SUP 10

Approved

persons

SUP 10.1

Application

- 01/12/2004

General

SUP 10.1.1

See Notes

- 21/06/2001

SUP 10.1.2

See Notes

- 21/06/2001

SUP 10.1.3

See Notes

- 01/12/2002

SUP 10.1.4

See Notes

- 21/06/2001

SUP 10.1.5

See Notes

- 21/06/2001

Overseas firms: UK services

SUP 10.1.6

See Notes

- 21/06/2001

Overseas firms: UK establishments

SUP 10.1.7

See Notes

- 21/06/2001

SUP 10.1.8

See Notes

- 21/06/2001

Incoming EEA firms, incoming Treaty firms and UCITS qualifiers

SUP 10.1.9

See Notes

- 21/06/2001

SUP 10.1.10

See Notes

- 21/06/2001

SUP 10.1.11

See Notes

- 21/06/2001

SUP 10.1.12

See Notes

- 21/06/2001

Incoming EEA firms: passported activities from a branch

SUP 10.1.13

See Notes

- 21/06/2001

Incoming EEA firms etc with top-up permission activities from a UK branch

SUP 10.1.14

See Notes

- 21/06/2001

SUP 10.1.15

See Notes

- 21/06/2001

Appointed representatives

SUP 10.1.16

See Notes

- 21/06/2001

SUP 10.1.16A

See Notes

applies, as appropriate, to an individual within that appointed representative who will be required to be an approved person.

- 21/06/2001

SUP 10.1.17

See Notes

- 21/06/2001

Members of a profession

SUP 10.1.18

See Notes

- 21/06/2001

SUP 10.1.19

See Notes

- 21/06/2001

SUP 10.1.20

See Notes

- 21/06/2001

Oil market participants, service companies, energy market participants, subsidiaries of local authorities or registered social landlords and insurance intermediaries.

SUP 10.1.21

See Notes

- 20/09/2001

SUP 10.1.22

See Notes

- 20/09/2001

Committees of the Society of Lloyd's

SUP 10.1.23

See Notes

- 21/06/2001

SUP 10.1.24

See Notes

- 21/06/2001

SUP 10.1.25

See Notes

- 21/06/2001

Insolvency practitioners

SUP 10.1.26

See Notes

- 21/06/2001

SUP 10.2

Purpose

- 01/12/2004

SUP 10.2.1

See Notes

- 21/06/2001

SUP 10.2.2

See Notes

- 21/06/2001

SUP 10.2.3

See Notes

- 21/06/2001

SUP 10.2.4

See Notes

- 21/06/2001

SUP 10.3

Provisions related to the act

- 01/12/2004

Arrangements and regulated activities

SUP 10.3.1

See Notes

- 21/06/2001

SUP 10.3.2

See Notes

- 21/06/2001

SUP 10.3.3

See Notes

- 01/12/2002

SUP 10.3.4

See Notes

- 21/06/2001

SUP 10.3.5

See Notes

- 21/06/2001

SUP 10.4

Specification of functions

- 01/12/2004

SUP 10.4.1

See Notes

- 01/12/2002

SUP 10.4.2

See Notes

- 01/12/2002

SUP 10.4.3

See Notes

- 01/12/2002

SUP 10.4.4

See Notes

- 21/06/2001

SUP 10.5

Significant influence functions

- 01/12/2004

What are the significant influence functions?

SUP 10.5.1

See Notes

- 21/06/2001

The first condition

SUP 10.5.2

See Notes

- 21/06/2001

SUP 10.5.3

See Notes

- 21/06/2001

SUP 10.5.4

See Notes

- 21/06/2001

Periods of less than 12 weeks

SUP 10.5.5

See Notes

- 21/06/2001

SUP 10.5.6

See Notes

- 21/06/2001

SUP 10.6

Governing functions

- 01/12/2004

Introduction

SUP 10.6.1

See Notes

- 21/06/2001

What the governing functions include

SUP 10.6.2

See Notes

- 21/06/2001

SUP 10.6.3

See Notes

- 01/12/2002

SUP 10.6.3A

See Notes

- 21/06/2001

SUP 10.6.3B

See Notes

- 21/06/2001

Director function (CF1)

SUP 10.6.4

See Notes

- 21/06/2001

SUP 10.6.5

See Notes

- 01/12/2002

SUP 10.6.6

See Notes

- 21/06/2001

SUP 10.6.7

See Notes

- 21/06/2001

Non-executive director function (CF2)

