PERG 1

Introduction to the Perimeter Guidance manual

PERG 1.1

Application and purpose

- 01/07/2005

Application

PERG 1.1.1

See Notes

- 01/07/2005

Purpose

PERG 1.1.2

See Notes

- 01/07/2005

PERG 1.2

Introduction

- 01/07/2005

PERG 1.2.1

See Notes

- 01/07/2005

PERG 1.2.2

See Notes

- 01/07/2005

PERG 1.2.3

See Notes

- 01/07/2005

PERG 1.2.4

See Notes

- 01/07/2005

PERG 1.3

Status of guidance

- 01/07/2005

PERG 1.3.1

See Notes

- 01/07/2005

PERG 1.4

General guidance to be found in PERG

- 01/07/2005

PERG 1.4.1

See Notes

- 01/07/2005

PERG 1.4.2

See Notes

| Chapter: | Applicable to: | About: |

|

PERG 2: Authorisation and regulated activities |

•an unauthorised person wishing to find out whether he needs to be authorised or exempt• an authorised person wishing to know whether he needs to vary his

Part IV permission

|

• the regulatory scope of the Act• the Regulated Activities Order•the Exemption Order•the Business Order

|

|

PERG 3: Issuing e-money | a person who needs to know • whether a particular electronic payment product ise-money and whether the person issuing it needs to beauthorised under the Act• whether any communications about the product will be restricted |

• the scope of the

regulated activity of issuing e-money• the application of the restriction in section 21 of the Act (Restrictions on financial promotion) to communications about e-money

|

|

PERG 4: Regulated activities connected with mortgages | any person who needs to know whether the activities he conducts in relation to mortgages are subject to

FSA

regulation. This is likely to include: •lenders•administration service providers•mortgage brokers and advisers | the scope of relevant orders (in particular, the Regulated Activities Order) as respects activities concerned with mortgages |

|

PERG 5: Insurance mediation activities | any person who needs to know whether he carries on insurance mediation activities and is, thereby, subject to

FSA

regulation. This is likely to include: •insurance brokers• insurance advisers•insurance undertakings• other persons involved in the sale or administration of contracts of insurance, where these activities are secondary to their main business. | the scope of relevant orders (in particular, the Regulated Activities Order) as respects activities concerned with the sale or administration of insurance |

|

PERG 6: Identification of contracts of insurance | any person who needs to know whether a contract with which he is involved is a contract of insurance | the general principles and range of specific factors that the

FSA

regards as relevant in deciding whether any arrangement is a contract of insurance |

|

PERG 7: Periodical publications, news services and broadcasts: application for certification | any person who needs to know whether he will be regulated for providing advice about investments through the medium of a periodical publication, a broadcast or a news service |

• the circumstances in which such persons will be carrying on the regulated activities of advising on investments or advising on regulated mortgage contracts (including where a request for a certificate may be appropriate)•how the

FSA

will exercise its power to grant certificates

|

|

PERG 8: Financial promotion and related activities | any person who needs to know •whether his communications are financial promotions or are subject to the restriction in section 21 of the Act or both•whether his activities in making or helping others to make financial promotions are regulated activities. |

•the scope of the restriction on financial promotion under section 21 of the Act and the main exemptions provided•the circumstances in which persons who are primarily involved in making or helping others to make financial promotions may themselves be conducting regulated activities requiring authorisation or exemption

|

|

PERG 9: Meaning of open-ended investment company | any person who needs to know whether a body corporate is an open-ended investment company as defined in section 236 of the Act (Open-ended investment companies) and is therefore a collective investment scheme. | the circumstances in which a body corporate will be an open-ended investment company |

|

PERG 10: Activities related to pension schemes | Any person who needs to know whether his activities in relation to pension schemes will amount to regulated activities or whether the restriction in section 21 of the Act will apply to any financial promotions he may make. |

•the regulated activities that arise in connection with the establishment and operation of pension schemes and any exclusions that may be relevant

•the circumstances in which financial promotions about pension schemes may be exempt from the restriction in section 21 of the Act

|

|

PERG 11: Property investment clubs and land investment schemes | Any person who needs to know whether his activities in relation to property investment clubs and land investment schemes will amount to regulated activities or whether the restriction in section 21 of the Act will apply to any financial promotions he may make. |

•the regulated activities that may arise in connection with the establishment and operation of property investment clubs and land investment schemes and any exclusions that may be relevant

|

|

PERG 12: Running or advising on personal pension schemes | any person who needs to know whether his activities in relation to establishing, running, advising on or marketing personal pension schemes will amount to regulated activities | the regulated activities that arise in connection with establishing, running, advising on or marketing personal pension schemes and any exclusions that may be relevant |

|

PERG 13: Guidance on the scope of the Markets in Financial Instruments Directive and the recast Capital Adequacy Directive [to be issued] | ||

|

PERG 14: Home reversion and home finance activities | Any person who needs to know whether his activities in relation to home reversion plans or home purchase plans will amount to regulated activities or whether the restriction in section 21 of the Act will apply to any financial promotions he may make. |

•the regulated activities that arise in connection with home reversion plansand

home purchase plans

and any exclusions that may be relevant•the circumstances in which financial promotions about home reversion plansand

home purchase plans

may be made without breaching the restriction in section 21 of the Act

|

- 06/11/2006

PERG 1.5

What other guidance about the perimeter is available from the FSA?

- 01/07/2005

PERG 1.5.1

See Notes

- 06/05/2006

PERG 1.5.2

See Notes

- 01/07/2005

PERG 1.5.3

See Notes

- 01/07/2005

PERG 1.5.4

See Notes

- 01/07/2005

PERG 2

Authorisation and regulated activities

PERG 2.1

Application and purpose

- 01/07/2005

Application

PERG 2.1.1

See Notes

- 01/07/2005

Purpose

PERG 2.1.2

See Notes

- 01/07/2005

PERG 2.2

Introduction

- 01/07/2005

PERG 2.2.1

See Notes

- 06/10/2007

PERG 2.2.2

See Notes

- 01/07/2005

PERG 2.2.3

See Notes

- 06/10/2007

PERG 2.2.4

See Notes

- 01/07/2005

PERG 2.2.5

See Notes

- 06/10/2007

PERG 2.3

The business element

- 01/07/2005

PERG 2.3.1

See Notes

- 01/07/2005

PERG 2.3.2

See Notes

- 06/04/2007

PERG 2.3.3

See Notes

- 01/07/2005

PERG 2.4

Link between activities and the United Kingdom

- 01/07/2005

PERG 2.4.1

See Notes

- 01/07/2005

PERG 2.4.2

See Notes

- 01/07/2005

PERG 2.4.3

See Notes

- 01/07/2005

PERG 2.4.4

See Notes

- 01/07/2005

PERG 2.4.5

See Notes

- 01/07/2005

PERG 2.4.6

See Notes

- 01/07/2005

PERG 2.4.7

See Notes

- 01/07/2005

PERG 2.5

Investments and activities: general

- 01/07/2005

PERG 2.5.1

See Notes

- 01/07/2005

PERG 2.5.2

See Notes

- 01/07/2005

Modification of certain exclusions as a result of Investment Services and Insurance Mediation Directives

PERG 2.5.3

See Notes

- 01/07/2005

Investment services

PERG 2.5.4

See Notes

- 01/07/2005

PERG 2.5.5

See Notes

- 06/10/2006

Insurance mediation or reinsurance mediation

PERG 2.5.6

See Notes

- 01/07/2005

PERG 2.6

Specified investments: a broad outline

- 01/07/2005

PERG 2.6.1

See Notes

- 01/07/2005

Deposits

PERG 2.6.2

See Notes

- 01/07/2005

PERG 2.6.3

See Notes

- 01/07/2005

PERG 2.6.4

See Notes

- 01/07/2005

Electronic money

PERG 2.6.4A

See Notes

- 01/07/2005

Rights under a contract of insurance

PERG 2.6.5

See Notes

- 01/07/2005

PERG 2.6.6

See Notes

- 01/07/2005

PERG 2.6.7

See Notes

- 01/07/2005

PERG 2.6.8

See Notes

- 01/07/2005

Shares etc

PERG 2.6.9

See Notes

- 01/07/2005

PERG 2.6.10

See Notes

- 01/07/2005

Debt instruments

PERG 2.6.11

See Notes

An instrument cannot fall within both categories of specified investments relating to debt instruments. 'Instrument' is defined to include any record whether or not in the form of a document (see article 3(1) of the Regulated Activities Order).

