The ways people make and record payments have changed dramatically - from ways to pay, to changing materials and technology. Today, digital payments are an important way to handle money. But cash remains vital to our economy.

1694

Wooden tally stick

Tally sticks are a way of recording debts. This hazlewood stick was carved with notches to represent the total debt. It was then split lengthwise so that each party had a record of the debt.

This tally is a record for one of the Bank of England’s first loans to the Government in 1694.

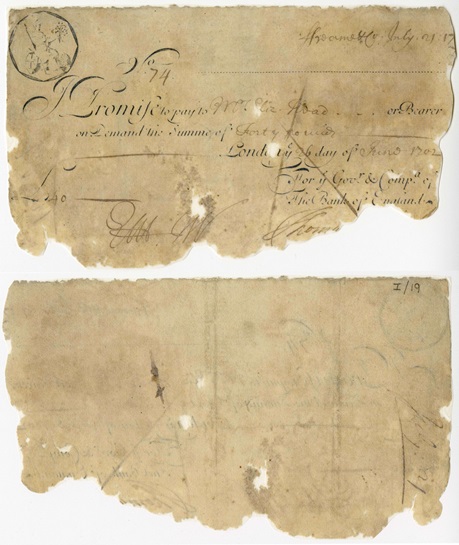

1702

One of the Bank of England’s earliest banknotes

The Bank of England issued banknotes to people who deposited money at the Bank of England. This one is addressed to Elizabeth Head, who had deposited £40. That’s the equivalent of around £9,200 today.

Early banknotes could be exchanged like money but their value was too high to be an everyday kind of currency.

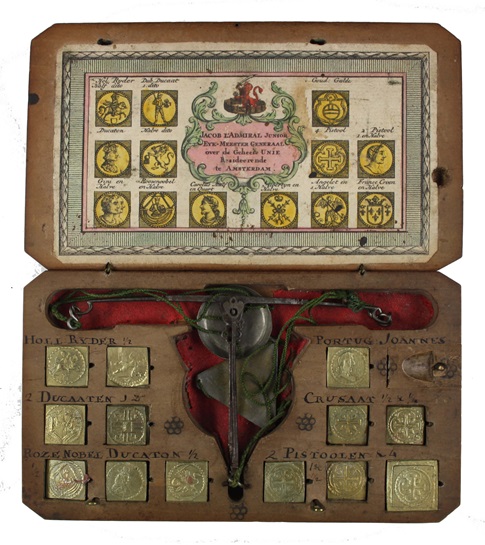

1749

Gold as currency and bullion

Gold has been both a commodity (a material that can be traded) and a currency (in the form of coins). Gold coins could be used outside their issuing country, based on their bullion value. These scales were used to work out the value of foreign coins: the names of specific coins are written beside the weights.

1796

A London and Westminster token penny

In the 1790s there was a shortage of official coinage because prices had risen. Many local businesses produced token coins to meet demand for small change. A token penny like this would have had a value of around 50p today. Some had the names of the company, or celebrated a local landmark, like this one. Others were adverts, or carried political messages.

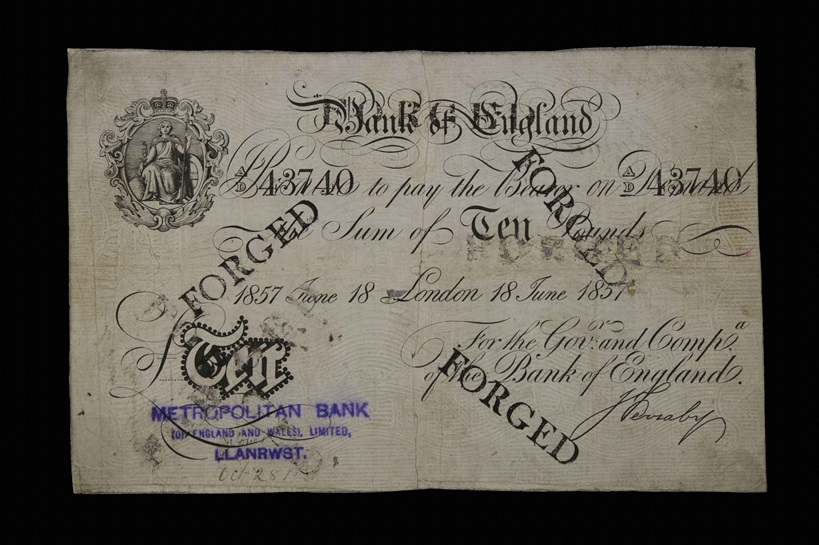

1898

A banknote forgery used twice

This banknote forgery was presented to the Bank of England to be exchanged for coins in 1858. Bank clerks recognised it as a forgery, stamped it with a ‘FORGED’, and returned it to its owner (as was the custom at the time). Bank staff finally confiscated it in 1895, after someone had erased the ‘FORGED’ marking and tried to exchange it again.