SUP 10.6.8

See Notes

- 30/04/2004

SUP 10.6.9

See Notes

- 30/04/2004

SUP 10.6.10

See Notes

- 21/06/2001

Chief executive function (CF3)

SUP 10.6.11

See Notes

- 21/06/2001

SUP 10.6.12

See Notes

- 21/06/2001

SUP 10.6.13

See Notes

- 21/06/2001

SUP 10.6.14

See Notes

- 21/06/2001

SUP 10.6.15

See Notes

- 21/06/2001

SUP 10.6.16

See Notes

- 21/06/2001

Partner function (CF4)

SUP 10.6.17

See Notes

- 21/06/2001

SUP 10.6.18

See Notes

- 21/06/2001

SUP 10.6.19

See Notes

- 21/06/2001

SUP 10.6.20

See Notes

- 21/06/2001

SUP 10.6.21

See Notes

- 21/06/2001

SUP 10.6.22

See Notes

- 21/06/2001

SUP 10.6.23

See Notes

- 21/06/2001

Director of unincorporated association function (CF5)

SUP 10.6.24

See Notes

- 21/06/2001

SUP 10.6.25

See Notes

- 21/06/2001

Small friendly society function (CF6)

SUP 10.6.26

See Notes

- 21/06/2001

SUP 10.6.27

See Notes

- 21/06/2001

SUP 10.6.28

See Notes

- 21/06/2001

SUP 10.6.29

See Notes

- 21/06/2001

Sole trader function (CF7)

SUP 10.6.30

See Notes

- 21/06/2001

SUP 10.6.31

See Notes

- 21/06/2001

SUP 10.6.32

See Notes

- 21/06/2001

SUP 10.7

Required functions

- 01/12/2004

Apportionment and oversight function (CF8)

SUP 10.7.1

See Notes

- 21/06/2001

SUP 10.7.2

See Notes

- 21/06/2001

SUP 10.7.3

See Notes

- 21/06/2001

SUP 10.7.4

See Notes

- 21/06/2001

SUP 10.7.4A

See Notes

- 21/06/2001

SUP 10.7.4B

See Notes

- 21/06/2001

SUP 10.7.5

See Notes

- 21/06/2001

EEA investment business oversight function (CF9)

SUP 10.7.6

See Notes

- 21/06/2001

SUP 10.7.7

See Notes

- 21/06/2001

Compliance oversight function (CF10)

SUP 10.7.8

See Notes

- 21/06/2001

SUP 10.7.9

See Notes

- 01/12/2002

SUP 10.7.10

See Notes

- 01/04/2004

SUP 10.7.11

See Notes

- 21/06/2001

SUP 10.7.12

See Notes

- 21/06/2001

Money laundering reporting function (CF11)

SUP 10.7.13

See Notes

- 21/06/2001

SUP 10.7.14

See Notes

- 21/06/2001

SUP 10.7.15

See Notes

- 21/06/2001

SUP 10.7.16

See Notes

- 21/06/2001

SUP 10.8

Systems and control functions

- 01/12/2004

Finance function (CF13)

SUP 10.8.1

See Notes

- 21/06/2001

SUP 10.8.2

See Notes

- 21/06/2001

Risk assessment function (CF14)

SUP 10.8.3

See Notes

- 21/06/2001

SUP 10.8.4

See Notes

- 21/06/2001

SUP 10.8.5

See Notes

- 01/12/2002

Internal audit function (CF15)

SUP 10.8.6

See Notes

- 21/06/2001

SUP 10.8.7

See Notes

- 21/06/2001

SUP 10.8.8

See Notes

- 21/06/2001

SUP 10.9

Significant management functions

- 01/12/2004

Application

SUP 10.9.1

See Notes

- 21/06/2001

SUP 10.9.2

See Notes

- 21/06/2001

SUP 10.9.3

See Notes

- 21/06/2001

SUP 10.9.4

See Notes

- 21/06/2001

SUP 10.9.5

See Notes

- 21/06/2001

SUP 10.9.6

See Notes

- 21/06/2001

SUP 10.9.7

See Notes

- 21/06/2001

Reporting requirement

SUP 10.9.8

See Notes

- 21/06/2001

SUP 10.9.9

See Notes

- 21/06/2001

Significant management (designated investment business) function (CF16)