- 01/07/2005

PERG 2.6.12

See Notes

- 01/07/2005

Warrants

PERG 2.6.13

See Notes

- 01/07/2005

PERG 2.6.14

See Notes

- 01/07/2005

Certificates representing securities

PERG 2.6.15

See Notes

- 01/07/2005

PERG 2.6.16

See Notes

- 01/07/2005

Units

PERG 2.6.17

See Notes

- 01/10/2005

PERG 2.6.18

See Notes

- 01/07/2005

Rights under a pension scheme

PERG 2.6.19

See Notes

- 06/04/2007

PERG 2.6.19A

See Notes

- 06/04/2007

PERG 2.6.19B

See Notes

- 06/04/2007

PERG 2.6.19C

See Notes

- 06/04/2007

Options

PERG 2.6.20

See Notes

- 01/07/2005

Futures

PERG 2.6.21

See Notes

- 01/07/2005

PERG 2.6.22

See Notes

- 01/07/2005

Contracts for differences

PERG 2.6.23

See Notes

- 01/07/2005

PERG 2.6.24

See Notes

- 01/07/2005

Lloyd's investments

PERG 2.6.25

See Notes

- 01/07/2005

Rights under a funeral plan

PERG 2.6.26

See Notes

- 01/07/2005

Rights under a regulated mortgage contract

PERG 2.6.27

See Notes

Detailed guidance on this is set out in PERG 4.4 (Guidance on regulated activities connected with mortgages).

- 01/07/2005

Rights under a home reversion plan

PERG 2.6.27A

See Notes

- 06/04/2007

Rights under a home purchase plan

PERG 2.6.27B

See Notes

- 06/04/2007

PERG 2.6.28

See Notes

- 06/04/2007

PERG 2.6.29

See Notes

- 01/07/2005

PERG 2.7

Activities: a broad outline

- 01/07/2005

PERG 2.7.1

See Notes

- 01/07/2005

Accepting deposits

PERG 2.7.2

See Notes

- 01/07/2005

Issuing e-money

PERG 2.7.2A

See Notes

- 01/07/2005

Effecting or carrying out contracts of insurance as principal

PERG 2.7.3

See Notes

- 01/07/2005

PERG 2.7.4

See Notes

PERG 5 (Insurance mediation activities) has more guidance on these regulated activities where they are insurance mediation activities.

- 01/07/2005

Dealing in investments (as principal or agent)

PERG 2.7.5

See Notes

- 01/07/2005

PERG 2.7.6

See Notes

- 01/07/2005

PERG 2.7.6A

See Notes

- 01/07/2005

Arranging deals in investments and arranging a home finance transaction

PERG 2.7.7

See Notes

- 01/07/2005

PERG 2.7.7A

See Notes

- 06/04/2007

PERG 2.7.7B

See Notes

- 01/07/2005

PERG 2.7.7C

See Notes

- 06/04/2007

Managing investments

PERG 2.7.8

See Notes

- 01/07/2005

Assisting in the administration and performance of a contract of insurance

PERG 2.7.8A

See Notes

- 01/07/2005

Safeguarding and administering investments

PERG 2.7.9

See Notes

- 01/07/2005

PERG 2.7.10

See Notes

- 01/07/2005

Sending dematerialised instructions

PERG 2.7.11

See Notes

- 01/07/2005

Establishing etc collective investment schemes

PERG 2.7.12

See Notes

- 06/03/2006

PERG 2.7.13

See Notes

In addition, express provision is included in the Regulated Activities Order to make acting as trustee of an authorised unit trust scheme a regulated activity. The full picture for authorised schemes (that is, schemes that can be promoted to the public) is as follows:

- (1) Acting as trustee of an authorised unit trust scheme is expressly included as a regulated activity.

- (2) Acting as depositary of an open-ended investment company that is authorised under regulations made under section 262 of the Act (Open-ended investment companies), is a regulated activity.

- (3) Acting as a sole director of such a company is a regulated activity.

- (4) Managing an authorised unit trust scheme will amount to operating the scheme and so will be a regulated activity. A person acting as manager is also likely to be carrying on other regulated activities (such as dealing (see PERG 2.7.5 G) or managing investments (see PERG 2.7.8 G)).

- (5) An open-ended investment company will, once it is authorised under regulations made under section 262 of the Act, become an authorised person in its own right under Schedule 5 to the Act (Persons concerned in Collective Investment Schemes). Under ordinary principles, a company operates itself and an authorised open-ended investment company will be operating the collective investment scheme constituted by the company. It is not required to go through a separate process of authorisation as a person because it has already undergone the process of product authorisation.

- (6) Operators, trustees or depositaries of UCITS schemes constituted in other EEA States are also authorised persons under Schedule 5 of the Act if those schemes qualify as recognised collective investment schemes for the purposes of section 264 of the Act.

- 01/07/2005

PERG 2.7.13C

where, in either case, the scheme or company is a UCITS.

- 01/07/2005

Establishing etc pension schemes

PERG 2.7.14

See Notes

- 06/04/2007

Providing basic advice on stakeholder products

PERG 2.7.14A

See Notes

- 01/07/2005

PERG 2.7.14B

See Notes

- 01/07/2005

Advising on investments

PERG 2.7.15

See Notes

- 01/07/2005

PERG 2.7.16

See Notes

- 01/07/2005

PERG 2.7.16A

See Notes

- 01/07/2005

Advising on regulated mortgage contracts

PERG 2.7.16B

See Notes

Advice on varying terms as referred to in (2) comes within article 53A only where the borrower entered into the regulated mortgage contract on or after 31 October 2004 and the variation varies the borrower's obligations under the contract. Further guidance on the scope of the regulated activity under article 53A is in PERG 4.6 (Advising on regulated mortgage contracts).

- 01/07/2005

Advising on home reversion plans

PERG 2.7.16C

See Notes

- 06/04/2007

Advising on a home purchase plan

PERG 2.7.16D

See Notes

- 06/04/2007

Lloyd's activities

PERG 2.7.17

See Notes

- 01/07/2005

Entering funeral plan contracts

PERG 2.7.18

See Notes

- 01/07/2005

PERG 2.7.19

See Notes

- 01/07/2005

Entering into and administering a regulated mortgage contract

PERG 2.7.20

See Notes

- 01/07/2005

Entering into and administering a home reversion plan

PERG 2.7.20A

See Notes

- 06/04/2007

Entering into and administering a home purchase plan

PERG 2.7.20B

See Notes

- 06/04/2007

Agreeing

PERG 2.7.21

See Notes

- 06/04/2007

PERG 2.8

Exclusions applicable to particular regulated activities

- 01/07/2005

PERG 2.8.1

See Notes

- 01/07/2005

Accepting deposits

PERG 2.8.2

See Notes

- 01/07/2005

Issuing e-money

PERG 2.8.2A

See Notes

- 01/07/2005

Effecting and carrying out contracts of insurance

PERG 2.8.3

See Notes

- 01/07/2005

Dealing in investments as principal

PERG 2.8.4

See Notes

The regulated activity of dealing in investments as principal applies to specified transactions relating to any security or to any contractually based investment (apart from rights under funeral plan contracts or rights to or interests in such contracts). The activity is cut back by exclusions as follows.

- (1) Of particular significance is the exclusion in article 15 of the Regulated Activities Order (Absence of holding out etc). This applies where dealing in investments as principal involves entering into transactions relating to any security or assigning rights under a life policy (or rights or interests in such a contract). In effect, it superimposes an additional condition that must be met before a person's activities become regulated activities. The additional condition is that a person must hold himself out as making a market in the relevant specified investments or as being in the business of dealing in them, or he must regularly solicit members of the public with the purpose of inducing them to deal. This exclusion does not apply to dealing activities that relate to any contractually based investment except the assigning of rights under a life policy.

- (2) Entering into a transaction relating to a contractually based investment is not regulated if the transaction is entered into by an unauthorised person and it takes place in either of the following circumstances (a transaction entered into by an authorised person would be caught). The first set of circumstances is where the person with whom the unauthorised person deals is either an authorised person or an exempt person who is acting in the course of a business comprising a regulated activity in relation to which he is exempt. The second set of circumstances is where the unauthorised person enters into a transaction through a non-UK office (which could be his own) and he deals with or through a person who is based outside the United Kingdom. This non-UK person must be someone who, as his ordinary business, carries on any of the activities relating to securities or contractually based investments that are generally treated as regulated activities.

- (3) A person (for example, a bank) who provides another person with finance for any purpose can accept an instrument acknowledging the debt (and as security for it) without risk of dealing as principal as a result.

- (4) A company does not deal as principal by issuing its own shares or share warrants and a person does not deal as principal by issuing his own debentures or debenture warrants.

- (4A) A company does not carry on the activity of dealing in investments as principal by purchasing its own shares where section 162A of the Companies Act 1985 (Treasury shares) applies to the shares purchased or by dealing in its own shares held as Treasury shares, in accordance with section 162D of that Act (Treasury shares: disposal and cancellation).

- (5) Risk-management activities involving options, futures and contracts for differences will not require authorisation if specified conditions are met. The conditions include the company's business consisting mainly of unregulated activities and the sole or main purpose of the risk management activities being to limit the impact on that business of certain kinds of identifiable risk.

- (6) A person will not be treated as carrying on the activity of dealing in investments as principal if, in specified circumstances (outlined in PERG 2.9), he enters as principal into a transaction:

- (a) while acting as bare trustee (or, in Scotland, as nominee);

- (b) in connection with the sale of goods or supply of services;

- (c) that takes place between members of a group or joint enterprise;

- (d) in connection with the sale of a body corporate;

- (e) in connection with an employee share scheme;

- (f) as an overseas person;

- (g) as an incoming ECA provider (see PERG 2.9.18 G).

