2005. | |||

| 3. | The activity group definitions are set out in SUP 20 Annex 1. |

- 03/09/2001

AUTH 5

Qualifying for authorisation under the Act

AUTH 5.1

Application and purpose

- 01/12/2004

AUTH 5.1.1

See Notes

AUTH 5.1.2

See Notes

- 21/08/2002

AUTH 5.1.3

See Notes

- 01/12/2001

Purpose

AUTH 5.1.4

See Notes

- 01/12/2001

AUTH 5.1.5

See Notes

- 21/02/2002

AUTH 5.2

EEA firms and Treaty firms

- 01/12/2004

AUTH 5.2.1

See Notes

- 01/12/2001

AUTH 5.2.2

See Notes

- 01/12/2001

AUTH 5.3

Qualification for authorisation under the Act

- 01/12/2004

EEA firms

AUTH 5.3.1

See Notes

- 01/12/2001

AUTH 5.3.2

See Notes

- (1) On qualifying for authorisation, subject to AUTH 5.3.2 G (1A), an EEA firm will have permission to carry on each permitted activity (see (2) below) which is a regulated activity:

- (a) through its UK branch (if it satisfies the establishment conditions); or

- (b) by providing cross border services into the United Kingdom (if it satisfies the service conditions).

- (1A)

- (a) Paragraph (1) does not apply to the activity of dealing in units in a collective investment scheme in the United Kingdom where:

- (i) the firm is an EEA UCITS management company;

- (ii) the firm satisfies the establishment conditions in AUTH 5.4.2 G; and

- (iii) the FSA notifies the EEA firm and the EEA firm's Home State regulator that the way in which it intends to market a relevant scheme in the United Kingdom does not comply with the law in force in the United Kingdom.

- (b) The FSA's notice under (1A)(a)(iii) has to be given to the EEA firm within two months of receiving the consent notice (AUTH 5.4.2 G(1)) and will be similar to a warning notice.

- (c) For details of the FSA's procedures for the giving of warning notices and references to the Tribunal, see DEC 2.2 (Statutory notice procedure: Warning notice and decision notice procedure) and DEC 5 (References to the Tribunal, publication and services of notices).

- (2) The permitted activities of EEA firm are those activities identified in the consent notice, regulator's notice or notice of intention. Permitted activities may include activities that are within the scope of a Single Market Directive but which are unregulated activity in the United Kingdom.

- (3) Paragraph 15(2) of Part II of Schedule 3 to the Act states that this permission is treated as being on terms equivalent to those appearing in the consent notice, regulator's notice or notice of intention. For example, it will reflect any limitations or requirements which are included in the firm's Home State authorisation.

- 13/02/2004

AUTH 5.3.3

See Notes

- 01/12/2001

Treaty firms

AUTH 5.3.4

See Notes

- 01/12/2001

AUTH 5.3.5

See Notes

- 01/12/2001

AUTH 5.3.6

See Notes

- 01/12/2001

AUTH 5.3.7

See Notes

- 01/12/2001

AUTH 5.3.8

See Notes

- 01/12/2001

AUTH 5.3.9

See Notes

- 01/07/2003

AUTH 5.3.10

See Notes

- 01/07/2003

AUTH 5.3.11

See Notes

- 01/07/2003

AUTH 5.3.12

See Notes

AUTH 5.3.13

See Notes

- 01/07/2003

UCITS qualifiers

AUTH 5.3.14

See Notes

- 01/12/2001

AUTH 5.3.15

See Notes

- 01/07/2003

AUTH 5.3.16

See Notes

- 01/04/2004

AUTH 5.4

EEA firms establishing a branch in the United Kingdom

- 01/12/2004

What constitutes a branch?

AUTH 5.4.1

See Notes

- 01/12/2001

The conditions for establishing a branch

AUTH 5.4.2

See Notes

- 01/12/2001

AUTH 5.4.3

See Notes

- 01/12/2001

The notification procedure

AUTH 5.4.4

See Notes

- 01/12/2001

AUTH 5.5

EEA firms providing cross border services into the United Kingdom

- 01/12/2004

Is the service provided within the United Kingdom?

AUTH 5.5.1

See Notes

- 01/12/2001

AUTH 5.5.2

See Notes

- 01/12/2001

The conditions for providing cross border services into the United Kingdom

AUTH 5.5.3

See Notes

- 01/12/2001

The notification procedure

AUTH 5.5.4

See Notes

- 01/12/2001

AUTH 5.5.5

See Notes

- 01/12/2001

AUTH 5.6

Which rules will an incoming EEA firm be subject to?