SUP 10.9.10

See Notes

- 01/05/2003

SUP 10.9.11

See Notes

- 15/11/2001

Significant management (other business operations) function (CF17)

SUP 10.9.12

See Notes

- 01/05/2003

SUP 10.9.13

See Notes

- 01/12/2002

SUP 10.9.13A

See Notes

- 21/06/2001

SUP 10.9.13B

See Notes

- 21/06/2001

Significant management (insurance underwriting) function (CF18)

SUP 10.9.14

See Notes

- 21/06/2001

SUP 10.9.15

See Notes

- 21/06/2001

Significant management (financial resources) function (CF19)

SUP 10.9.16

See Notes

- 21/06/2001

SUP 10.9.17

See Notes

- 01/12/2002

Significant management (settlements) function (CF20)

SUP 10.9.18

See Notes

- 21/06/2001

SUP 10.9.19

See Notes

- 21/06/2001

SUP 10.9.20

See Notes

- 19/01/2003

SUP 10.10

Customer functions

- 01/12/2004

SUP 10.10.1

See Notes

- 01/12/2002

SUP 10.10.2

See Notes

- 01/12/2002

SUP 10.10.3

See Notes

- 21/06/2001

The customer conditions (the second and third conditions)

SUP 10.10.4

See Notes

- 21/06/2001

SUP 10.10.5

See Notes

- 21/06/2001

SUP 10.10.6

See Notes

- 21/06/2001

Investment adviser function (CF21)

SUP 10.10.7

See Notes

- 01/12/2002

SUP 10.10.8

See Notes

- 21/06/2001

SUP 10.10.9

See Notes

- 01/07/2004

SUP 10.10.10

See Notes

- 01/07/2004

Investment adviser (trainee) function (CF22)

SUP 10.10.11

See Notes

- 21/06/2001

SUP 10.10.12

See Notes

- 21/06/2001

Corporate finance adviser function (CF23)

SUP 10.10.13

See Notes

- 01/12/2002

SUP 10.10.13A

See Notes

- 01/07/2004

Pension transfer specialist function (CF24)

SUP 10.10.14

See Notes

- 21/06/2001

Adviser on syndicate participation at Lloyds's function (CF25)

SUP 10.10.15

See Notes

- 21/06/2001

Customer trading function (CF26)

SUP 10.10.16

See Notes

- (1) The customer trading function is the function of dealing, as principal or as agent, and arranging (bringing about) deals in investments other than a non-investment insurance contract with or for, or in connection with, private customers and intermediate customers where:

- (a) the dealing or arranging deals is governed by COB 7 (Dealing and managing); and

- (b) the person performing the function is not advising on or managing investments unless approved to perform the investment adviser function or the investment management function.

- (2) This function does not extend to an individual who is based overseas and who, in a 12 month period, spends no more than 30 days in the United Kingdom to the extent that he is appropriately supervised by a person approved for this function.

- 01/12/2002

SUP 10.10.17

See Notes

- 21/06/2001

SUP 10.10.18

See Notes

- 21/06/2001

SUP 10.10.19

See Notes

- 21/06/2001

Investment management function (CF27)

SUP 10.10.20

See Notes

- 01/12/2002

SUP 10.10.21

See Notes

- 01/12/2002

SUP 10.10.22

See Notes

- 01/07/2004

SUP 10.11

Procedures relating to approved persons

- 01/12/2004

Forms

SUP 10.11.1

See Notes

- 21/06/2001

SUP 10.11.2

See Notes

Approved persons forms

| Form A | SUP 10 Ann 4D | Application to perform controlled functions under the approved persons regime |

| Form B | SUP 10 Ann 5R | Notice to withdraw an application to perform controlled functions under the approved persons regime |

| Form C | SUP 10 Ann 6R | Notice of ceasing to perform controlled functions |

| Form D | SUP 10 Ann 7R | Notification of changes in personal information or application details |

| Form E | SUP 10 Ann 8G | Internal transfer of an approved person |

- 21/06/2001

SUP 10.11.3

See Notes

- 21/06/2001

SUP 10.11.4

See Notes

- 21/06/2001

SUP 10.11.5

See Notes

- 21/06/2001

SUP 10.11.6

See Notes

- 01/12/2004

SUP 10.12

Application for approval and withdrawing an application for approval

- 01/12/2004

When to apply for approval

SUP 10.12.1

See Notes

- 21/06/2001

How to apply for approval

SUP 10.12.2

See Notes

- 21/06/2001

SUP 10.12.4

See Notes

Outsourcing arrangements

| Outsourcing arrangements | Submitting form | |

| Firm A to firm B | The FSA will consider A to have taken reasonable care if it enters into a contract with B under which B is responsible for ensuring that the relevant controlled functions are performed by approved persons, and that it is reasonable for A to rely on this | Firm B submits approved persons forms on behalf of firm A |

| Outsourcing by A to B (both being a member of the same United Kingdom group and each having its registered office in the United Kingdom) | See SUP 10.3.4 G | See SUP 15.7.8 G |

|

(i)

