COLLG 1A

Overview

COLLG 1A.1

Introduction

- 14/12/2012

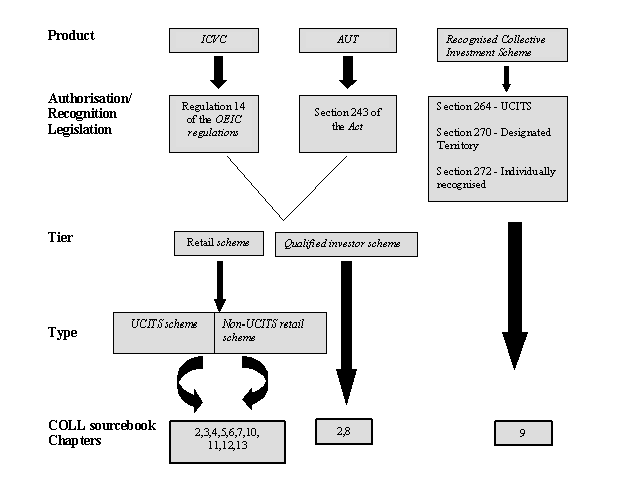

About this guide

Structure of collective investment regulation in the United Kingdom

COLLG 1A.1.2

See Notes

- 14/12/2012

What are regulated collective investment schemes?

COLLG 1A.1.3

See Notes

- 14/12/2012

What is an AUT?

COLLG 1A.1.4

See Notes

- 14/12/2012

What is an ICVC?

COLLG 1A.1.5

See Notes

- 14/12/2012

Authorisation to carry on regulated activities

COLLG 1A.1.6

See Notes

- 14/12/2012

COLLG 2A

European Legislation

COLLG 2A.1

Introduction

- 14/12/2012

Background and scope

COLLG 2A.1.1

See Notes

- 14/12/2012

General scope of the UCITS Directive

COLLG 2A.1.2

See Notes

- 14/12/2012

Obligations on the management company and depositary

COLLG 2A.1.3

See Notes

- 14/12/2012

Investment and borrowing powers and limits

COLLG 2A.1.4

See Notes

- 14/12/2012

Information to investors

COLLG 2A.1.5

See Notes

- 14/12/2012

The management company passport

COLLG 2A.1.6

See Notes

- 14/12/2012

Marketing requirements

COLLG 2A.1.7

See Notes

- 14/12/2012

COLLG 3A

The FSA's

responsibilities under the Act

COLLG 3A.1

Introduction

- 14/12/2012

COLLG 3A.1.1

See Notes

- 14/12/2012

Promotion of schemes in the United Kingdom (section 238)

COLLG 3A.1.2

See Notes

- 14/12/2012

Application for authorisation as an authorised unit trust (sections 242 and 243)

COLLG 3A.1.3

See Notes

- 14/12/2012

Determining and refusing applications (sections 244 and 245)

COLLG 3A.1.4

See Notes

- 14/12/2012

Revocation of authorisation (section 254)

COLLG 3A.1.5

See Notes

- 14/12/2012

Notification of changes to unit trusts (sections 251 and 252A)

COLLG 3A.1.6

See Notes

- 14/12/2012

Powers of intervention (sections 257 and 281)

COLLG 3A.1.7

See Notes

- 14/12/2012

Scheme particulars (section 248)

COLLG 3A.1.8

See Notes

- 14/12/2012

Recognition of overseas schemes

COLLG 3A.1.9

See Notes

- 14/12/2012

Recognition of schemes constituted in other EEA states (section 264)

COLLG 3A.1.10

See Notes

- 14/12/2012

Recognition of schemes authorised in designated territories (section 270)

COLLG 3A.1.11

See Notes

- 14/12/2012

Recognition of individual overseas schemes (section 272)

COLLG 3A.1.12

See Notes

- 14/12/2012

Subsequent notification in respect of schemes recognised under section 272 of the Act