- 01/07/2005

PERG 2.8.4A

See Notes

- 01/07/2005

PERG 2.8.4B

See Notes

- 01/07/2005

PERG 2.8.4C

See Notes

- 06/10/2006

Dealing in investments as agent

PERG 2.8.5

See Notes

More detailed guidance on the exclusions that relate to contracts of insurance is in PERG 5 (Insurance mediation activities).

- 06/10/2006

PERG 2.8.5A

See Notes

- 06/10/2006

Arranging deals in investments and arranging a home finance transaction

PERG 2.8.6

See Notes

- 06/04/2007

PERG 2.8.6A

See Notes

- 06/04/2007

PERG 2.8.6B

See Notes

- 06/04/2007

Managing investments

PERG 2.8.7

See Notes

- 06/10/2006

Assisting in the administration and performance of a contract of insurance

PERG 2.8.7A

See Notes

The term 'relevant insurer' is defined in article 39B(2).

- 01/07/2005

PERG 2.8.7B

See Notes

- 01/07/2005

Safeguarding and administering investments

PERG 2.8.8

See Notes

- 06/10/2006

Sending dematerialised instructions

PERG 2.8.9

See Notes

- 01/07/2005

Establishing etc collective investment schemes

PERG 2.8.10

See Notes

- 01/10/2005

Establishing etc pension schemes

PERG 2.8.11

See Notes

- 06/04/2007

Advising on investments

PERG 2.8.12

See Notes

- 06/04/2007

PERG 2.8.12A

See Notes

- 06/04/2007

Lloyd's activities

PERG 2.8.13

See Notes

- 01/07/2005

Entering funeral plan contracts

PERG 2.8.14

See Notes

- 01/07/2005

Administering regulated mortgage contracts

PERG 2.8.14A

See Notes

- 06/04/2007

PERG 2.8.14B

See Notes

- 06/04/2007

Agreeing

PERG 2.8.15

See Notes

- 01/07/2005

PERG 2.8.16

See Notes

- 01/07/2005

PERG 2.9

Regulated activities: exclusions applicable in certain circumstances

- 01/07/2005

PERG 2.9.1

See Notes

- 06/04/2007

PERG 2.9.2

See Notes

- 01/07/2005

Trustees, nominees or personal representatives

PERG 2.9.3

See Notes

The exclusion is, however, disapplied where a person is carrying on insurance mediation or reinsurance mediation . This is due to article 4(4A) of the Regulated Activities Order. Guidance on exclusions relevant to insurance mediation activities is in PERG 5 (Insurance mediation activities).

- 06/04/2007

PERG 2.9.4

See Notes

- 06/04/2007

Professions or business not involving regulated activities

PERG 2.9.5

See Notes

The exclusion is, however, disapplied where a person is carrying on insurance mediation or reinsurance mediation. This is due to article 4(4A) of the Regulated Activities Order. Guidance on exclusions relevant to insurance mediation activities is in PERG 5 (Insurance mediation activities).

- 06/04/2007

PERG 2.9.6

See Notes

- 01/07/2005

Sale of goods and supply of services

PERG 2.9.7

See Notes

- 01/07/2005

PERG 2.9.8

See Notes

- 06/10/2006

Group and joint enterprises

PERG 2.9.9

See Notes

- 01/07/2005

PERG 2.9.10

See Notes

- 06/10/2006

Sale of body corporate

PERG 2.9.11

See Notes

- 01/07/2005

PERG 2.9.12

See Notes

These exclusions also apply to transactions that are entered into for the purposes of the above transactions (such as transactions involving the offer of securities in the offeror as consideration or part consideration for the sale of the shares in the body corporate). These exclusions do not have effect in relation to shares in an open-ended investment company. The exclusions in PERG 2.9.11G (2), (3) and (4) are disapplied where they concern a contract of insurance. Guidance on exclusions relevant to insurance mediation activities is in PERG 5 (Guidance on insurance mediation activities). The exclusions are also disapplied for persons who, in carrying on the relevant regulated activity, are investment firms (see PERG 2.5.4 G (Investment services and activities)).

- 06/10/2006

PERG 2.9.12A

See Notes

- 01/10/2005

Employee share schemes

PERG 2.9.13

See Notes

- 01/07/2005

PERG 2.9.14

See Notes

- 01/07/2005

Overseas persons

PERG 2.9.15

See Notes

- 06/04/2007

PERG 2.9.16

See Notes

- 01/07/2005

PERG 2.9.17

See Notes

- 06/04/2007

PERG 2.9.17A

See Notes

- 06/04/2007

Incoming ECA providers

PERG 2.9.18

See Notes

- 01/02/2006

Insurance mediation activities

PERG 2.9.19

See Notes

Guidance on these and other exclusions relevant to insurance mediation activities is in PERG 5 (Insurance mediation activities).

- 01/07/2005

Business angel-led enterprise capital funds

PERG 2.9.20

See Notes

- 01/10/2005

PERG 2.9.21

See Notes

- 01/10/2005

PERG 2.9.22

See Notes

- 06/10/2006

PERG 2.10

Persons carrying on regulated activities who do not need authorisation

- 01/07/2005

PERG 2.10.1

See Notes

- 01/07/2005

PERG 2.10.2

See Notes

- 01/07/2005

PERG 2.10.3

See Notes

- 01/07/2005

PERG 2.10.4

See Notes

- 01/07/2005

Appointed representatives

PERG 2.10.5

See Notes

- 01/07/2005

Recognised Investment Exchanges and Recognised Clearing Houses

PERG 2.10.6

See Notes

- 01/07/2005

Particular exempt persons

PERG 2.10.7

See Notes

- 01/07/2005

PERG 2.10.8

See Notes

- 01/07/2005

Members of Lloyd's

PERG 2.10.9

See Notes

- 01/07/2005

PERG 2.10.10

See Notes

- 01/07/2005

PERG 2.10.11

See Notes

- 01/07/2005

Members of the professions

PERG 2.10.12

See Notes

- 01/07/2005

PERG 2.10.13

See Notes

- 01/07/2005

PERG 2.10.14

See Notes

- 06/04/2007

PERG 2.10.15

See Notes

- 06/04/2007

PERG 2.10.16

See Notes

- 01/07/2005

PERG 2.11

What to do now ?

- 01/07/2005

PERG 2.11.1

See Notes

- 06/10/2007

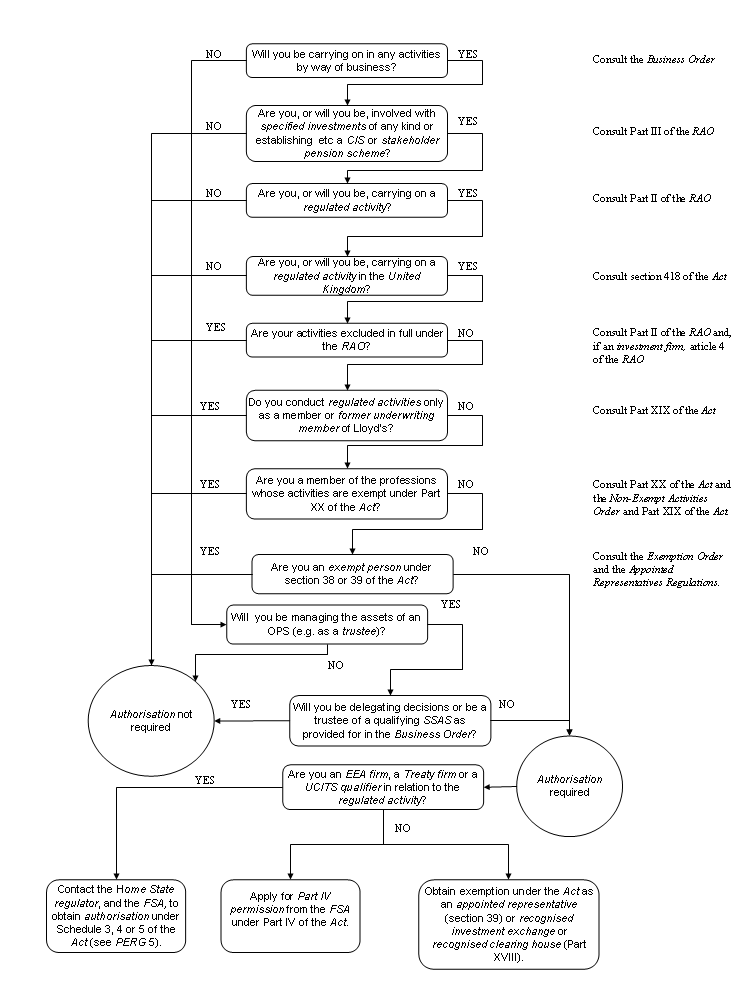

PERG 2 Annex 1

Authorisation and regulated activities

- 01/07/2005

PERG 2 Annex 1

See Notes

- 01/07/2005

PERG 2 Annex 2

Regulated activities and the permission regime

- 01/07/2005

See Notes

| 1.1 G | Table 1 is designed to relate the permission regime to regulated activities. Section 42(6)of the Act gives the FSA the power to describe the regulated activity or regulated activities for which it gives permission in such manner as the FSA considers appropriate. Table 1 details how the FSA has chosen to describe the regulated activities and specified investments for the purposes of the permission regime. | |

| 1.2 G | In an application for Part IV permission , an applicant will need to state the regulated activities it requires permission to carry on. This will involve an applicant identifying the regulated activities and the specified investments associated with those activities for which it requires Part IV permission. | |