- 01/12/2004

AUTH 5.6.1

See Notes

- 01/12/2001

AUTH 5.6.2

See Notes

- 01/12/2001

AUTH 5.6.3

See Notes

- 01/12/2001

AUTH 5.6.4

See Notes

- 01/12/2001

AUTH 5.6.5

See Notes

- 01/12/2001

AUTH 5.7

Top-up permission

- 01/12/2004

AUTH 5.7.1

See Notes

- 01/12/2001

AUTH 5.7.2

See Notes

- 01/12/2001

AUTH 5.7.3

See Notes

- 01/12/2001

AUTH 5.7.4

See Notes

- 01/12/2001

AUTH 5.8

Sources of further information

- 01/12/2004

AUTH 5.8.1

See Notes

For further information on UK regulation, an EEA firm, aTreaty firm or a UCITS qualifier should contact the Authorisation and Approvals Department (Authorisation Enquiries) at the FSA. Questions about the passporting notification procedures can be addressed to the Passport Notification Unit.

- (1) To contact the Authorisation Enquiries team:

- (a) telephone on +44 20 7066 0082 or fax on +44 20 7066 9719;

- (b) write to: Authorisation and Approvals Department (Authorisation Enquiries), The Financial Services Authority, 25 The North Colonnade, Canary Wharf, London E14 5HS.

- (2) To contact the Passport Notification Unit:

- (a) telephone on +44 20 7066 1000 or fax on +44 20 7066 xxxx;

- (b) write to: Passport Notification Unit, The Financial Services Authority, 25 The North Colonnade, Canary Wharf, London E14 5HS;

- (c) email: passport.notifications@ fsa.gov.uk.

- 01/12/2001

AUTH 5 Annex 1

Establishment of a branch: Contents of Consent Notice G

- 01/12/2004

See Notes

| Type of firm | Para No. | Contents of consent notice (Regulation 2) | |

| Investment firm | (2)(a) | a statement that the firm is an investment firm; | |

| (b) | the requisite details of the branch (see SUP 13 Annex 1 ); | ||

| (c) | details of any compensation scheme which is intended to protect the branch's investors. | ||

| EEA UCITS management company | (2A)(a) | a statement that the firm is an EEA UCITS management company; | |

| (b) | the requisite details of the branch; and | ||

| (c) | details of any compensation scheme which is intended to protect the branch's investors. | ||

|

Credit institution

or | (3)(a) | a statement that the firm is a credit institution; | |

| (b) | the requisite details of the branch (see SUP 13 Annex 1 ); | ||

| (c) | the amount of the firm's own funds (as defined in Section 1 of Chapter 2 of Title V to the Banking Consolidation Directive); and | ||

| (d) | the solvency ratio of the firm (calculated in accordance with the Banking Consolidation Directive). | ||

| Financial institution | (4)(a) | a statement that: | |

| (i) | the firm is a financial institution; | ||

| (ii) | the firm is a subsidiary undertaking of a credit institution which is authorised in the EEA State in question and which holds at least 90 per cent of the voting rights in the firm (and for the purpose of this paragraph any two or more credit institutions which are authorised in that EEA State and hold voting rights in the firm are to be treated as a single credit institution, and as being "parent undertakings" of the firm); | ||

| (iii) | the firm carries on in that EEA State the EEA activities in question; | ||

| (iv) | the memorandum and articles of association, or other constituent instrument, of the firm permit it to carry on those activities; | ||

| (v) | the consolidated supervision of the firm's parent undertaking or, if more than one of them, any one of them effectively includes supervision of the firm; | ||

| (vi) | the firm's parent undertaking has guaranteed or, if more than one, they have jointly and severally guaranteed, the firm's obligations, with the consent of the Home State regulator; | ||

| (vii) | the firm's business is being conducted in a prudent manner. | ||

| (b) | the requisite details of the branch (see SUP 13 Annex 1 ); | ||

| (c) | the amount of the firm's own funds (as defined in Section 1 of Chapter 2 of Title V to the Banking Consolidation Directive); | ||

| (d) | the solvency ratio of the firm's parent undertaking (calculated in accordance with the Banking Consolidation Directive). | ||

| Insurance undertaking | (5)(a) | a scheme of operations prepared in accordance with such requirements as may be imposed by the firm's Home State regulator, setting out (among other things) the types of business to be carried on and the structural organisation of the branch; | |

| (b) | the name of the firm's authorised agent; | ||

| (c) | the address in the United Kingdom from which information about the business may be obtained, and a statement that this is the address for service on the firm's authorised agent; | ||