A to B, where B is a non-authorised

person not part of the samegroup as

A (ii) A to B, where A is a branch of an overseas firm in the United Kingdom, and B is an overseas undertaking of the samegroup (iii) A to B, where A is a UK authorised subsidiary of an overseas firm, and B is an overseas undertaking of the same group | Responsibility for (as opposed to the performance of) any activity outsourced to B will remain with A. See SYSC 3.2.4 G | A ensures that an individual approved under one of the significant influence functions has responsibility for the outsourced arrangement and A submits a form in relation to that individual |

- 21/06/2001

SUP 10.12.4A

See Notes

- 01/12/2002

Processing an application

SUP 10.12.5

See Notes

- 21/06/2001

SUP 10.12.6

See Notes

- 21/06/2001

SUP 10.12.7

See Notes

- 21/06/2001

SUP 10.12.8

See Notes

- 21/06/2001

SUP 10.12.9

See Notes

- 21/06/2001

SUP 10.12.10

See Notes

- 21/06/2001

Decisions on applications

SUP 10.12.11

See Notes

- 21/06/2001

SUP 10.12.12

See Notes

- 21/06/2001

Withdrawing an application for approval

SUP 10.12.13

See Notes

- 21/06/2001

SUP 10.12.14

See Notes

- 21/06/2001

SUP 10.13

Changes to an approved person's details

- 01/12/2004

Moving within a firm

SUP 10.13.1

See Notes

- 21/06/2001

SUP 10.13.2

See Notes

- 21/06/2001

SUP 10.13.3

See Notes

- 01/11/2004

Moving between firms

SUP 10.13.4

See Notes

- 21/06/2001

SUP 10.13.5

See Notes

- 21/06/2001

Ceasing to perform a controlled function

SUP 10.13.6

See Notes

- 21/06/2001

SUP 10.13.7

See Notes

- 01/12/2002

SUP 10.13.8

See Notes

- 21/06/2001

SUP 10.13.9

See Notes

- 21/06/2001

SUP 10.13.10

See Notes

- 21/06/2001

SUP 10.13.11

See Notes

- 21/06/2001

SUP 10.13.12

See Notes

- 01/12/2002

SUP 10.13.13

See Notes

- 21/06/2001

Changes to an approved person's personal details

SUP 10.13.14

See Notes

- 21/06/2001

SUP 10.13.15

See Notes

- 21/06/2001

SUP 10.13.16

See Notes

- 21/06/2001

SUP 10.13.17

See Notes

- 21/06/2001

SUP 10.13.18

See Notes

- 01/12/2002

SUP 10.13.19

See Notes

- 01/12/2002

SUP 10.13.20

See Notes

- 01/12/2002

SUP 10.14

Further questions

- 01/12/2004

SUP 10.14.1

See Notes

- 21/06/2001

SUP 10.14.2

See Notes

- 21/06/2001

SUP 10 Annex 1

Frequently asked questions

- 01/12/2004

See Notes

| Question | Answer | |

| Requirements of the regime | ||

| 1 | Does pre-approval apply to individuals taking up a new controlled function within the same firm? | Yes. Pre-approval applies in all circumstances (see section 59 of the Act (Approval for particular arrangements)) except under the temporary ('12 weeks') provision. See SUP 10.5.5 R and question 2. |

| 2 | What are the procedures for 'emergency situations'? | Individuals may perform significant influence function for up to 12 weeks in any consecutive 12 month period without requiring approval. When it becomes clear that a person will be performing the function on a permanent basis, then an application for approval should be made. However, there is no provision for individuals to perform the customer functions on a continuing basis without approval. See SUP 10.5.5 R. |

| 3 | Can a person be approved for more than one controlled function? | Yes. A firm will need to seek approval in respect of each controlled function a person is to perform. |