1.3 G | Part II of the Regulated Activities Order (Specified activities) specifies the activities for the purposes of section 22 of the Act. This section states that an activity is a regulated activity if it is an activity of a specified kind which is carried on by way of business and: | |

| (1) | relates to an investment of a specified kind; or | |

| (2) | in the case of an activity specified for the purposes of section 22(1)(b) of the Act, is carried on in relation to property of any kind. | |

Part III of the Regulated Activities Order (Specified investments) specifies the investments referred to in (1). | ||

| 1.4 G | Column 1 of Table 1 lists the regulated activities and column 2 lists the associated specified investments. Descriptions of some categories of specified investments are expanded in Tables 2 and 3. There are notes to all three tables which provide further explanation where appropriate. | |

| 1.5 G | A reference to an article in the tables in PERG 2 Annex 2 G is to the relevant article in the Regulated Activities Order. | |

2 Table

3 Table

| Notes to Table 1 |

| Note 1: In addition to the regulated activities listed in Table 1, article 64 of the Regulated Activities Order specifies that agreeing to carry on a regulated activity is itself a regulated activity in certain cases. This applies in relation to all the regulated activities listed in Table 1 apart from: •accepting deposits (article 5);•issuing electronic money (article 9B);•effecting and carrying out contracts of insurance (article 10);•establishing, operating or winding up a collective investment scheme (article 51(1)(a));•acting as trustee of an authorised unit trust scheme (article 51(1)(b));•acting as the sole depositary or sole director of an open-ended investment company (article 51(1)(c)); and•establishing, operating or winding up a stakeholder pension schemeor establishing operating or winding up a personal pension scheme(article 52). |

| Permission to carry on the activity of agreeing to carry on a regulated activity will be given automatically by the FSA in relation to those other regulated activities for which an applicant is given permission (other than those activities in articles 5,9B, 10,51 and 52 detailed above). |

| Note 1A: Funeral plan contracts are contractually based investments. Accordingly, the following are regulated activities when carried on in relation to a funeral plan contract: (a) arranging (bringing about) deals in investments, (b) making arrangements with a view to transactions in investments, (c) managing investments, (d) safeguarding and administering investments, (e) advising on investments, (f) sending dematerialised instructions and (g) causing dematerialised instructions to be sent (as well as agreeing to carry on each of the activities listed in (a) to (g)). However, they are not designated investment business. |

| Note 1B: Life policies are contractually based investments. Where the regulated activities listed as designated investment business in (e) to (g) and (j) are carried on in relation to a life policy, these activities also count as 'insurance mediation activities'. The full list of insurance mediation activities is set out in (pb) to (pf). The regulated activities of agreeing to carry on each of these activities will, if carried on in relation to a life policy, also come within both designated investment business and insurance mediation activities. |

| Note 2: For the purposes of the regulated activities of dealing in investments as principal (article 14) and dealing in investments as agent (article 21), the definition ofcontractually based investments [expanded in Table 3] excludes a funeral plan contract (article 87) and rights to or interests in funeral plan contracts. |

| Note 3: The regulated activities of managing investments (article 37) and safeguarding and administering investments (article 40) may apply in relation to any assets, in particular circumstances, if the assets being managed or safeguarded and administered include, (or may include), any security or contractually based investment. |

| Note 4: For the purposes of the permission regime, the activity in (j)(ii) of advising on pension transfers and pension opt-outs is carried on in respect of the following specified investments: unit (article 81);stakeholder pension scheme (article 82(1));personal pension scheme (article 82(2));life policy (explained in note 5); andrights to or interests in investments in so far as they relate to a unit, a stakeholder pension scheme, a personal pension scheme or a life policy. |

| Note 5: Article 4(2) of the Regulated Activities Order specifies the activities (m)to (p) for the purposes of section 22(1)(b) of the Act. That is, these activities will be regulated activities if carried on in relation to any property and are not expressed as relating to a specified investment. |

| Note 5A: Where they are carried on in relation to a life policy, the activities listed as insurance mediation activities in (pb) to (pf) (as well as the regulated activity of agreeing to carry on those activities) are also designated investment business. |

| Note 5B: In PERG, life policy is the term used in the Handbook to mean 'qualifying contract of insurance' (as defined in article 3(1) of the Regulated Activities Order). For the purpose of the permission regime, the term also includes a long-term care insurance contract which is a pure protection contract and a pension term assurance policy. |

| Note 5C: Non-investment insurance contract is the term used in firms permissions to mean pure protection contract or general insurance contract. Pure protection contract is the term used in the Handbook to mean a long-term insurance contract which is not a life policy. General insurance contract is the term used in the Handbook to mean contract of insurance within column 1 of Table 2. |

| Note 5D: [deleted] |

| Note 5E: For the purposes of the permission regime, the activity in (pf)(ii) of advising on pension transfers and pension opt-outs is carried on in respect of the following specified investments: life policy (explained in note 5A); andrights to or interests in investments in so far as they relate to a life policy. |

| Note 6: Section 315 of the Act (The Society: authorisation and permission) states that the Society of Lloyd's has permission to carry on the regulated activities referred to in that section, one of which is specified in article 58 of the Regulated Activities Order. This permission is unique to the Society of Lloyd's. |

| Note 7: A stakeholder product is defined in the Glossary as: an investment of a kind specified in the Stakeholder Regulations:a stakeholder pension scheme; anda stakeholder CTF. |

| Table 2: Contracts of insurance | ||

| Contract of insurance (article 75 of the RAO) | ||

| (a) general insurance contract (Part I of Schedule 1 to the Regulated Activities Order) | (b) long-term insurance contract (Part II of Schedule 1 to the Regulated Activities Order ) | |

| Number | ||

| 1 | Accident (paragraph 1) | life and annuity (paragraph I) |

| 2 | Sickness (paragraph 2) | marriage or the formation of a civil partnership and birth (paragraph II) |

| 3 | Land vehicles (paragraph 3) | linked long-term (paragraph III) |

| 4 | Railway rolling stock (paragraph 4) | permanent health (paragraph IV) |

| 5 | Aircraft (paragraph 5) | tontines (paragraph V) |

| 6 | Ships (paragraph 6) | capital redemption (paragraph VI) |

| 7 | Goods in transit (paragraph 7) | pension fund management (paragraph VII) |

| 8 | fire and natural forces (paragraph 8) | collective insurance (paragraph VIII) |

| 9 | damage to property (paragraph 9) | social insurance (paragraph IX) |

| 10 | motor vehicle liability (paragraph 10) | |

| 11 | aircraft liability (paragraph 11) | |

| 12 | liability of ships (paragraph 12) | |

| 13 | general liability (paragraph 13) | |

| 14 | credit (paragraph 14) | |

| 15 | suretyship (paragraph 15) | |

| 16 | miscellaneous financial loss (paragraph 16) | |

| 17 | legal expenses (paragraph 17) | |

| 18 | assistance (paragraph 18) | |

| Notes to Table 2 | ||

| Note 1: See IPRU(INS) Ann 10.2 Part II for the groups of classes of general insurance business from the Annex to the First non-Life Directive. | ||

| Note 2: See IPRU(INS) 11.8 and the definition of ancillary risks in IPRU(INS) for guidance on the treatment of supplementary and ancillary provisions in relation to contracts of insurance. | ||

| Table 3: Securities, contractually based investments and relevant investments [see notes 1 and 2 to Table 3] | ||

| Security (article 3(1)) | Contractually based investment (article 3(1)) | Relevant investments (article 3(1)) |

|

share (article 76) debenture (article 77) government and public security (article 78) warrant (article 79) certificate representing certain security (article 80) unit (article 81) stakeholder pension scheme (article 82(1)) personal pension scheme (article 82(2)); rights to or interests in investments (article 89) in so far as they relate to any of the above categories of security |

option (article 83) For the purposes of the permission regime, option is subdivided into: (i)option (excluding a commodity option and an option on a commodityfuture);(ii)commodity option and option on a commodity future. future (article 84) For the purposes of the permission regime, future is subdivided into: (i)future (excluding a commodity future and a rolling spot forex contract);(ii)commodity future;(iii)rolling spot forex contract. contract for differences (article 85) For the purposes of the permission regime, contract for differences is subdivided into: (i)contract for differences (excluding a spread bet and a rolling spot forex contract);(ii)spread bet;(iii)rolling spot forex contract. life policy (but excluding a long-term care insurance contract which is a pure protection contract) [see note 5B to Table 1] funeral plan contract (article 87) [see note 1A to Table 1] rights to or interests in investments (article 89) in so far as they relate to any of the above categories of contractually based investment. |

contractually based investments (article 3(1)) non-investment insurance contract [see note 5C to Table 1] |

| Notes to Table 3 | ||

| Note 1: Security, contractually based investment and relevant investment are not, in themselves, specified investments they are defined as including a number of specified investments as set out in Table 3. Relevant investments is the term that is used to cover contractually based investments together with rights under a general insurance contract and a pure protection contract. Note 2: For the purposes of the regulated activities of dealing in investments as principal (article 14) and dealing in investments as agent (article 21), the definition of contractually based investments excludes a funeral plan contract (article 87) and rights to or interests in funeral plan contracts. | ||