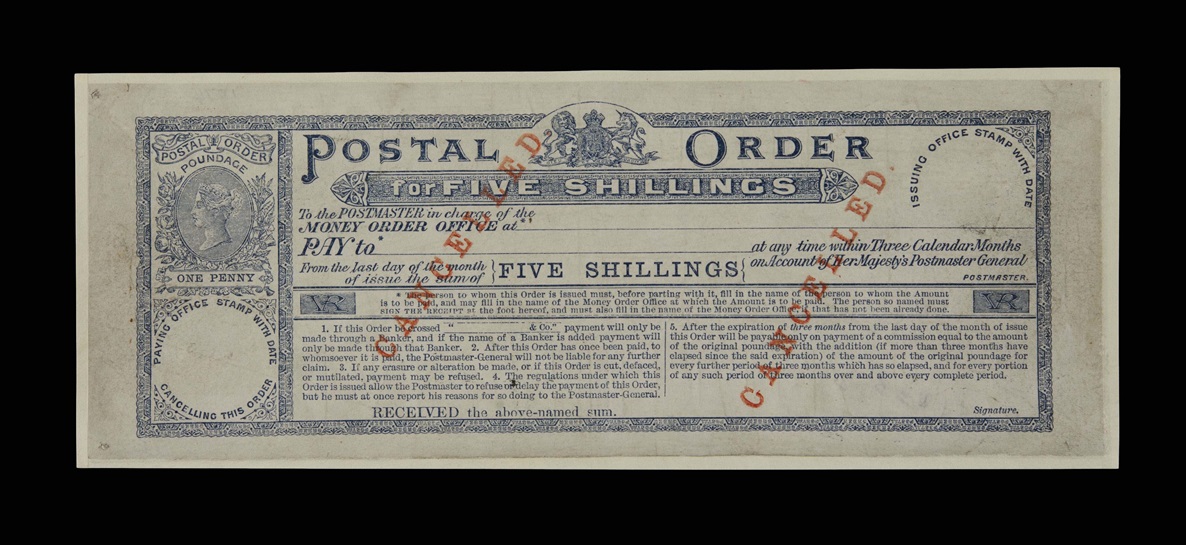

1881

The creation of postal orders

Postal orders were first introduced in 1881. They allowed people who didn’t have a bank account (or cheque book) to buy things by post. Postal orders were printed by the Bank of England from 1881 until 1923.

1896

Sorting coinage

This device could sort mixed batches of coins. Coins are poured in the top and the layers catch different sizes as they fall through. The largest coins, crowns (5 shillings), are trapped at the top. The next layers catch double florins (four shillings), half crowns (two and a half shillings), florins (two shillings) and shillings (12 pence).

1916

Pre-decimal cash register

This cash register was once used at the Bank of England’s staff canteen. Its keys are labelled for the pre-decimal currency system, with 12 pennies (the symbol D) per shilling and 20 shillings (the symbol /-) per pound. In 1971, British currency moved to a decimal system with 100 pennies to the pound and the cash register had to be replaced.

2007

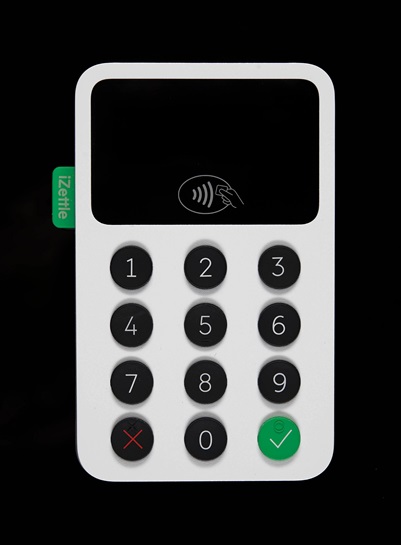

Contactless payment introduced in the UK

Credit cards were introduced in Britain in 1966 and debit cards in 1987. These are important forms of payment. The first contactless bank cards were introduced in the UK in 2007, making card transactions even more convenient.

The number of debit card transactions overtook the number of cash transactions for the first time in 2017.

2019

Payments systems today

The Bank of England plays an important role in ensuring that non-cash payments are transferred securely and reliably. It is a part of the payment system that settles debit card transactions between banks. It also runs a payment system called CHAPS which is used to settle high-value or time-critical payments, like house purchases.

2019

Cash today

Cash is still vital to the UK economy and an essential way for many people to manage their money. The future demand for cash may change but it is unlikely that cash will die out any time soon. The Bank of England will continue to produce banknotes that are durable, hard to counterfeit, and fit for purpose.