| (d) | in the case of a firm which intends to cover relevant motor vehicle risks, a declaration by the firm that it has become a member of the Motor Insurers' Bureau (being a company limited by guarantee and incorporated under the Companies Act 1929(1) on 14 th June 1946); and | ||

| (e) | a statement by the firm's Home State regulator attesting that the firm has the minimum margin of solvency calculated in accordance with such of the following as are appropriate: | ||

| (i) | articles 16 and 17 of the First Non-Life Insurance Directive; and; | ||

| (ii) | articles 18, 19 and 20 of the First Life Insurance Directive. | ||

- 13/02/2004

AUTH 5 Annex 2

Provision of services: Contents of regulator's notice G

- 01/12/2004

See Notes

| Type of firm | Para No. | Contents of regulator's notice (Regulation 3) | |

| Investment firm | (2)(a) | a statement that the firm is an investment firm; and | |

| (b) | particulars of the programme of operations to be carried on in the United Kingdom including a description of the particular activities which the firm is seeking to carry on in the United Kingdom in the exercise of an EEA right. | ||

| EEA UCITS management company | (2A)(a) | a statement that the firm is an EEA UCITS management company; | |

| (b) | particulars of the programme of operations to be carried on in the United Kingdom including a description of the particular activities which the firm is seeking to carry on in the United Kingdom in the exercise of an EEA right; and | ||

| (c) | details of any compensation scheme which is intended to protect the branch's investors. | ||

| Insurance undertaking | (3)(a) | a statement of the classes of business which the firm is authorised to carry on in accordance with Article 6 of the First Non-Life Directive or Article 6 of the First Life Directive; | |

| (b) | the name and address of the firm; | ||

| (c) | the nature of the risks or commitments which the firm proposes to cover in the United Kingdom; | ||

| (d) | in the case of a firm which intends to cover relevant motor vehicle risks: | ||

| (i) | the name and address of the claims representative (Note); and | ||

| (ii) | a declaration by the firm that it has become a member of the Motor Insurers' Bureau (being a company limited by guarantee and incorporated under the Companies Act 1929 (1) on 14 th June 1946); and | ||

| (e) | a statement by the firm's Home State regulator attesting that the firm has a minimum margin of solvency calculated in accordance with such of the following as are appropriate: | ||

| (i) | articles 16 and 17 of the First Non-Life Insurance Directive ; and | ||

| (ii) | article 18, 19 and 20 of the First Life Insurance Directive | ||

| Insurance intermediary | (4) | that the firm intends to carry on insurance mediation or reinsurance mediation by providing services in the United Kingdom. | |

- 13/02/2004

AUTH 5 Annex 3

Application of the Handbook to Incoming EEA Firms G

- 01/12/2004

See Notes

| 1. | The table below summarises the application of the Handbook to an incoming EEA firm. Where the table indicates that a particular module of the Handbook may apply, its application in relation to any particular activity is dependent on the detailed application provisions in that module. The table does not apply to incoming ECA providers. These should refer to ECO 1 for guidance on how the Handbook applies to them. |

| 2. | In some cases, the application of the Handbook depends on whether responsibility for a matter is reserved under a European Community instrument to the incoming EEA firm's Home State regulator. Guidance on the reservation of responsibility is contained in SYSC App 1 (Matters reserved to a Home State regulator). |

| 3. | For an incoming EEA firm which has permission for cross-border services only, many parts of the Handbook apply only if the firm carries on regulated activities in the United Kingdom. Those parts of the Handbook will therefore not apply if the firm confines its activities to those within the overseas persons exclusions in article 72 of the Regulated Activities Order, or which would not be regarded as carried on in the United Kingdom. Further guidance may be found in AUTH 2.4 (Link between activities and the United Kingdom) and AUTH 2.9.15 G to AUTH 2.9.17 G (Overseas persons). |

| (1) Module of Handbook | (2) Potential application to an incoming EEA firm with respect to activities carried on from an establishment of the firm (or its appointed representative) in the United Kingdom | (3) Potential application to an incoming EEA firm with respect to activities carried on other than from an establishment of the firm (or its appointed representative) in the United Kingdom |

| PRIN | The Principles apply only in so far as responsibility for the matter in question is not reserved by a European Community instrument to the firm's Home State regulator (PRIN 3.1.1 R). For an incoming EEA firm which is a BCD credit institution without a top-up permission, Principle 4 applies only in relation to the liquidity of a branch established in the United Kingdom (PRIN 3.1.1 R (2)). |