- 06/10/2007

PERG 3

Guidance on the scope of the regulated

activity of issuing e-money

PERG 3.1

Application and purpose

- 01/07/2005

Application

PERG 3.1.1

See Notes

- 01/07/2005

PERG 3.1.2

See Notes

- 01/07/2005

Purpose

PERG 3.1.3

See Notes

- 01/07/2005

PERG 3.1.4

See Notes

- 01/07/2005

PERG 3.1.5

See Notes

- 01/07/2005

PERG 3.2

The regulated activity of issuing e-money

- 01/07/2005

The Regulated Activities Order

PERG 3.2.1

See Notes

- 01/07/2005

PERG 3.2.2

See Notes

- 01/07/2005

PERG 3.2.3

See Notes

- 01/07/2005

PERG 3.2.4

See Notes

- 01/07/2005

PERG 3.2.5

See Notes

- 01/07/2005

The E-Money Directive

PERG 3.2.6

See Notes

- 01/07/2005

PERG 3.2.7

See Notes

- 31/12/2005

PERG 3.2.8

See Notes

- 31/12/2005

PERG 3.2.9

See Notes

- 01/07/2005

PERG 3.2.10

See Notes

- 01/07/2005

Exclusions

PERG 3.2.11

See Notes

- 01/07/2005

The issuer of e-money

PERG 3.2.12

See Notes

- 01/07/2005

PERG 3.2.13

See Notes

- 01/07/2005

PERG 3.2.14

See Notes

- 01/07/2005

Exclusion from the definition of deposit

PERG 3.2.15

See Notes

- 01/07/2005

PERG 3.2.16

See Notes

- 01/07/2005

PERG 3.2.17

See Notes

- 01/07/2005

PERG 3.2.18

See Notes

- 31/12/2005

PERG 3.2.19

See Notes

- 31/12/2005

PERG 3.3

Elements of the definition of e-money

- 01/07/2005

Monetary value

PERG 3.3.1

See Notes

- 01/07/2005

Storage on an electronic device

PERG 3.3.2

See Notes

- 01/07/2005

PERG 3.3.3

See Notes

- 01/07/2005

PERG 3.3.4

See Notes

- 01/07/2005

Prepayment

PERG 3.3.5

See Notes

- 01/07/2005

PERG 3.3.6

See Notes

- 01/07/2005

PERG 3.3.7

See Notes

- 01/07/2005

PERG 3.3.8

See Notes

- 01/07/2005

PERG 3.3.9

See Notes

- 01/07/2005

Multipurpose

PERG 3.3.10

See Notes

- 01/07/2005

PERG 3.3.11

See Notes

- 01/07/2005

PERG 3.3.12

See Notes

- 01/07/2005

PERG 3.3.13

See Notes

- 31/12/2005

Accounted e-money schemes

PERG 3.3.14

See Notes

- 01/07/2005

PERG 3.3.15

See Notes

"An important issue that respondents [to HM Treasury's consultation on the implementation of the E-Money Directive] requested clarification on was whether the Directive's definition should catch account-based schemes (i.e. e-money held remote from the owner and spent at the owner's direction) as well as, for example, card-based schemes (i.e. e-money in the possession of the owner, whether stored on a personal computer or a smart card, and directly spent by them). The Treasury believes that the Directive's definition does allow for the possibility of account-based schemes being e-money. Not allowing account-based e-money schemes would effectively create a regulatory gap between the e-money and deposit-taking regimes - and a difference of treatment between schemes that pose similar regulatory risks. Rather than attempting to amend the definition in the Order (which is already expressed suitably widely), the Treasury has clarified in the accompanying Explanatory Memorandum that the definition of e-money is to be interpreted as covering account-based schemes (so long as they remain distinct from deposit-taking)."

- 01/07/2005

PERG 3.3.16

See Notes

"The Treasury believes the Directive's definition includes both e-money schemes in which value is stored on a card that is used by the bearer to make purchases, and account-based e-money schemes where value is stored in an electronic account that the user can access remotely."

- 01/07/2005

PERG 3.3.17

See Notes

- 01/07/2005

PERG 3.3.18

See Notes

- 01/07/2005

PERG 3.3.19

See Notes

- 01/07/2005

PERG 3.3.20

See Notes

- 01/07/2005

PERG 3.3.21

See Notes

- 01/07/2005

Substance of the scheme

PERG 3.3.22

See Notes

- 31/12/2005

PERG 3.3.23

See Notes

- 31/12/2005

PERG 3.3.24

See Notes

- 31/12/2005

PERG 3.3.25

See Notes

- 31/12/2005

PERG 3.4

Financial promotion

- 01/07/2005

PERG 3.4.1

See Notes

- 01/07/2005

PERG 3.4.2

See Notes

- 01/07/2005

PERG 3.4.3

See Notes

- 01/07/2005

PERG 3.4.4

See Notes

- 01/07/2005

PERG 3.4.5

See Notes

- 01/07/2005

PERG 3.4.6

See Notes

- 01/07/2005

PERG 3.4.7

See Notes

- 01/07/2005

PERG 3.5

The application of the e-money definition to various products

- 31/12/2005

PERG 3.5.1

See Notes

- 31/12/2005

Electronic travellers cheques

PERG 3.5.2

See Notes

- 31/12/2005

PERG 3.5.3

See Notes

- 31/12/2005

PERG 3.5.4

See Notes

- 31/12/2005

PERG 3.5.5

See Notes

- 31/12/2005

PERG 3.5.6

See Notes

- 31/12/2005

Trust accounts

PERG 3.5.7

See Notes

- 31/12/2005

PERG 3.5.8

See Notes

- 31/12/2005

PERG 3.5.9

See Notes

- 31/12/2005

PERG 4

Guidance on regulated activities connected with mortgages

PERG 4.1

Application and purpose

- 01/07/2005

Application

PERG 4.1.1

See Notes

- 01/07/2005

Purpose of guidance

PERG 4.1.2

See Notes

- 01/07/2005

Effect of guidance

PERG 4.1.3

See Notes

- 01/07/2005

PERG 4.1.4

See Notes

- 01/07/2005

PERG 4.1.5

See Notes

- 01/07/2005

Guidance on other activities

PERG 4.1.6

See Notes

- 06/04/2007

PERG 4.2

Introduction

- 01/07/2005

Requirement for authorisation or exemption

PERG 4.2.1

See Notes

- 06/10/2007

Professional firms

PERG 4.2.2

See Notes

- 01/07/2005

Questions to be considered to decide if authorisation is required

PERG 4.2.3

See Notes

If a person gets as far as question (8) and the answer to that question is 'no', that person requires authorisation and should refer to the FSA website "How do I get authorised": http://www.fsa.gov.uk/Pages/Doing/how/index.shtml for details of the application process.

- 06/10/2007

PERG 4.2.4

See Notes

- 01/07/2005

Financial promotion

PERG 4.2.5

See Notes

- 01/07/2005

PERG 4.3

Regulated activities related to mortgages

- 01/07/2005

PERG 4.3.1

See Notes

- 01/07/2005

PERG 4.3.2

See Notes

- 01/07/2005

The business test

PERG 4.3.3

See Notes

- 01/07/2005

PERG 4.3.4

See Notes

- 01/07/2005

PERG 4.3.5

See Notes

| By way of business | Carrying on the business |

| Entering into a regulated mortgage contract (article 61(1)) | Arranging (bringing about) regulated mortgage contracts (article 25A(1)) |

| Administering a regulated mortgage contract (article 61(2)) (and the contract administered must have been entered into by way of business) | Making arrangements with a view to regulated mortgage contracts (article 25A(2)) |

| Advising on regulated mortgage contracts (article 53A) |

- 01/07/2005

PERG 4.3.6

See Notes

In the case of the 'carrying on the business' test, these factors will need to be considered having regard to all the activities together.

- 01/07/2005

PERG 4.3.7

See Notes

- 01/07/2005

PERG 4.3.8

See Notes

- 01/07/2005

PERG 4.3.9

See Notes

- 01/07/2005

PERG 4.4

What is a regulated mortgage contract?

- 01/07/2005

The definition of "regulated mortgage contract"

PERG 4.4.1

See Notes

- 06/04/2007

Provision of credit

PERG 4.4.1A

See Notes

- 01/07/2005

Which borrowers?