| 4 | Do the controlled functions apply to an incoming EEA firm that is providing cross border services into the United Kingdom? | No. The approved persons regime does not apply to cross border services. See SUP 10.1.6 R. |

| 5 | May any activity be outsourced by a firm? | Yes. But if that activity constitutes a regulated activity, the person to whom it is outsourced will itself need permission. |

| 6 | Can a significant influence function be outsourced? | It is a question of fact in each case who is performing a significant influence function. These functions are mostly described at a high level of responsibility, that is, for example, the director of a company or a partner in a partnership. The persons performing these functions cannot avoid their ultimate responsibility and therefore the need for approval. However, some of the significant influence functions may be performed by a person who is specifically brought in to do the job, for example the chief executive function (where it is to be performed by a body corporate) and the appointed actuary function. |

| 7 | Do Lloyd's underwriting agents still require registration with Lloyd's? | Yes. Approval for a controlled function is not sufficient. |

| 8 | What should a firm do if it is unsure whether an individual needs approval? | The firm should contact the Authorisation and Approvals Department. See SUP 10.11.6 G. |

| Submitting an application | ||

| 9 | Who applies for approval? | The firm. See section 60 of the Act (Applications for approval). |

| 10 | What is the role of the candidate in the application process? | Before the firm submits Form A it must verify the information contained in it. As part of this verification, the Form provides for the candidate to confirm the accuracy of the information given by the firm so far as it relates to him. |

| 11 | What checks musta firm make on a candidate before submitting an application for approval from the FSA? | The FSA expects firms to perform due and diligent enquiries into their candidates. Note also the requirements of ENF 8.12.2 G and TC2.2.1 R. |

| 11A | Should these checks include a check of criminal records? | It is for senior management to decide what checks should be made. By virtue of the Rehabilitation of Offenders Act 1974 (Exceptions) Order 1975 (see Articles 3 and 4 of the Order), the FSA and the industry also have a right to ask about spent, as well as unspent, criminal convictions for employment purposes about candidates for approved person status (see Question 5.01a of Form A (Application to perform controlled functions under the approved persons regime)). Note also the provisions of ENF 8.12.2 G (Publication) and TC2.2.1 R (Recruitment). |

| 12 | What is the "fit and proper" test for approval? | Section 61(1) of the Act (Determination of applications) provides that the FSA may grant an application only if it is satisfied that the candidate is a fit and proper person to perform the relevant function. In determining this question, the Act sets out the matters to which the FSA may have regard (section 61(2)) and the FSA has given guidance on this in FIT. |

| 13 | If a firm is unsure whether or not something may have an impact upon an individual's fitness and propriety, should it be disclosed? | Yes, always. The deliberate non-disclosure of material facts is taken very seriously by the FSA as it is seen as possible evidence of current dishonesty. Therefore, if in doubt, disclose. |

| 14 | What happens if adverse information comes to light after the application form has been submitted or after the individual has been approved? | The firm must inform the FSA at the earliest opportunity. See SUP 10.13.16 R. |

| 15 | Will the FSA consider an application in respect of a candidate who has not yet signed a contract with the firm? | Yes, as the FSA will consider the arrangement under which the candidate will perform the function. However, the FSA will not consider speculative or provisional applications - such as for the candidates in an election to a mutual society Board.The FSA must be informed immediately of any material changes to the information provided on the application form which arises before the application has been determined. All changes must be communicated to the FSA by the firm making the application (seeSUP 15.6.4 R). Failure to notify the FSA may result in a delay in processing or rejection or both. |

| 16 | How can we get a supply of application forms (Form A)? | These can either be ordered through the Authorisation and Approvals Departmentor obtained from the FSA website at www.fsa.gov.uk. There is no charge for an application form. |

| 17 | Is there a separate fee for making an application for approved person status? | No. |

| 18 | Must all gaps in previous employment be explained? | Yes. |

| FSA procedures | ||

| 19 | Does the FSA verify the information provided to it? | Yes, as far as possible, information is verified. |

| 20 | Will the FSA handle information confidentially? | Yes. The FSA is obliged to handle all information confidentially and is subject to the provisions of the Data Protection Act 1998. |