COLLG 3A.1.13

See Notes

- 14/12/2012

Refusal of approval: schemes recognised under sections 270 and 272 of the Act

COLLG 3A.1.14

See Notes

- 14/12/2012

Revocation of recognition of overseas schemes

COLLG 3A.1.15

See Notes

- 14/12/2012

Scheme facilities in the United Kingdom (section 283)

COLLG 3A.1.16

See Notes

- 14/12/2012

COLLG 4A

The FSAs Responsibilities under the OEIC Regulations

COLLG 4A.1

Introduction

- 14/12/2012

COLLG 4A.1.1

See Notes

- 14/12/2012

Applications for authorisation (Regulations 12-17)

COLLG 4A.1.2

See Notes

- 14/12/2012

Notification of changes to ICVCs (Regulations 21 and 22A)

COLLG 4A.1.3

See Notes

- 14/12/2012

Revocation of authorisation (Regulation 23)

COLLG 4A.1.4

See Notes

- 14/12/2012

Power of intervention (Regulation 25)

COLLG 4A.1.5

See Notes

- 14/12/2012

Corporate Code

COLLG 4A.1.6

See Notes

- 14/12/2012

The FSA's registration function

COLLG 4A.1.7

See Notes

- 14/12/2012

Sub-funds of umbrella ICVC

COLLG 4A.1.8

See Notes

- 14/12/2012

COLLG 5A

The COLL sourcebook

COLLG 5A.1

Introduction

- 14/12/2012

COLLG 5A.1.1

See Notes

- 14/12/2012

Definition of terms in COLL

COLLG 5A.1.2

See Notes

- 14/12/2012

Outline of the content of COLL

COLLG 5A.1.3

See Notes

The contents of COLL are outlined below.

- (1) COLL 1 (Introduction) sets out which firms COLL applies to and gives an overview of the types of authorised fund.

- (2) COLL 2 (Authorised fund applications) sets out the initial application requirements for authorised funds and the rules concerning notifications which need to be made to the FSA in its role as registrar of ICVCs.

- (3) COLL 3 (Constitution) includes requirements regarding the contents of the instrument constituting the scheme for authorised funds that are retail schemes and other matters relating to their constitutional features, such as classes of units.

- (4) COLL 4 (Investor relations) includes consumer-facing material relating to authorised funds that are retail schemes. So, material on the prospectus, key investor information document, simplified prospectus (for non-UCITS retail schemes or feeder NURS, where the authorised fund manager opts to produce this), and reports and accounts is included in that chapter, together with rules relating to when unitholders must be notified of events and when meetings of unitholders, are required. The chapter also includes the information to be given to unitholders of a feeder UCITS in certain circumstances. (A key investor information document is not required for a non-UCITS retail scheme or feeder NURS. However, an authorised fund manager of such a scheme can choose to produce an equivalent document to the key investor information document, which is referred to as a NURS-KII document, by applying for a modification by consent(see www.fsa.gov.uk/pages/doing/regulated/notify/waiver/consent/cobs_coll.shtml). If an authorised fund manager of such a scheme does not choose to produce a NURS-KII document it must produce a key features document, in accordance with the provisions of COBS 13.3 (Contents of a key features document), or opt to produce a simplified prospectus).

- (5) COLL 5 (Investment and borrowing powers) requires authorised funds that are retail schemes, their authorised fund managers and depositaries, to comply with rules on the investment composition of the scheme. It is divided up as follows:

- (a) COLL 5.2 to COLL 5.3 implement the UCITS Directive requirements which require quality, spread and counterparty limits to be imposed on the assets of funds within the scope of the Directive (as set out in COLLG 2A.1.4 G);

- (b) COLL 5.4 provides rules on stock lending;

- (c) COLL 5.5 provides rules on holding cash and near cash, borrowing and lending;

- (d) COLL 5.6 provides investment rules for non-UCITS retail schemes;

- (e) COLL 5.7 provides a regime for a non-UCITS retail scheme that is to be operated as a fund of alternative investment funds (FAIF). The authorised fund manager of such a fund must carry out certain additional due diligence procedures in relation to the funds in which the FAIF is to invest;

- (f) COLL 5.8 sets out investment powers and limits for a UCITS scheme that is to be operated as a feeder UCITS. It also sets out what other provisions in COLL 5 are applicable to a feeder UCITS; and

- (g) COLL 5.9 specifies the permitted investments for a UCITS scheme or a non-UCITS retail scheme operating as a money market fund or a short-term money market fund. These restrictions reflect CESR's guidelines on a common definition of European money market funds.