PERG 4.4.2

See Notes

- 01/07/2005

Date the contract is entered into

PERG 4.4.3

See Notes

- 01/07/2005

PERG 4.4.4

See Notes

- 01/07/2005

Land in the United Kingdom

PERG 4.4.5

See Notes

- 01/07/2005

Occupancy requirement

PERG 4.4.6

See Notes

- 01/07/2005

PERG 4.4.7

See Notes

- 01/07/2005

PERG 4.4.8

See Notes

- 01/07/2005

PERG 4.4.9

See Notes

- 05/12/2005

Purpose of the loan is irrelevant

PERG 4.4.10

See Notes

- 01/07/2005

Type of lending

PERG 4.4.11

See Notes

- 01/07/2005

PERG 4.4.12

See Notes

- 01/07/2005

Regulated mortgage contracts and contract variations

PERG 4.4.13

See Notes

- 01/07/2005

PERG 4.4.14

See Notes

- 01/07/2005

PERG 4.5

Arranging regulated mortgage contracts

- 01/07/2005

Definition of the regulated activities involving arranging

PERG 4.5.1

See Notes

- 01/07/2005

PERG 4.5.2

See Notes

The first activity (article 25A(1)) is referred to in this guidance as arranging (bringing about) regulated mortgage contracts. Various points arise:

- (1) It is not necessary for the potential borrower himself to be involved in making the arrangements.

- (2) This activity is carried on only if the arrangements bring about, or would bring about a regulated mortgage contract. This is because of the exclusion in article 26 (see PERG 4.5.4 G).

- (3) This activity therefore includes the activities of brokers who make arrangements on behalf of a borrower to enter into or vary a regulated mortgage contract where these arrangements go beyond merely introducing (see PERG 4.5.10 G) or advising (although giving advice may be the regulated activity of advising on regulated mortgage contracts). Such arrangements might include, for instance, negotiating the terms of the regulated mortgage contract with the eventual lender, on behalf of the borrower. It also includes the activities of certain so-called 'packagers' (see PERG 4.15 (Mortgage activities carried on by 'packagers'.)

- (4) PERG 4.6.2 G contains examples of variations that are, in the FSA's view, within the definition of advising on regulated mortgage contracts and would also be covered by article 25A(1) arrangements.

- 01/07/2005

PERG 4.5.3

See Notes

- 01/07/2005

Exclusion: article 25A(1) arrangements not causing a deal

PERG 4.5.4

See Notes

- 01/07/2005

Exclusion: article 25(A)2 arrangements enabling parties to communicate

PERG 4.5.5

See Notes

- 01/07/2005

PERG 4.5.6

See Notes

- 01/07/2005

Exclusion: article 25A(1) and (2) arranging of contracts to which the arranger is a party

PERG 4.5.7

See Notes

- 01/07/2005

Exclusion: article 25A(1) and (2) arrangements with or through authorised persons

PERG 4.5.8

See Notes

- 01/07/2005

Exclusion: article 25A(1)(b) arrangements made in the course of administration by authorised person

PERG 4.5.9

See Notes

- 01/07/2005

Exclusion: article 25A(2) arrangements and introducing

PERG 4.5.10

See Notes

- 01/07/2005

PERG 4.5.11

See Notes

The exclusion applies for introductions to:

- (1) an authorised person who has permission to carry on a regulated activity specified in article 25A (Arranging regulated mortgage contracts) or article 53A (Advising on regulated mortgage contracts) or article 61(1) (Entering into a regulated mortgage contract as lender); introducers can check the status of an authorised person and its permission by visiting the FSA's register at http://www.fsa.gov.uk/register/;

- (2) an appointed representative who is appointed to carry on a regulated activity specified in article 25A or article 53A of the Regulated Activities Order; introducers can check the status of an appointed representative by visiting the FSA's register at http://www.fsa.gov.uk/register/; the FSA would normally expect introducers to request and receive confirmation of the regulated activities that the appointed representative is appointed to carry on, prior to proceeding with an introduction; and

- (3) an overseas person who carries on a regulated activity specified in article 25A (Arranging regulated mortgage contracts) or article 53A (Advising on regulated mortgage contracts) or article 61(1) (Entering into a regulated mortgage contract).

- 01/07/2005

PERG 4.5.12

See Notes

- 01/07/2005

PERG 4.5.13

See Notes

- 01/07/2005

PERG 4.5.14

See Notes

- 01/07/2005

PERG 4.5.15

See Notes

- 01/07/2005

PERG 4.5.16

See Notes

- 01/07/2005

PERG 4.5.17

See Notes

- 01/07/2005

PERG 4.5.18

See Notes

- 01/07/2005

Other exclusions

PERG 4.5.19

See Notes

- 01/07/2005

PERG 4.6

Advising on regulated mortgage contracts

- 01/07/2005

Definition of 'advising on regulated mortgage contracts'

PERG 4.6.1

See Notes

- 01/07/2005

PERG 4.6.2

See Notes

Although advice on varying the terms of a regulated mortgage contract is not a regulated activity if the contract was entered into before 31 October 2004, there may be instances where the variation to the old contract is so fundamental that it amounts to entering into a new regulated mortgage contract (see PERG 4.4.4 G and PERG 4.4.13G (2)). In that case, giving the advice would be a regulated activity.

- 01/07/2005

PERG 4.6.3

See Notes

- 01/07/2005

PERG 4.6.4

See Notes

- 01/07/2005

Advice must relate to a particular regulated mortgage contract

PERG 4.6.5

See Notes

- 01/07/2005

PERG 4.6.6

See Notes

- 01/07/2005

PERG 4.6.7

See Notes

This table belongs to PERG 4.6.5 G and PERG 4.6.6 G.

| Recommendation | Regulated or not? |

| I recommend you take out the ABC Building Society 2 year fixed rate mortgage at 5%. | Yes. This is advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I recommend you do not take out the ABC Building Society 2 year fixed rate mortgage at 5%. | Yes. This is advice which steers the borrower away from a particular mortgage which the borrower could have entered into. |

| I recommend that you take out either the ABC Building Society 2 year fixed rate mortgage at 5% or the XYZ Bank standard variable rate mortgage. | Yes. This is advice which steers the borrower in the direction of more than one particular mortgage which the borrower could enter into. |

| I recommend you take out (or do not take out) an ABC Building Society fixed rate mortgage. | This will depend on the circumstances. If, for example, the society only offers one such mortgage, this would be a recommendation intended implicitly to steer the borrower in the direction of that particular mortgage which the borrower could enter into and therefore would be advice. |

| I suggest you take out (or do not take out) a mortgage with ABC Building Society. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. However, if the society only offers one mortgage, this would be a recommendation intended implicitly to steer the borrower in the direction of that particular mortgage which the borrower could enter into and therefore would be advice. |

| I suggest you change (or do not change) your current mortgage from a variable rate to a fixed rate. | No in respect of the advice about rate type, as this does not steer the borrower in the direction of a particular mortgage which the borrower could enter into. Yes in respect of the advice about varying the terms of the particular mortgage that the borrower had already entered into. |

| I suggest you take out (or do not take out) a variable rate mortgage. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I recommend you take out (or do not take out) a mortgage. | No. This is not advice which steers the borrower in the direction of a particular mortgage which the borrower could enter into. |

| I would always recommend buying a house and taking out a mortgage as opposed to renting a property. | No. This is an example of generic advice which does not steer the borrower in the direction of a particular mortgage that he could enter into. |

| I recommend you do not borrow more than you can comfortably afford. | No. This is an example of generic advice. |

| If you are looking for flexibility with your mortgage I would recommend you explore the possibilities of either a flexible mortgage or an off-set mortgage. There are a growing number of lenders offering both. | No. This is an example of generic advice. |

- 01/07/2005

PERG 4.6.8

See Notes

- 01/07/2005

PERG 4.6.9

See Notes

- 01/07/2005

Advice given to a person in his capacity as a borrower or potential borrower

PERG 4.6.10

See Notes

- 01/07/2005

PERG 4.6.11

See Notes

- 01/07/2005

PERG 4.6.12

See Notes

- 01/07/2005

Advice or information

PERG 4.6.13

See Notes

- 01/07/2005

PERG 4.6.14

See Notes

- 01/07/2005

PERG 4.6.15

See Notes

- 01/07/2005

PERG 4.6.16

See Notes

- 01/07/2005

Advice must relate to the merits (of entering into as borrower or varying)

PERG 4.6.17

See Notes

- 01/07/2005

PERG 4.6.18

See Notes

- 01/07/2005

PERG 4.6.19

See Notes

- 01/07/2005

PERG 4.6.20

See Notes

- 01/07/2005

Scripted questioning (including decision trees)

PERG 4.6.21

See Notes

- 01/07/2005

PERG 4.6.22

See Notes

- 01/07/2005

PERG 4.6.23

See Notes

- 01/07/2005

PERG 4.6.24

See Notes

- 01/07/2005

PERG 4.6.25

See Notes

- 06/10/2007

Medium used to give advice

PERG 4.6.26

See Notes

- 01/07/2005

PERG 4.6.27

See Notes

- 01/07/2005

PERG 4.6.28

See Notes

- 01/07/2005

PERG 4.6.29

See Notes

- 01/07/2005

Exclusion: periodical publications, broadcasts and websites

PERG 4.6.30

See Notes

This is explained in greater detail, together with the provisions on the granting of certificates, in PERG 7 (Periodical publications, news services and broadcasts: applications for certification).