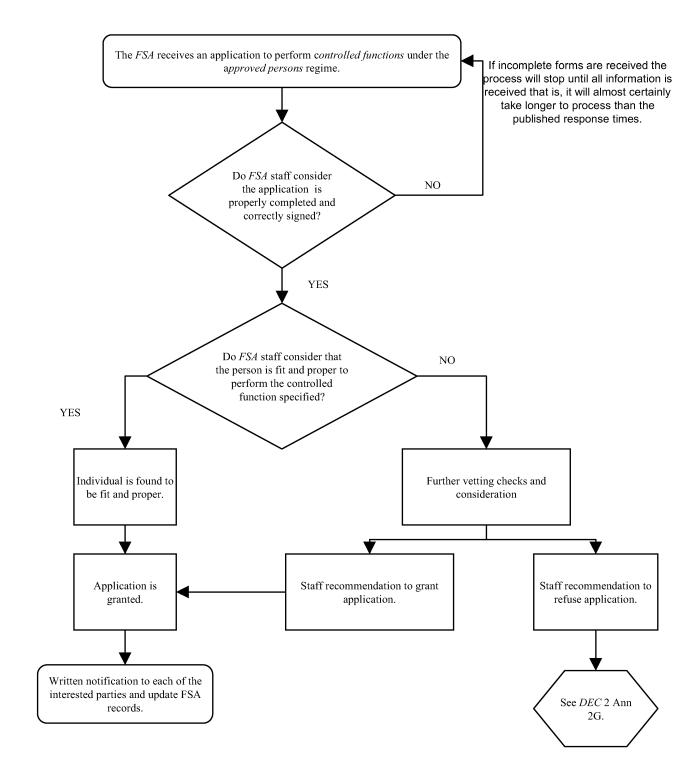

| 21 | How long will the FSA take to process an application for approved person status? | Generally the FSA will handle this within seven business days for significant influence functions and four business days for customer functions. However, if information is missing, or the information provided gives the FSA cause for concern, processing time will almost always be longer. In each case, the FSA will notify the firm of any extension to the processing times. |

| 22 | Will the firm and individual be notified if there is a delay in processing the application form? | Yes. The FSA will contact the firm explaining the position and, where appropriate, giving the reasons for delay. It will then be the responsibility of the firm to keep the candidate and any other interested party informed. |

| 23 | How are non-routine cases handled? | Refer to DEC 2 Annex 2 . |

| 24 | Can the FSA apply conditions to an approved person? | No. The application can either be granted or refused. The Act provides no equivalent to the limitations or requirements which may be included in permissions. If the application is refused, the firm may re-apply in respect of the same individual but a different controlled function. If it is considering doing this, the firm is encouraged to discuss the matter with the FSA.Where there are reasonable grounds for doing so, the FSA may require a firm to provide information about an approved person (see section 165 of the Act (Power to require information)). |

| 25 | Will the firm be issued with confirmation of approval? | Yes. The firm will be sent a letter setting out the effective date of approval together with the controlled function for which the individual has been approved. It will then be the firm's responsibility to inform the individual and any other interested party, for example any appointed representative. |

| Withdrawing an application | ||

| 26 | Can a firm withdraw its application? | Yes, but only with the consent of the candidate. See section 61(5) of the Act (Determination of applications). |

| 27 | What happens if the individual refuses to consent to the withdrawal of the application? | The FSA will consider with all interested parties what to do. If it proposes to refuse the application, it will give a warning notice to all interested parties. See section 62 of the Act (Applications for approval: procedure and right to refer to the Tribunal). |

| 28 | Can the firm withdraw only part of an application - say, in relation to a specific controlled function? | The FSA will allow the firm to amend its application at any time before determination with the consent of all other interested parties. Whether the amendment will have the effect of amounting to a fresh application will be considered on a case by case basis. |

| Conduct of approved persons | ||

| 29 | How and when must the firm report to the FSA potentially adverse information about an approved person's fitness and propriety? | Normally, the firm should report such matters to the FSA on Form D once it is reasonably satisfied as to the information's validity. See SUP 10.13.16 R. See also, Principle for Businesses 11 (PRIN) and Statements of Principle 4 (APER). However, if an approved person is dismissed, is suspended, or resigns while under investigation by the firm, the FSA or another regulatory body, or there are any other matters that might affect the individual's fitness and propriety to perform a controlled function, the firm should inform the FSA (SUP 10.13.7 R) that it will be submitting a Form C containing adverse information. Full details must then be provided within seven business days, on the Form C. See SUP 10.13.6 R. |

| 30 | For how long are individuals accountable to the FSA after ceasing to be an approved person? | A person is guilty of misconduct if, while an approved person, he fails to comply with a Statement of Principle or is knowingly concerned in the contravention by a firm of a requirement in the Act or the Handbook. But the FSA may not bring proceedings after two years from when it first knew of the misconduct. |

| Activity | Paragraph 1 of the table in TC 2.1.4R | Controlled Function | SUP |

| Advising and dealing | (a) - (c), (d) and (e), (f) - (o) | investment adviser function (CF21) investment adviser (trainee) function (CF22) |