- (6) COLL 6 (Operating duties and responsibilities) contains rules on the day-to-day operation of authorised funds that are retail schemes. In particular:

- (a) COLL 6.2 sets out rules relating to dealing in units, including the issue and cancellation of units;

- (b) COLL 6.3 sets out how authorised funds must be valued and prices of units calculated and published;

- (c) COLL 6.4 provides requirements relating to the register of unitholders in an AUT (see the OEIC Regulations for ICVCs) and any plan register;

- (d) COLL 6.5 sets out rules relating to the appointment and replacement of the authorised fund manager and depositary;

- (e) COLL 6.6 imposes certain powers and duties on the authorised fund manager and the depositary and COLL 6.6A imposes certain powers and duties on the authorised fund managers of UCITS schemes and on a UK UCITS management company of an EEA UCITS scheme;

- (f) COLL 6.7 lays down conditions concerning charges and expenses that may be taken when investors buy or sell units, and what payments may be made out of the scheme property;

- (g) COLL 6.8 provides rules and guidance on the calculation and distribution of income;

- (h) COLL 6.9 gives guidance relating to independence of the depositary and management company, scheme names and the restrictions on the business of the UCITS;

- (i) COLL 6.10 sets out the oversight responsibilities of senior personnel in relation to a UCITS scheme;

- (j) COLL 6.11 and COLL 6.12 set out more detail about the risk controls and risk management policy that must be employed in relation to a UCITS scheme; and

- (k) COLL 6.13 sets out record-keeping requirements in relation to a UCITS scheme.

- (7) COLL 7 (Suspension of dealings and termination of authorised funds) includes the requirements for suspension of dealing in the units of authorised funds and how they may be wound up (including termination of sub-funds). COLL 7.7 provides rules in relation to mergers subject to the UCITS Directive.

- (8) COLL 8 (Qualified Investor Schemes) provides a framework of rules for a scheme which restricts subscription to certain prescribed categories of investor (principally professional clients and sophisticated investors). For such a scheme, the FSA considers that not all the detailed product rule protections that apply to retail schemes are necessary. This type of scheme, called a qualified investor scheme, satisfies the essential features of an authorised product and so distinguishes itself from an unregulated collective investment scheme, but otherwise is allowed more flexibility in its operation compared to the framework for retail schemes. COLL 2 (Authorised fund applications) contains details of the application procedure for qualified investor schemes.

- (9) COLL 9 (Recognised Schemes) applies to collective investment schemes established outside the United Kingdom. It brings together the material relating to the admission to marketing of such schemes in the United Kingdom, supplementing material in chapter V of Part XVIIof the Act (Recognised overseas schemes).

- (10) COLL 10 (Fees) is no longer used as the provisions are set out in FEES.

- (11) COLL 11 (Master-feeder arrangements under the UCITS Directive) sets out various Directive requirements applicable to feeder UCITS and master UCITS, including the arrangements for co-ordination and information-sharing between the UCITS management companies, depositaries and auditors of each scheme.

- (12) COLL 12 (Management company and product passports under the UCITS Directive) provides more information about the rules that are applicable to the use of the UCITS management company passport and the UCITS product passport. It sets out which rules in COLL are applicable to an EEA UCITS management company that wishes to operate a UCITS scheme in the UK through the exercise of passporting rights.

- (13) COLL 13 (Operation of a feeder NURS) sets out requirements relating to the operation of a feeder NURS and certain types of qualifying master scheme. Such operational obligations concern, for example, information which is to be obtained and/or provided pre-investment, and the treatment of a charge made to a feeder NURS for acquisition or disposal of units in a qualifying master scheme.

- 14/12/2012

Related Sourcebooks

COLLG 5A.1.4

See Notes

- 14/12/2012