- 01/07/2005

Exclusion: advice in the course of administration by authorised person

PERG 4.6.31

See Notes

- 01/07/2005

Other exclusions

PERG 4.6.32

See Notes

- 01/07/2005

PERG 4.7

Entering into a regulated mortgage contract

- 01/07/2005

Definition of 'entering into a regulated mortgage contract'

PERG 4.7.1

See Notes

- 01/07/2005

Exclusions

PERG 4.7.2

See Notes

- 01/07/2005

Transfer of lending obligations

PERG 4.7.3

See Notes

- 01/07/2005

PERG 4.8

Administering a regulated mortgage contract

- 01/07/2005

Definition of 'administering a regulated mortgage contract'

PERG 4.8.1

See Notes

- 01/07/2005

PERG 4.8.2

See Notes

- 01/07/2005

PERG 4.8.3

See Notes

but does not include merely having or exercising a right to take action to enforce the regulated mortgage contract, or to require that action is or is not taken.

- 01/07/2005

Exclusion: arranging administration by authorised persons

PERG 4.8.4

See Notes

Article 62 of the Regulated Activities Order provides that a person who is not an authorised person does not administer a regulated mortgage contract if he:

- (1) arranges for a firm with permission to administer a regulated mortgage contract (a 'mortgage administrator') to administer the contract; or

- (2) administers the regulated mortgage contract itself, provided that the period of administration is no more than one month after the arrangement in (1) has come to an end.

- 01/07/2005

PERG 4.8.5

See Notes

- 01/07/2005

PERG 4.8.6

See Notes

- 01/07/2005

Exclusion: administration pursuant to agreement with authorised person

PERG 4.8.7

See Notes

- 01/07/2005

Other exclusions

PERG 4.8.8

See Notes

- 01/07/2005

PERG 4.9

Agreeing to carry on a regulated activity

- 01/07/2005

PERG 4.9.1

See Notes

- 01/07/2005

PERG 4.9.2

See Notes

- 01/07/2005

PERG 4.10

Exclusions applying to more than one regulated activity

- 01/07/2005

Exclusion: Activities carried on in the course of a profession or non-investment business

PERG 4.10.1

See Notes

- 01/07/2005

PERG 4.10.2

See Notes

- 01/07/2005

PERG 4.10.3

See Notes

- 01/07/2005

PERG 4.10.4

See Notes

- 01/07/2005

Exclusion: Trustees, nominees and personal representatives

PERG 4.10.5

See Notes

- 01/07/2005

PERG 4.10.6

See Notes

- 01/07/2005

PERG 4.10.7

See Notes

- 01/07/2005

PERG 4.10.8

See Notes

- 01/07/2005

PERG 4.11

Link between activities and the United Kingdom

- 01/07/2005

Introduction

PERG 4.11.1

See Notes

- 01/07/2005

PERG 4.11.2

See Notes

- 01/07/2005

Legislative provisions: definition of "regulated mortgage contract"

PERG 4.11.3

See Notes

- 01/07/2005

Legislative provisions: section 418 of the Act

PERG 4.11.4

See Notes

- 01/07/2005

PERG 4.11.5

See Notes

- 01/07/2005

Legislative provisions: overseas persons exclusion

PERG 4.11.6

See Notes

- 01/07/2005

PERG 4.11.7

See Notes

- 01/07/2005

Territorial scenarios: general

PERG 4.11.8

See Notes

- 01/07/2005

PERG 4.11.9

See Notes

This table belongs to PERG 4.11.8 G

| Individual borrower resident and located: | |||

| in the UK | outside the UK | ||

| Service provider carrying on regulated activity from establishment: | in the UK | Yes | Yes |

| outside the UK | Yes | No | |

| Yes = authorisation or exemption required No = authorisation or exemption not required | |||

- 01/07/2005

Service provider in the United Kingdom

PERG 4.11.10

See Notes

- 01/07/2005

PERG 4.11.11

See Notes

- 06/10/2007

Service provider overseas: general

PERG 4.11.12

See Notes

The factors in (1), (3) and (4) are considered in relation to each regulated activity in PERG 4.11.13 G to PERG 4.11.20 G. The factor in (5) is considered in PERG 4.11.21 G.

- 01/07/2005

Service provider overseas: arranging regulated mortgage contracts

PERG 4.11.13

See Notes

- 01/07/2005

PERG 4.11.14

See Notes

In the case of arranging (bringing about) regulated mortgage contracts, the normal residence of the borrower at the time the arrangements are made is the determining factor, except in the case of arranging (bringing about) a variation of a contract, in which case it is the normal residence of the borrower at the time that the regulated mortgage contract was entered into. In the case of making arrangements with a view to regulated mortgage contracts, the normal residence of the borrower at the time he participates in the arrangements is the determining factor.

- 01/07/2005

Service provider overseas: advising on regulated mortgage contracts

PERG 4.11.15

See Notes

- 01/07/2005

Service provider overseas: entering into a regulated mortgage contract

PERG 4.11.16

See Notes

- 01/07/2005

PERG 4.11.17

See Notes

- 01/07/2005

Service provider overseas: administering a regulated mortgage contract

PERG 4.11.18

See Notes

- 01/07/2005

PERG 4.11.19

See Notes

- 01/07/2005

Service provider: agreeing to carry on a regulated activity

PERG 4.11.20

See Notes

- 01/07/2005

E-Commerce Directive

PERG 4.11.21

See Notes

- 01/07/2005

Distance marketing directive

PERG 4.11.22

See Notes

- 01/07/2005

PERG 4.12

Appointed representatives

- 01/07/2005

What is an appointed representative?

PERG 4.12.1

See Notes

- 01/07/2005

PERG 4.12.2

See Notes

- 01/07/2005

Business for which an appointed representative is exempt

PERG 4.12.3

See Notes

- 01/07/2005

Persons who are not already appointed representatives

PERG 4.12.4

See Notes

- 01/07/2005

Persons who are already appointed representatives

PERG 4.12.5

See Notes

- 01/07/2005

PERG 4.13

Other exemptions

- 01/07/2005

PERG 4.13.1

See Notes

- 01/07/2005

PERG 4.14

Mortgage activities carried on by professional firms

- 01/07/2005

Introduction

PERG 4.14.1

See Notes

- 01/07/2005

PERG 4.14.2

See Notes

- 01/07/2005

PERG 4.14.3

See Notes

- 01/07/2005

Part XX exemption: arranging regulated mortgage contracts

PERG 4.14.4

See Notes

- 01/07/2005

Part XX exemption: advising on regulated mortgage contracts

PERG 4.14.5

See Notes

- 01/07/2005

Part XX exemption: entering into and administering a regulated mortgage contract

PERG 4.14.6

See Notes

- 01/07/2005

PERG 4.15

Mortgage activities carried on by 'packagers'

- 01/07/2005

Introduction

PERG 4.15.1

See Notes

- 01/07/2005

Mortgage Clubs (sometimes called mortgage wholesalers)

PERG 4.15.2

See Notes

- 01/07/2005

Mortgage packaging companies

PERG 4.15.3

See Notes

- 01/07/2005

Broker packagers (sometimes called 'intermediary brokers')

PERG 4.15.4

See Notes

- 01/07/2005

PERG 4.16

Mortgage activities

- 01/07/2005

Introduction

PERG 4.16.1

See Notes

- 01/07/2005

PERG 4.16.2

See Notes

- 01/07/2005

Entering into a regulated mortgage contract

PERG 4.16.3

See Notes

- 01/07/2005

Administering, arranging and advising on a regulated mortgage contract

PERG 4.16.4

See Notes

- 01/07/2005

PERG 4.17

Interaction with the Consumer Credit Act

- 01/07/2005

Entering into and administering a regulated mortgage contract

PERG 4.17.1

See Notes

- 01/07/2005

PERG 4.17.2

See Notes

- 01/07/2005

PERG 4.17.3

See Notes

- 01/07/2005

PERG 4.17.4

See Notes

- 01/07/2005

PERG 4.17.5

See Notes

- 01/07/2005

Advising on and arranging a regulated mortgage contract

PERG 4.17.6

See Notes

- 01/07/2005

PERG 4.17.7

See Notes

- 01/07/2005

PERG 4.17.8

See Notes

- 01/07/2005

PERG 4.17.9

See Notes

- 01/07/2005

PERG 4.17.10

See Notes

- 01/07/2005

PERG 4.17.11

See Notes

- 01/07/2005

PERG 4.17.12

See Notes

- 01/07/2005

PERG 4.17.13

See Notes

- 01/07/2005

PERG 4.17.14

See Notes

- 01/07/2005

Financial Promotion and advertisements

PERG 4.17.15

See Notes

- 01/07/2005

PERG 4.17.16

See Notes

- 01/07/2005

PERG 4.18

Regulated activities related to mortgages: flowchart

- 01/07/2005

Do you need authorisation?