10.10.7R 10.10.11R |

| Managing | (d) and (e) | investment management function (CF27) | 10.10.20R |

| Advising (without dealing) | (f) - (h) | investment adviser function (CF21) | 10.10.7R |

| investment adviser (trainee) function (CF22) | 10.10.11R | ||

| (i) | corporate finance adviser function (CF23) | 10.10.13R | |

| (j) - (m) | investment adviser function (CF21) | 10.10.7R | |

| investment adviser (trainee) function (CF22) | 10.10.11R | ||

| (n) | adviser on syndicate participation at Lloyd's function (CF25) | 10.10.15R | |

| (o) | pension transfer specialist function (CF24) | 10.10.14R |

- 01/12/2004

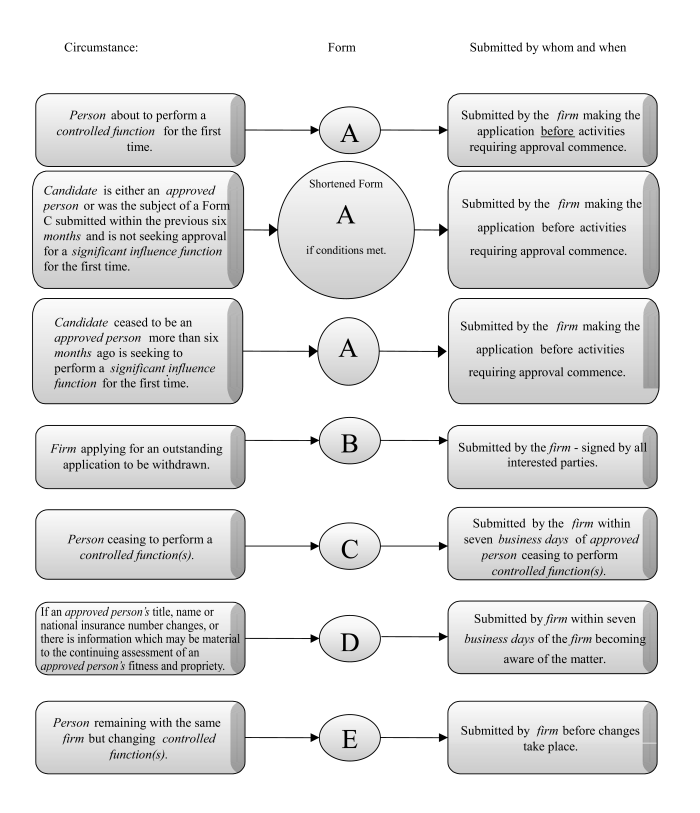

SUP 10 Annex 2

Approved person regime: summary of forms and their use

- 01/12/2004

Approved person regime: summary of forms and their use

See Notes

- 21/06/2001

SUP 10 Annex 3

Summary of procedures on applications for approved status

- 01/12/2004

See Notes

- 21/06/2001

SUP 10 Annex 4

Form A: Application to perform controlled functions under the approved person regime

- 01/12/2004

See Notes

Supervision forms - Notes from direction in SUP 10.12

- 01/07/2004

SUP 10 Annex 5

Form B: Notice to withdraw an application to perform controlled functions under the approved persons regime

- 01/12/2004

See Notes

Supervision forms - SUP 10 Annex 5

- 01/07/2004

SUP 10 Annex 6

Form C: Notice of ceasing to perform controlled functions

- 01/12/2004

See Notes

Supervision forms - SUP 10 Annex 6

- 01/12/2002

SUP 10 Annex 7

Form D: Notification of changes in personal information or application details

- 01/12/2004

See Notes

Supervision forms - SUP 10 Annex 7

- 01/12/2002

SUP 10 Annex 8

Form E: Internal transfer of an approved person

- 01/12/2004

See Notes

Supervision forms - SUP 10 Annex 8

- 01/12/2002