PERG 4.18.1

- 01/07/2005

PERG 5

Guidance on insurance mediation activities

PERG 5.1

Application and purpose

- 01/07/2005

Application

PERG 5.1.1

See Notes

- 01/07/2005

Purpose of guidance

PERG 5.1.2

See Notes

- 01/07/2005

PERG 5.1.3

See Notes

- 01/07/2005

PERG 5.1.4

See Notes

- 01/07/2005

PERG 5.1.5

See Notes

- 01/07/2005

PERG 5.1.6

See Notes

- 01/07/2005

Effect of guidance

PERG 5.1.7

See Notes

- 01/07/2005

PERG 5.1.8

See Notes

- 01/07/2005

PERG 5.1.9

See Notes

- 01/07/2005

PERG 5.1.10

See Notes

- 01/07/2005

Guidance on other activities

PERG 5.1.11

See Notes

- 01/07/2005

PERG 5.2

Introduction

- 01/07/2005

PERG 5.2.1

See Notes

- 01/07/2005

Requirement for authorisation or exemption

PERG 5.2.2

See Notes

- 06/10/2007

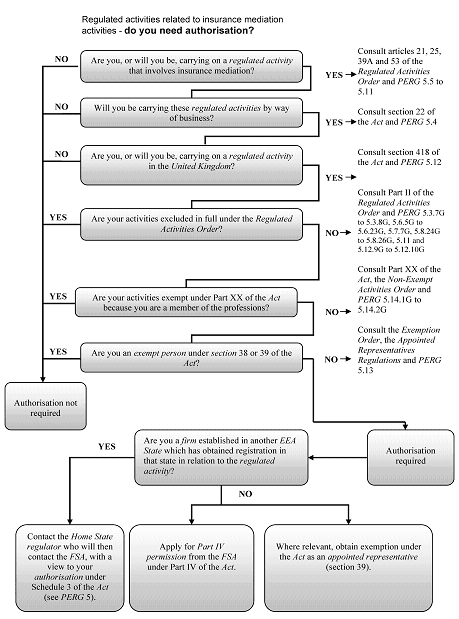

Questions to be considered to decide if authorisation is required

PERG 5.2.3

See Notes

If a person gets as far as question (8) and the answer to that question is "no", that person requires authorisation and should refer to the FSA website "How do I get authorised": http://www.fsa.gov.uk/Pages/Doing/how/index.shtml for details of the application process. The order of these questions considers firstly whether a person is carrying on insurance mediation activities before dealing separately with the questions "will I be carrying on my activities by way of business?" (3) and "if so, will any or all of my activities by excluded?" (5).

- 06/10/2007

PERG 5.2.4

See Notes

- 01/07/2005

Approach to implementation of the IMD

PERG 5.2.5

See Notes

- 01/07/2005

PERG 5.2.6

See Notes

- 01/07/2005

PERG 5.2.7

See Notes

- 01/07/2005

PERG 5.2.8

See Notes

- 01/07/2005

PERG 5.2.9

See Notes

- 01/07/2005

Financial promotion

PERG 5.2.10

See Notes

- 01/07/2005

PERG 5.3

Contracts of insurance

- 01/07/2005

PERG 5.3.1

See Notes

- 01/07/2005

Definition

PERG 5.3.2

See Notes

- 01/07/2005

PERG 5.3.3

See Notes

- 01/07/2005

PERG 5.3.4

See Notes

- 01/07/2005

PERG 5.3.5

See Notes

- 01/07/2005

PERG 5.3.6

See Notes

- 01/07/2005

Connected contracts of insurance

PERG 5.3.7

See Notes

- 01/07/2005

Large risks

PERG 5.3.8

See Notes

- 01/07/2005

Specified investments

PERG 5.3.9

See Notes

'Relevant investments' is the term used in articles 21 (Dealing in investments as agent), 25 (Arranging deals in investments) and 53 (Advising on investments) of the Regulated Activities Order to help define the types of investment to which the activities in each of these articles relate.

- 01/07/2005

PERG 5.3.10

See Notes

- 01/07/2005

PERG 5.3.11

See Notes

- 01/07/2005

PERG 5.4

The business test

- 01/07/2005

PERG 5.4.1

See Notes

- 01/07/2005

PERG 5.4.2

See Notes

- 01/07/2005

PERG 5.4.3

See Notes

- 01/07/2005

PERG 5.4.4

See Notes

- 01/07/2005

PERG 5.4.5

See Notes

- 01/07/2005

PERG 5.4.6

See Notes

- 01/07/2005

PERG 5.4.7

See Notes

- 01/07/2005

PERG 5.4.8

See Notes

| Carrying on insurance mediation activities 'for remuneration' and 'by way of business' | ||

| 'For remuneration' | ||

| Factor | Indicators that P does not carry on activities "for remuneration" | Indicators that P does carry on activities "for remuneration" |

Direct remuneration, whether received from the customer or the insurer/broker (cash or benefits in kind such as tickets to the opera, a reduction in other insurance premiums, a remission of a debt or any other benefit capable of being measured in money's worth) | P does not receive any direct remuneration specifically identified as a reward for his carrying on insurance mediation activities. | P receives direct remuneration specifically identified as being a reward for his carrying on insurance mediation activities. |

| Indirect remuneration (such as any form of economic benefit as may be explicitly or implicitly agreed between P and the insurer/broker or P's customer - including, for example, through the acceptance of P's terms and conditions or mutual recognition of the economic benefit that is likely to accrue to P). An indirect economic benefit can include expectation of making a profit of some kind as a result of carrying on insurance mediation activities as part of other services. | P does not obtain any form of indirect remuneration through an economic benefit other than one which is not likely to have a material effect on P's ability to make a profit from his other activities. | P obtains an economic benefit that: (a) is explicitly or implicitly agreed between P and the insurer/broker or P's customer; and (b) has the potential to go beyond mere cost recovery through fees or other benefits received for providing a package of services that includes insurance mediation activities but where no particular part of the fees is attributable to insurance mediation activities. This could include where insurance mediation activities are likely to: •play a material part in the success of P's other business activities or in P's ability to make a profit from them; or•provide P with a materially increased opportunity to provide other goods or services; or•be a major selling point for P's other business activities; or•be essential for P to provide other goods or services. P charges his customers a greater amount for other goods or services than would be the case if P were not also carrying on insurance mediation activities for those customers and this: •is explicitly or implicitly agreed between P and the insurer/broker or P's customer; and•has the potential to go beyond mere cost recovery. |

| Recovery of costs | P receives no benefits of any kind (direct or indirect) in respect of his insurance mediation activities beyond the reimbursement of his actual costs incurred in carrying on the activity (including receipt by P of a sum equal to the insurance premium that P is to pass on to the insurer or broker). | P receives benefits of any kind (direct or indirect) in respect of his insurance mediation activities which go beyond the reimbursement of his actual costs incurred in carrying on the activity. |

| 'By way of business' | ||

| Factor | Indicators that P does not carry on activities "by way of business" | Indicators that P does carry on activities "by way of business" |

| Regularity/ frequency | Involvement is one-off or infrequent (for instance, once or twice a year) provided that the transaction(s) is not of such size and importance that it is essential to the success of P's other business activities. Transactions do not result from formal arrangements (for instance, occasional involvement purely as a result of an unsolicited approach). | Involvement is frequent (for instance, once a week). Involvement is infrequent but the transactions are of such size or importance that they are essential to the success of P's other business activities. P has formal arrangements which envisage transactions taking place on a regular basis over time (whether or not such transactions turn out in practice to be regular). |

| Holding out | P does not hold himself out as providing a professional service that includes insurance mediation activities (by professional is meant not the services of a layman). | P holds himself out as providing a professional service that includes insurance mediation activities. |

| Relevance to other activities/ business |

Insurance mediation activities: •have no relevance to P's other activities; or•have some relevance but could easily be ceased without causing P any difficulty in carrying on his main activities; or•would be unlikely to result in a material reduction in income from P's main activities if ceased |

Insurance mediation activities: •are essential to P in carrying on his main activities; or•would cause a material disruption to P carrying on his main activities if ceased; or•would be likely to reduce P's income by a material amount. |

| Commercial benefit | P receives no direct or indirect pecuniary or economic benefit. P is a layman and acting in that capacity. P would not obtain materially less income from his main activities if they did not include insurance mediation activities. | P receives a direct or indirect pecuniary or economic benefit from carrying on insurance mediation activities - such as a fee, a benefit in kind or the likelihood of materially enhanced sales of other goods or services that P provides. P would obtain materially less income from his main activities if they did not include insurance mediation activities. |

- 01/07/2005

PERG 5.5

The regulated activities: dealing in contracts as agent

- 01/07/2005

PERG 5.5.1

See Notes

- 01/07/2005

PERG 5.5.2

See Notes

- 01/07/2005

PERG 5.5.3

See Notes

- 01/07/2005

PERG 5.6